Anzeige / Werbung

Jetzt könnte der ideale Kaufzeitpunkt für Outcrop Silver sein!

-Advertorial | Werbeanzeige-

Liebe Leserinnen, liebe Leser,

der größte Fehler, den Anleger in diesen Börsenzeiten machen können: sich von der Börse abwenden. Denn Fakt ist: Jede Krise bietet immer auch gewaltige Gewinnchancen.

Anstatt der Börse in dieser fraglos schwierigen, aber eben auch chancenreichen Marktphase den Rücken zuzukehren, muss man genau jetzt seine Hausaufgaben machen.

Wer jetzt seine Hausaufgaben macht, der sichert sich heute den entscheidenden Informationsvorsprung für die Gewinne von morgen. Doch was sind diese Hausaufgaben?

MIT EINEM KONTO BEI SMARTBROKER KÖNNEN SIE DIESE AKTIE AB 0 EURO HANDELN. - EIN BROKERWECHSEL ZAHLT SICH OFT AUS!

Während die Masse der Anleger wie das Kaninchen vor der Schlage hockt und gebannt auf die Kursentwicklungen der Aktienindizes, der Mag7-Werte und der Rohstoffmärkte schaut, denken clevere Anleger schon einen Schritt weiter. Denn die Märkte werden auch aus dieser Korrektur - wie lang und heftig sie auch ausfallen mag - mit einem neuen Bullenmarkt hervorgehen.

- So wie es im Covid-Crash im März/April 2020 war.

- So wie es nach dem Platzen der New Economy-Blase und dem 11. September 2021 war.

- So wie nach dem Kollaps des Hedgefonds LTCM im Herbst 1998.

- Oder dem Black Monday 1987.

Sie erkennen das Verlaufsmuster: Die Börsen sind immer wieder in neue Bullenmärkte übergegangen und auf neue Höchstkurse angestiegen. So wird es auch dieses Mal sein. Denn mit der Künstlichen Intelligenz, Roboter-Technologien und der Energierevolution (von E-Mobilität bis Solarenergie) laufen aktuell gleich drei große industrielle Revolutionen parallel ab, die neues Wirtschaftswachstum entfachen werden.

Doch wichtig zu verstehen: Jeder neue Bullenmarkt bringt neue Börsenstars hervor.

So, wie das kanadische Rohstoffunternehmen Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG) ein Gewinner der nächsten Generation der Börsenstars 2025 werden könnte. Denn was brauchen die aktuell laufenden industriellen Hightech-Revolutionen in großen Mengen? Silber!

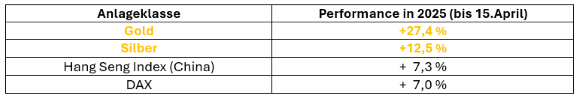

Schauen Sie sich die Performance verschiedener Märkte bis Mitte April dieses Börsenjahres an und Sie sehen sofort: Im laufenden Jahr 2025 und in den kommenden Jahren ist der heißeste Bullenmarkt: Gold und Silber!

Quelle: Tradingview

Silber: Befindet sich bereits in einem massiven Angebotsdefizit

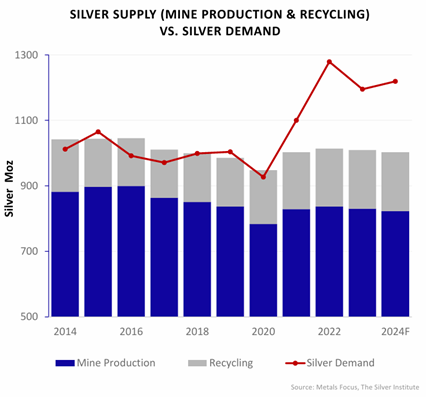

Ein absolut wichtiger Fakt - ja vielleicht einer der wichtigsten Börsenfakten, die Sie in 2025 kennen sollten: Wir befinden uns bei Silber bereits im 3. Jahr eines massiven Angebotsdefizits. Die folgende Grafik zeigt Ihnen eindrucksvoll, wie kritisch die Lage zwischen limitiertem Angebot und Nachfrage im Silbersektor in 2025 ist und in den kommenden Jahren sein wird.

Photovoltaik für die Energieunabhängigkeit. E-Mobilität. KI. Robotics - die Nachfrage für Silber aus den Hightech-Boommärkten steigt immer weiter! Ein Teil des Angebotsdefizits kann durch Recycling kompensiert werden. Aber nicht genug, wie Sie in der Grafik sehen. Zumal die Börse einen sehr wichtigen Faktor auf der Nachfrageseite noch gar nicht auf dem Radar hat: Silber ist im Hochtechnologiezeitalter auch ein unverzichtbarer Rohstoff für die Rüstungsindustrie!

Ja, Sie haben richtig gelesen: Silber ist neben seinem unverzichtbaren Einsatz in den Hightech-Produkten, in der Photovoltaik oder in der E-Mobilität auch ein kritischer Rohstoff für die (leider) boomende Rüstungsindustrie in der neuen geopolitischen Welt des neuen Kalten Krieges zwischen Ost und West.

Das bedeutet aber auch: Wir sprechen bei Silber nicht von einem Nachfrageüberhang, der den Silberpreis mittelfristig deckelt. Nein, selbst wenn Teile der Silbernachfrage aufgrund einer möglichen Rezession temporär sinken könnten, dürfte das existierende Angebotsdefizit dadurch bestenfalls zeitweise reduziert werden.

