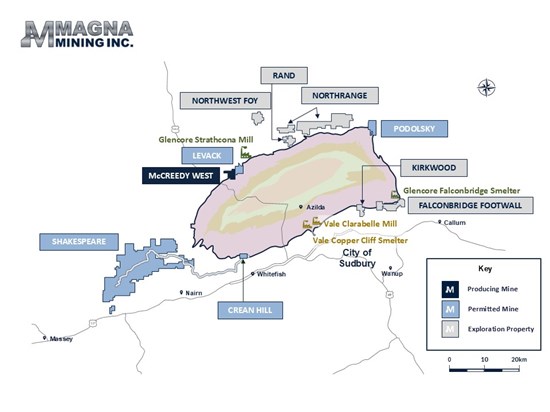

Sudbury, Ontario--(Newsfile Corp. - March 31, 2025) - Magna Mining Inc. (TSXV: NICU) (OTCQB: MGMNF) (FSE: 8YD) ("Magna" or the "Company") is pleased to announce assay results from the producing McCreedy West Mine and the adjacent Levack Mine (Figure 1). Drilling at McCreedy West was focused on the 700 Footwall Cu-PGE zone resource expansion and definition in support of mid-term production planning, and targeted areas near historical mining. Drilling at Levack was targeting the near surface Keel Footwall Cu zone.

Highlights from the new assay results include:

McCreedy West Mine

- FNX33323: 4.4% Cu, 0.6% Ni, 13.8 g/t Pt + Pd + Au over 18.0 metres

Including 8.2% Cu, 0.8% Ni, 7.5 g/t Pt + Pd + Au over 7.3 metres

- FNX33338: 8.7% Cu, 0.3% Ni, 32.8 g/t Pt + Pd + Au over 3.2 metres

And 3.7% Cu, 3.1% Ni, 2.8 g/t Pt + Pd + Au over 17.5 metres

- FNX33361: 4.3% Cu, 5.0% Ni, 3.6 g/t Pt + Pd + Au over 2.9 metres

Levack Mine

- FNX33323: 12.2 % Cu, 0.5% Ni, 2.8 g/t Pt + Pd + Au over 3.4 metres

Including 24.9% Cu, 0.4% Ni, 5.0 g/t Pt + Pd + Au over 1.6 metres

Dave King, S.V.P. Exploration and Geoscience for Magna Mining stated: "Magna is pleased to be able to announce the first assays received from diamond drilling under Magna's management since taking ownership of the mine on February 28, 2025. The results today include high grade copper intersections at the McCreedy West and Levack Mines, which continue to demonstrate the quality of resources remaining at both sites. We look forward to providing additional updates as we continue to advance our understanding of these deposits, and as more drilling results become available over the coming months."

McCreedy West Mine 2025 Drilling

Currently there are two drills active underground at McCreedy West supporting ongoing production and longer-term planning. Drilling results released today are from the first drillholes completed by Magna mining and are targeting mineralized remnant pillars within the 700 Footwall Zone (Figures 2 and 3). Results include 4.4% Cu, 0.6% Ni, 13.8 g/t Pt + Pd + Au over 18.0 metres, including 8.2% Cu, 0.8% Ni, 7.5 g/t Pt + Pd + Au over 7.3 metres in drillhole FNX33323. A summary of assay results is presented in Table 1 and drillhole collar information is provided in Table 2.

Levack Mine 2025 Drilling Program

The Levack Mine (Figure 4) was in production by KGHM until 2019 and is currently in care and maintenance. There are two surface diamond drillholes active at Levack, with a third drill scheduled to mobilize to site in April. The 2025 drilling program at Levack is designed to support the Magna Mining internal Levack Mine restart study and exploration for new footwall and contact style deposits. The initial diamond drilling is focussed on defining near surface mineralization in the footwall of the main orebody and defining the unmined Keel FW zone (Figure 4). Definition drilling within the Keel zone will also provide material to be used for metallurgical test work. Results from the first drillhole completed by Magna mining included 24.9% Cu, 0.4% Ni & 5.0 g/t Pt + Pd + Au Over 1.6 metres in drillhole MLV-25-01. See Table 1 for a complete summary of assay results.

Figure 1: Magna Mining - Current Properties in the Sudbury Basin.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8002/246644_777bc052241de8b8_002full.jpg

Figure 2: McCreedy West Mine 3D Oblique View Showing the Location of Mineralized Zones and the Location of Figure 3 Plan View.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8002/246644_777bc052241de8b8_003full.jpg

Figure 3: McCreedy West Mine Plan View, Showing the Mined Stopes with Respect to the Location of Drillhole FNX33323.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8002/