Wichtiger Rohstoff für den Boom der Rüstungsindustrie

(Quelle: SilverOne Res.)

Vor allem, wenn wir bedenken: Das in der Rüstungsindustrie verwendete Silber wird für Dekaden aus dem Markt gezogen. Das Gleiche werden wir im Bereich der Robotertechnologie sehen. Dies ist eine völlig andere Situation als in der Hochphase der Consumer-Electronic-Hightechprodukte der 1980er- bis 2000er-Jahre.

Damals kamen ständig neue und bessere Hightech-Produkte (von PCs und Laptops über TVs bis zu Handys und Smartphones) auf den Markt - wodurch das Silber aus den alten Produkten ungewöhnlich schnell recycelt und damit zurück in den Wirtschaftskreislauf kam. Aber wenn die USA ein 100-Mio.-USD-Kampfflugzeug produzieren, ist das darin verwendete Silber vom Markt.

Noch ein wichtiger Faktor, den die Börse aktuell (noch) völlig falsch einschätzt: die Effekte der Trump-Strafzölle und Trumps Weltpolitik für den Edelmetallsektor. Die Strafzölle für Importe in die USA spielen für Gold und auch für Silber eine viel geringere Rolle als für andere Produkte. Die Gold- und Silberproduzenten verkaufen ihre Edelmetalle einfach in andere Länder.

Deshalb hat sich der Aktienkurs von Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG) in den Wochen nach den Strafzöllen auch viel besser gehalten als viele andere Aktien und Märkte. Denn Outcrop Silver gehört zu der kleinen Gruppe an Aktien, für welche die Trump-Politik in 2025 kein bedeutender Einflussfaktor in der Unternehmensentwicklung sein dürfte. Die Aktie notiert schon wieder da, wo sie vor dem "Liberation Day" notierte. Das können nur ganz wenige Aktien vorweisen.

Outcrop Silver: Der Warren Buffett des Gold/Silber-Marktes kauft massiv!

Wichtiger sind für Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054) in 2025/26 die Entwicklungen der Gold- und Silberpreise sowie die Fortschritte und Nachrichten rund um die Entwicklung des weit fortgeschrittenen Santa Ana-Silberprojekt in Kolumbien, an dem Outcrop Silver 100% hält.

Outcrop Silver hält zudem jeweils 100% an drei weiteren Projekten in Kolumbien (Argelia, Mallama, Oribella), die sich aber noch in sehr frühen Entwicklungsstadien befinden. Die Aktienstory von Outcrop Silver ist ganz klar das Silberprojekt Santa Ana, welches in einem der historisch besten Silber- und Goldgebiete in Kolumbien, ja wahrscheinlich sogar in ganz Südamerika, liegt.

(Quelle: Outcrop Silver)

Die Börse missversteht das Unternehmen und das Silber- und Goldprojekt noch völlig - woraus sich für gut informierte Anleger jetzt eine fantastische Investmentchance eröffnen könnte. An der Börse zahlt es sich für clevere Anleger oft in barer Münze - oder großen Gewinnen - aus, auf die Investmententscheidungen des Smart Money der Wall Street zu achten. Im Aktienmarkt ist der stellvertretende Name für das Smart Money natürlich Warren Buffett.

Im Rohstoffsektor ist der stellvertretende Name des Smart Money Eric Sprott. Eric Sprott ist das Gegenstück zu Buffett, für Rohstoffaktien. Besonders bei kleineren Minenunternehmen haben Anleger in der Vergangenheit oft sehr viel Geld damit verdient, den Investments von Sprott zu folgen. Denn kaum jemand hat ein so gutes Netzwerk im internationalen Minensektor wie Sprott.

Eric Sprott kauft sich mit Millionen CAD bei Outcrop Silver ein

Nun, wenn clevere Anleger den Investments von Sprott folgen, dann führt sie dieser Weg … direkt zu Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG). Denn Erik Sprott hält sage und schreibe 21 % an Outcrop Silver.

Dies ist ein sehr hoher Anteil für ein Unternehmen mit einer derartig kleinen Börsenbewertung wie Outcrop Silver (erst 60 Mio. CAD). Tatsächlich war Outcrop Silver in den letzten 12 Monaten das sechstgrößte Investment von Sprott im Silberminen-Sektor. Das ist ein Hammer! Es zeigt Ihnen, wie bullisch Superinvestor Eric Sprott für Outcrop Silver gestimmt ist.

(Quelle: Resource100.com)

Noch spannender: Sie sehen den durchschnittlichen Kaufkurs von Eric Sprott: 0,19 CAD. Clevere Anleger, die jetzt schnell agieren, können also sogar noch günstiger als Sprott bei Outcrop Silver einsteigen. Was sieht Superinvestor Eric Sprott, der sein Vermögen im Rohstoffsektor machte, in Outcrop Silver, das der Markt nicht sieht? Es sind drei Faktoren:

- Die Aktie wird von der Börse noch völlig falsch eingeschätzt - wodurch Outcrop Silver aktuell nur eine Mini-Börsenbewertung von rund 60 Mio. CAD (rund 42 Mio. USD) aufweist.

- Die Entwicklung des Spitzenprojekts Santa Ana ist viel weiter fortgeschritten, als die aktuelle Börsenbewertung vermuten lässt.

- Outcrop Silver hat einen extrem hohen Hebel auf den Silberpreis. Wenn Sie also von weiter steigenden Silberpreisen ausgehen, dann könnte die Aktie von Outcrop Silber wie ein Call-Optionsschein auf den Silberpreis reagieren - mit dementsprechenden Gewinnchancen.

Börse bewertet Outcrop Silver noch völlig falsch!

Das macht Outcrop Silver so spannend: Mit einer kleinen Börsenbewertung von erst rund 60 Mio. CAD (rund 42 Mio. USD) ist der Wert so klein, dass er sich völlig von der allgemeinen Börsenstimmung lösen und unabhängig von den Kursentwicklungen der großen Indizes ansteigen kann, wenn das Unternehmen gute Nachrichten veröffentlicht.

Was Outcrop Silver so spannend macht: Das Unternehmen wird aktuell noch - und wir betonen das Wort "noch" - von der Börse wie ein kleiner Junior-Explorer bewertet. Das sind junge Rohstoffkonzerne, die außer einem Landgebiet, einigen geologischen Schätzungen über potenzielle Vorkommen und euphorischen Prognosen der Managements nichts zu bieten haben.

Outcrop Silver spielt in einer viel höheren Liga. Outcrop Silver ist ein weit fortgeschrittener Senior-Explorer, der nicht nur Explorationsergebnisse für sein Flaggschiffprojekt Santa Ana besitzt. Nein, Outcrop Silver besitzt bereits eine erste Ressourcenschätzung für Santa Ana! Davon können die Manager von 95 % der Explorer nur träumen!

Weit fortgeschrittenes Silber- und Goldprojekt in Kolumbien

Das Santa Ana-Projekt ist ein neues Silberprojekt mit im weltweiten Vergleich überdurchschnittlich hohen Silbervorkommen. Nicht in Kolumbien. Nicht in Lateinamerika - was schon toll wäre. Nein, Santa Ana ist eines der besten Silberprojekte mit den höchsten Silber- und Goldgehalten in der ganzen Welt! So eine Investmentchance erhält man an der Börse vielleicht nur sehr selten.

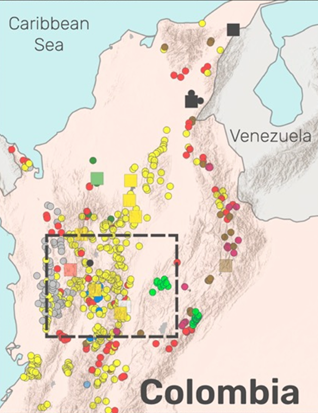

(Quelle: Outcrop Silver)

Denn das Santa Ana-Projekt liegt genau in DEM großen Gold- und Silbergebiet im Rohstoffland Kolumbien. Sie sehen den Silber- und Goldgürtel anhand der gelben Punkte in dem Bild. In dem Rechteck, so wo die größte Dichte der Silber- und Goldvorkommen liegen, befindet sich das Santa-Ana-Projekt von Outcrop Silver.

Seit Jahrhunderten wird in diesem Gebiet erfolgreich nach Edelmetallen gesucht. Es gibt in diesem Gebiet seit Jahren produzierende Minen. Das belegt: Der Aufbau einer Mine und eine erfolgreiche Silber- und Gold-Produktion sind in diesem Gebiet nicht nur möglich. Es ist schon Realität.

Angesichts der Geologie verwundert es wenig, dass die bisherige Exploration des Santa Ana-Projektes neben fantastisch hohen Silbergehalten als Nebenprodukt auch Gold zutage förderte. Rund 75 % des Projektwertes von Santa Ana kommt von Silber. 25 % von Gold, wobei dieser Anteil mit steigenden Goldpreisen weiter zulegen könnte. Aktionäre profitieren mit Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG) also auch noch zusätzlich von den hohen Goldpreisen.

Doch Santa Ana ist ein primäres Silberprojekt ... in einem der besten Gebiete für Gold- und Silbervorkommen weltweit. Deshalb rechnet Outcrop Silver das Gold in Santa Ana als Nebenprodukt Silber umgerechnet. Sprich: Eine Unze Gold wird in Silberunzen umgerechnet. Im Rohstoffsektor wird dies Silber-Äquivalent genannt.

Diese Umrechnung in Silber-Äquivalent hilft, um den wahren Projektwert in dem primären Rohstoff - bei Santa Ana ist es Silber - einfacher zu berechnen. Outcrop Silver plant, die Silber- und Goldvorkommen in Santa Ana in Form einer Untertagemine abzubauen.

Doch warum ist Outcrop Silver dann so günstig bewertet?

Hier wird es für Anleger richtig spannend! Denn die günstige Bewertung hat nichts mit dem Unternehmen oder dem Silberprojekt Santa Ana zu tun. Es liegt an dem Standort. Santa Ana befindet sich in Kolumbien - und Kolumbien ist bei Rohstoffinvestoren nach den letzten Präsidentschaftswahlen in 2022 in Ungnade gefallen.

Der Grund: Durch den Wahlsieg des Kandidaten Gustavo Petro kam es in Kolumbien zur ersten Links-Regierung seit 40 Jahren. Deren Politik war leider sehr kontraproduktiv für die Wirtschaft und die wichtige Minenindustrie - wie in so vielen lateinamerikanischen Ländern in den vergangenen 5 Jahren. Bessere Löhne und Rechte für die Arbeiter sind gute Ziele. Aber wie so oft, schoss die Links-Regierung in Kolumbien über das Ziel hinaus.

Daraufhin wandten sich internationale Investoren von Kolumbien und Minenunternehmen, die Projekte in Kolumbien betreiben, ab. Durchaus verständlich. Konnte man doch bis letztes Jahr Aktien von Bergbauunternehmen mit Projekten in Nordamerika oder minenfreundlicheren Ländern ebenfalls zu günstigen Preisen kaufen.

Doch mit dem Ausbruch des Goldpreises hat sich diese Situation im letzten Jahr völlig verändert: Viele Aktien von Gold- und Silberunternehmen mit Projekten in Nordamerika sind inzwischen teuer bis extrem teuer bewertet - während auf der anderen Seite Unternehmen wie Outcrop Silver zu absoluten Schnäppchenpreisen zu haben sind.

Präsidentschaftswahlen am 8. März 2026 könnten Gamechanger-Moment werden

Hier wird die Story um Outcrop Silver für gut informierte Börsianer richtig spannend: Denn bezüglich der kolumbianischen Regierung muss man wissen, dass der Wahlsieg des linken Präsidenten Gustavo Petro extrem knapp war. Er konnte in den normalen Wahlen nicht mal die Mehrheit von 50 % der abgegebenen Stimmen erzielen und es bedurfte in 2022 Stichwahlen, um ihn ins Amt zu bringen.

Im März 2025 erreichten die neuen Umfragewerte für die Links-Regierung um Petro, der aktuell mit schweren Korruptionsvorwürfen zu kämpfen hat, neue Allzeittiefs. Fast 60 % der befragten Kolumbianer sind gegen den amtierenden Präsidenten. Seine Unterstützung fiel im März auf ein Allzeittief von 32 %.

Jetzt kommt der Clou: Die nächsten Präsidentschaftswahlen in Kolumbien sind für den 8. März 2026 angesetzt. Das ist nicht mal mehr ein Jahr. Doch wenn Sie sich die Aktien von Rohstoffunternehmen mit Kolumbien-Projekten anschauen, dann sehen Sie: Die Börsen haben diese Entwicklung noch überhaupt nicht auf dem Schirm.

(Quelle: Tradingview)

Die Aktie von Outcrop Silver ist derzeit noch gepreist, als ob die amtierende Links-Regierung die Wahlen erneut gewinnen kann. Das bedeutet: Wenn die amtierenden Links-Regierung die Wahl gegen einen konservativen Kandidaten verliert, könnte blitzartig massiv Aufwärtspotenzial in Kolumbien-Aktien freigesetzt werden.

Denn derartig positive Nachrichten über eine neue Regierung in Kolumbien mit einer freundlicheren Politik für den Rohstoffsektor dürften in den aktuellen Kursen kolumbianischer Aktien und Aktien mit Geschäften in Kolumbien, noch überhaupt nicht eingepreist sein. Sie sehen es im Aktienchart von Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG),

Die Situation erinnert an argentinische Aktien in 2023/24, nachdem die dortige linke Regierung um Sergio Massa durch den amtierenden Präsidenten Javier Mileis ersetzt wurde. Was nach dem Regierungswechsel und den pro-marktwirtschaftlichen Aktivitäten von Neu-Präsident Mileis mit argentinischen Aktien passierte, ist bekannt:

(Quelle: Travingview)

Jegliche positive politische Nachricht aus Kolumbien nicht im Aktienkurs enthalten

Ein derart positiver politischer Turbo könnte fantastische Aufwärtspotenziale für die Aktie von Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG) freisetzen. Doch das Besondere an Outcrop Silver: Der Wert braucht den politischen Rückenwind nicht. Denn das Santa Ana-Projekt ist hoch spannend, und hier dürfte in 2025 richtig viel passieren.

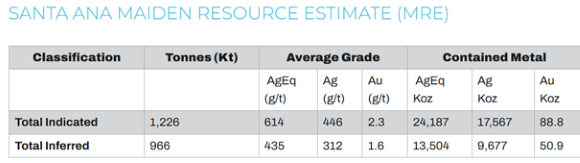

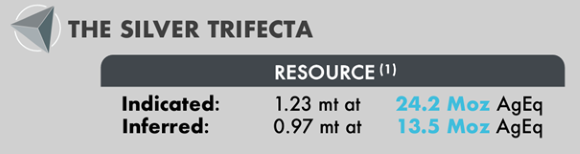

Was Santa Ana so spannend macht: Wir wissen bereits, dass Outcrop Silber & Gold auf einem hoch spannenden Silberprojekt sitzt. Denn es gibt bereits eine Ressourcenschätzung aus dem Jahr 2023, wonach von 24,2 Mio. Unzen an Silber-Äquivalent der Kategorie "Angezeigte Ressource" und weiter 13,5 Mio. Unzen an Silber-Äquivalent der Kategorie "Vermutete Ressource" ausgegangen wird.

(Quelle: Outcrop Silver)

Doch das ist erst der Anfang!

Denn jetzt kommt ein Faktor, der zu einem Gamechanger für Outcrop Silver werden könnte: Über 75 % der definierten Silber- und Goldadern wurden noch überhaupt nicht exploriert! 75 %! Damit besitzt die Exploration des Santa Ana-Projekts größtes positives Überraschungspotenzial für Aktionäre von Outcrop Silver.

Oder anders ausgedrückt: Die bisherige Ressourcenschätzung basiert erst auf weniger als 25 % der vermuteten Silber- und Goldadern. Erst diese 25 % wurden bisher systematisch mit Bohrungen erforscht. Dabei handelt es sich um das Gebiet im Nordosten des Santa Ana-Projektes. Das Management erwartet: Umfassende Explorationen dieser noch nicht weitgehend erforschten 75 % im mittleren Teil und im Süden könnten laut dem Management das Potenzial haben, die Ressourcen des Santa Ana-Projekts zu VERDOPPELN ODER SOGAR ZU VERDREIFACHEN!

Sehr erfreulich. Die bisherigen Testergebnisse der Probebohrungen lassen darauf schließen, dass Santa Ana eine tolle Gewinnungsrate von hohen 96,3 % für Silber und sogar 98,5 % für Gold haben soll. Ein wichtiger zusätzlicher Faktor: Die Gesteinsstruktur mit hohen Silberkonzentraten macht komplexe Silber-Gewinnungsmethoden unnötig, was die Produktionskosten attraktiv niedrig machen dürfte.

Achtung: Neue Ressourcenschätzung für Silberprojekt in Planung!

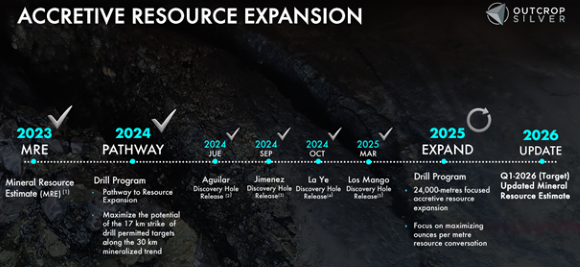

Vor allem, wenn die Gold- und Silberpreise in den neuen Bohrungen hoch bleiben wie bisher. Das Management will in 2025 ein gewaltiges Explorationsprogramm über sage und schreibe 24.000 Meter durchführen. Das Ziel ist eine Ausweitung der Silber-Ressourcen im Santa Ana-Projekt. Outcrop Silber will dafür satte 12 Mio. CAD investieren.

Das ist sehr viel für ein so kleines Unternehmen wie Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG). Doch das hat einen fantastischen Grund, den Anleger kennen müssen. Das Management hat einen klaren und sehr cleveren Plan … für die heißeste Unternehmensphase von Outcrop Silver!

Die Exploration ist der Schritt zum ganz großen Highlight am Horizont: Das Management hat in der neuesten Unternehmenspräsentation in Aussicht gestellt, im 1. Quartal 2026 eine neue Ressourcenschätzung zu veröffentlichen. Das ist der Knaller. Denn wir haben schon April 2025. Damit dürfte diese neue Ressourcenschätzung nicht mal mehr ein Jahr entfernt sein.

(Quelle: Outcrop Silver )

Jetzt könnte der ideale Kaufzeitpunkt für Outcrop Silver sein!

Die Börse antizipiert bekanntlich derartig große Ereignisse oftmals 3-6 Monate im Voraus - und bewegt die involvierten Aktien dementsprechend häufig schon im Vorfeld. Das bedeutet: Jetzt könnte für Aktionäre der ideale Zeitpunkt für den Einstieg bei Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG).

Denken Sie daran: Outcrop Silver hat einen selten hohen Hebel auf steigende Silberpreise. Denn rund 73 % des gesamten Silber-Äquivalents stammt von Silber. Zum Vergleich: Vizsla Silver ist wesentlich bekannter als Outcrop Silver und gilt als eine der primären Silberaktien mit einem besonders hohen Hebel auf den Silberpreis. Aber nur 56 % kommen bei Vizsla von Silber. Outcrop Silver hat 73 %!

Es kommt noch ein weiterer Faktor hinzu, der Outcrop Silver JETZT zu einem besonders chancenreichen Investment machen könnte: In 2024 konnte Outcrop Silver über 17 Mio. CAD an neuem Kapital einsammeln. Das ist sehr viel für ein so kleines Unternehmen wie Outcrop Silver. Rohstoff-Superinvestor Eric Sprott steuerte im Oktober 2024 mit 5 Mio. CAD den Löwenanteil des frischen Kapitals bei.

Superinvestor Eric Sprott hat seine Beteiligung in letzten 6 Monaten massiv ausgebaut!

Doch Sprott war noch nicht fertig: Erst im März 2025 führte Outcrop Silver eine Kapitalerhöhung über 7,5 Mio. CAD durch. Ursprünglich war nur eine Kapitalerhöhung von 5 Mio. CAD geplant. Aber das Interesse unter Käufern war so groß, das Outcrop Silver das Volumen kurzfristig um 50 % erhöhte. Auch hier kaufte Sprott: Mit satten 3 Mio. CAD kaufte er gleich 40 % der gesamten angebotenen Anteile an Outcrop Silver auf.

Das öffnet die Augen eines jeden klugen Anlegers.

Angesichts der bevorstehenden großen Katalysatoren für potenzielle Aktiensprünge von Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG) macht der große Einstieg von Superinvestor Sprott absolut Sinn - ein klassischer cleverer Schachzug des immer besser informierten Smart Money:

- Starker Newsflow aus dem großen Explorationsprogramm von über 24.000 Metern in Santa Ana in 2025.

- Die vom Management für das 1. Quartal 2026 anvisierte neue Ressourcenschätzung.

- Eine mögliche Fortsetzung der Silber-Rallye mit deutlich steigenden Silberpreisen - wovon Outcrop Silver aufgrund seines außerordentlich hohen Anteils von rund 73 % Silber an den bisher gemessenen Ressourcen besonders stark profitieren sollte.

- Die für den 8. März 2026 angesetzten Präsidentschaftswahlen in Kolumbien, die einen "Argentinien-Effekt" für Aktien mit Projekten und Geschäften in Kolumbien auslösen könnten.

Potenzielle Mega-Katalysatoren für steigende Aktienkurse stehen bevor!

Eine Rechnung zeigt, warum sich Superinvestor Eric Sprott so dick bei Outcrop Silver einkauft: Dieses Unternehmen könnte ein seltenes asymmetrisches Chance-Risiko-Verhältnis besitzen. Das bedeutet: Die Gewinnchancen könnten im Idealfall um ein Vielfaches höher sein als die Risiken. Sie stehen nicht mehr in einem normalen Verhältnis.

Darauf waren wir ja bereits im Rahmen der kolumbianischen Präsidentschaftswahlen eingegangen: Die Aktie von Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG) ist aktuell bewertet, als ob der amtierende Links-Regierung im Amt bleibt. Passiert dies, dürfte die Aktie also gar nicht oder nur leicht abgeben.

Aber wenn die unpopuläre Links-Regierung abgewählt wird und ähnlich wie in Argentinien eine pro-marktwirtschaftliche Regierung an die Macht kommt, könnte Outcrop Silver gewaltiges Aufwärtspotenzial besitzen - denn dieses Szenario ist noch überhaupt nicht eingepreist. Ein asymmetrisches Chance-Risiko-Verhältnis.

Dazu zeigt eine Rechnung, über was für ein fundamentales Multibagger-Gewinnpotenzial wir bei Outcrop Silver sprechen könnten. Silber-Ressourcen werden normalerweise in Silber-Bullenmärkten, den wir inzwischen haben, mit einem Discount von 70 bis 90 % zum aktuellen Silberpreis bewertet.

Denn es ist ja nicht genau sicher, ob wirklich alle prognostizierten Ressoucen vorhaben sind. Seien wir konservativ und setzen den Mittelwert von 80 % für die Ressourcen aus der Schätzung von 2023 an. Das entspricht bei einem Silberpreis von 32 USD/Unze also 6,4 USD für eine Unze Silberressource. Aber seien wir noch mal konservativ und setzen wir nur 6,0 USD an.

Ressourcenberechnung könnte seltenes asymmetrisches Chance-Risiko-Profil aufdecken!

Die Ressourcenschätzung von 2023 belief sich insgesamt auf 37,7 Mio. Unzen an Silberäquivalent. Selbst bei einer lächerlich niedrigen Bewertung von 6 USD/Unze Silber ergibt sich damit ein Wert von 226,2 Mio. USD für das Santa Ana-Projekt - und dabei sind 70 % des Gebietes noch gar nicht exploriert! 226,2 Mio. USD entspricht rund 315 Mio. CAD.

(Quelle: Outcrop Silver)

Aber Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG) wird aktuell nur mit 60 Mio. CAD bewertet! Das bedeutet: Selbst basierend auf der alten Ressourcenschätzung von 2023 und einem Silberpreis von 32 USD/Unze besitzt das Unternehmen ein Gewinnpotenzial von rund +425 % - vorausgesetzt, die kommende Unternehmensentwicklung verläuft erfolgreich.

In dieser Berechnung sind keine weiteren Ressourcen einberechnet, die Outcrop Silver mit seinem jetzt laufenden Explorationsprogramm in 2025 finden und in die kommende Ressourcenschätzung einbringen könnte. Aber fragen Sie sich Folgendes: Ist es wahrscheinlich, dass die Ressource in der kommenden Schätzung höher ausfallen wird als in 2023, als erst rund 25 % des Gebietes exploriert wurden?

Zudem basiert diese Schätzung auf einem Silberpreis von 32 USD/Unze. Wenn Silber nur auf 40 USD/Unze ansteigt - was viele Silberexperten spätestens für 2026 erwarten -, so erhöht sich der Wert des Santa Ana-Projekts blitzschnell auf rund 420 Mio. CAD (301,6 Mio. USD). Gegenüber der aktuellen Börsenbewertung würde dies eine fantastische Multibaggerchance von +600 % bedeuten.

Aktie könnte gewaltiges Multibagger-Gewinnpotenzial besitzen

Jetzt wird klar, was Superinvestor Eric Sprott für eine asymmetrische Gewinnchance bei Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG) sehen dürfte. Was mit dem Aktienkurs von Outcrop Silver passieren könnte, wenn

- der Silberpreis auf 40 USD/Unze oder gar auf 50 USD/Unze ansteigt oder

- die kommende Ressourcenschätzung ein Erfolg wird und eine deutliche Ressourcenerweiterung ausweist,

ist leicht vorstellbar. Kein Wunder, dass Superinvestor Eric Sprott im letzten halben Jahr aggressiv Aktien von Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG) gekauft hat! Das Beste für Sie: Aufgrund der Börsenturbulenzen können Sie aktuell sogar zu Preisen kaufen, die deutlich unter den Kursen im September 2024 und März 2025 liegen (als die beiden Kapitalerhöhungen durchgeführt wurden).

Wann hat man als Privatanleger schon mal die Chance, zu ähnlichen oder gar günstigeren Kursen als das Smart Money der Superinvestoren in eine Aktie mit einem asymmetrischen Chance-Risiko-Verhältnis einzusteigen? In einen Wert wie Outcrop Silver, den Eric Sprott vermutlich als massiv unterbewertet und extrem chancenreich einstuft.

Die massive aktuelle Fehlbewertung der Aktie von Outcrop Silver (WKN: A3CSAT, ISIN: CA69002Q1054, TSXV:OCG) könnte cleveren Investoren an der Seite von Eric Sprott eine fantastische Multibagger-Chancen im boomenden Silbermarkt eröffnen! Sehen wir eine massive Silberrallye und das Unternehmen entwickelt Santa Ana erfolgreich, könnte dieser Wert geduldigen Investoren langfristig sogar eine echte Tenbagger-Gewinnchance bieten.

Wir wünschen Ihnen viel Erfolg bei Ihren Investments und verbleiben mit spekulativen Grüßen aus der Mining Investor Redaktion

Weitere Informationen zum Unternehmen erhalten Sie auf der Webseite des Unternehmens

Hinweise gemäß §34b Abs. 1 WpHG in Verbindung mit FinAnV (Deutschland)

Disclaimer

Dieser Werbeartikel wurde von Mitarbeitern der Orange Unicorn Ltd. am 23. April 2025 erstellt und am 28. April abgeändert. Gemäß §84 WPHG ist die Tätigkeit der Orange Unicorn LTD. bei der Bafin angezeigt.

Sämtliche Veröffentlichungen, also Berichte, Darstellungen, Mittelungen sowie Beiträge ("Veröffentlichungen") dienen ausschließlich der Information und stellen keine Handelsempfehlung hinsichtlich des Kaufs oder Verkaufs von Wertpapieren dar. Die Veröffentlichungen sind nicht mit einer professionellen Finanzanalyse gleichzusetzen, sondern geben lediglich die Meinung der Orange Unicorn/hotstock-investor.com ("Herausgeber"), bzw. der für diese tätigen Verfasser der Veröffentlichungen ("Verfasser") wieder. Jedes Investment in die hier vorgestellten Finanzinstrumente wie Aktien, Anleihen, Derivate auf Wertpapiere etc. (zusammen "Finanzinstrumente") ist mit Chancen, aber auch mit Risiken bis hin zum Totalverlust verbunden. Kauf-/Verkaufsaufträge sollten zum eigenen Schutz stets limitiert werden. Dies gilt insbesondere für die hier behandelten Werte aus dem Small- und Micro-Cap-Bereich, die sich ausschließlich für spekulative und risikobewusste Anleger eignen.

Jeder Anleger handelt auf eigenes Risiko.

Der Herausgeber und die für ihn tätigen Verfasser übernehmen keinerlei Gewähr auf die Aktualität, Richtigkeit, Vollständigkeit oder sonstige Qualität der Veröffentlichungen.

Hinweise gemäß §34b Abs. 1 WpHG in Verbindung mit FinAnV (Deutschland)

Für die Berichterstattung über das Unternehmen Outcrop Silver Corp. wurden Vermittler, Autor und Herausgeber vom Unternehmen Outcrop Silver Corp. entgeltlich entlohnt. Hierdurch besteht konkret und eindeutig ein Interessenkonflikt.

Vermittler und Autor halten Aktien von Outcrop Silver Corp. Diese unterliegen einer Sperrfrist und können erst danach verkauft werden. Vermittler und Autor haben angekündigt, diese Aktien nach Ende der Sperrfrist, auch wenn dieser Zeitpunkt innerhalb dieses Werbezeitraums fallen könnte, zu verkaufen. Hierdurch besteht konkret und eindeutig ein Interessenskonflikt.

Eine individuelle Offenlegung zu Wertpapierbeteiligungen des Herausgebers und der Verfasser und/oder der Vergütung des Herausgebers oder der Verfasser durch das mit Veröffentlichungen im Zusammenhang stehende Unternehmen Dritte, werden in beziehungsweise unter der jeweiligen Veröffentlichung ausdrücklich ausgewiesen.

Die in den jeweiligen Veröffentlichungen angegebenen Preise/Kurse zu besprochenen Finanzinstrumenten sind, soweit nicht näher erläutert, Tagesschlusskurse des zurückliegenden Börsentages oder aber aktuellere Kurse vor der jeweiligen Veröffentlichung. Allgemeiner Haftungsausschluss Die Veröffentlichungen dienen ausschließlich Informationszwecken. Alle Informationen und Daten in den Veröffentlichungen stammen aus Quellen, die der Herausgeber bzw. der Verfasser zum Zeitpunkt der Erstellung für zuverlässig und vertrauenswürdig hält. Der Herausgeber und die Verfasser haben die größtmögliche Sorgfalt darauf verwandt, sicherzustellen, dass die verwendeten und zugrunde liegenden Daten und Tatsachen vollständig und zutreffend sowie die herangezogenen Einschätzungen und aufgestellten Prognosen realistisch sind.

Der Herausgeber übernimmt jedoch keine Gewähr auf Richtigkeit, Vollständigkeit, und Aktualität der in den Veröffentlichungen enthaltenen Informationen.

Der Herausgeber hat keine Aktualisierungspflicht.

Er weist darauf hin, dass nachträglich Veränderungen der in den Veröffentlichungen enthaltenen Informationen und der darin enthaltenen Meinungen des Herausgebers oder des Verfassers entstehend können. Im Falle derartiger nachträglicher Änderungen ist der Herausgeber nicht verpflichtet, diese mitzueilen bzw. gleichfalls zu veröffentlichen. Die Aussagen und Meinungen des Herausgebers bzw. Verfassers stellen keine Empfehlung zum Kauf oder Verkauf eines Finanzinstruments dar. Der Herausgeber ist nicht verantwortlich für Konsequenzen, speziell für Verluste, welche durch die Verwendung der in Veröffentlichungen enthaltenen Informationen und Meinungen folgen bzw. folgen könnten.

Der Herausgeber und die Verfasser übernehmen insbesondere keine Gewähr dafür, dass aufgrund des Erwerbs von Finanzinstrumenten der Gegenstand von Veröffentlichungen sind Gewinne erzielt oder bestimmte Kursziele erreicht werden können.

Herausgeber und Verfasser sind keine professionellen Investitionsberater. Der Herausgeber und der Verfasser sind im Zusammenhang mit Veröffentlichungen für Dritte tätig. Sie erhalten von Dritten Entgelte für Veröffentlichungen, was zu einem Interessenkonflikt führen kann, auf den hiermit ausdrücklich hingewiesen wird.

Die auf den Internetseiten des Herausgebers wiedergegebenen Informationen und Meinungen Dritter, insbesondere in den Chats, geben nicht die Meinung des Herausgebers wieder, so dass dieser entsprechend keinerlei Gewähr auf die Aktualität, Korrektheit, Vollständigkeit oder Qualität der Informationen übernimmt. Die Urheberrechte der einzelnen Artikel liegen bei dem jeweiligen Autor. Nachdruck und/oder kommerzielle Weiterverbreitung sowie die Aufnahme in kommerzielle Datenbanken ist nur mit ausdrücklicher Genehmigung des jeweiligen Autors oder des Herausgebers erlaubt.

Urheberrecht

Die Urheberrechte der einzelnen Artikel liegen bei dem Herausgeber. Der Nachdruck und/oder kommerzielle Weiterverbreitung sowie die Aufnahme in kommerzielle Datenbanken ist nur mit ausdrücklicher Genehmigung des Herausgebers erlaubt. Die Nutzung der Veröffentlichungen ist nur zu privaten Zwecken erlaubt. Eine professionelle Verwertung ist entgeltpflichtig und nur mit vorheriger schriftlicher Zustimmung des Herausgebers zulässig. Veröffentlichungen dürfen weder direkt noch indirekt nach Großbritannien, in die USA oder Kanada oder an US-Amerikaner oder eine Person, die ihren Wohnsitz in den USA, Kanada oder Großbritannien hat, übermittelt werden.

Impressum

Angaben gemäß § 5 TMG:

Orange Unicorn Ltd

132-134 Great Ancoats Street

M4 6DE Manchester

Kontakt: Telefon: +44 (0)161 768 0646

E-Mail: info@hotstock-investor.com

Registergericht: England and Wales

Registernummer: 15974038

Aufsichtsbehörde: Companies House

Enthaltene Werte: CA85207K1075,CA85208R1010,CA03062D1006,CA2546771072,CA69002Q1054

Die hier angebotenen Beiträge dienen ausschließlich der Information und stellen keine Kauf- bzw. Verkaufsempfehlungen dar. Sie sind weder explizit noch implizit als Zusicherung einer bestimmten Kursentwicklung der genannten Finanzinstrumente oder als Handlungsaufforderung zu verstehen. Der Erwerb von Wertpapieren birgt Risiken, die zum Totalverlust des eingesetzten Kapitals führen können. Die Informationen ersetzen keine, auf die individuellen Bedürfnisse ausgerichtete, fachkundige Anlageberatung. Eine Haftung oder Garantie für die Aktualität, Richtigkeit, Angemessenheit und Vollständigkeit der zur Verfügung gestellten Informationen sowie für Vermögensschäden wird weder ausdrücklich noch stillschweigend übernommen. ABC New Media hat auf die veröffentlichten Inhalte keinerlei Einfluss und vor Veröffentlichung der Beiträge keine Kenntnis über Inhalt und Gegenstand dieser. Die Veröffentlichung der namentlich gekennzeichneten Beiträge erfolgt eigenverantwortlich durch Autoren wie z.B. Gastkommentatoren, Nachrichtenagenturen, Unternehmen. Infolgedessen können die Inhalte der Beiträge auch nicht von Anlageinteressen von ABC New Media und / oder seinen Mitarbeitern oder Organen bestimmt sein. Die Gastkommentatoren, Nachrichtenagenturen, Unternehmen gehören nicht der Redaktion von ABC New Media an. Ihre Meinungen spiegeln nicht notwendigerweise die Meinungen und Auffassungen von ABC New Media und deren Mitarbeiter wider. (Ausführlicher Disclaimer)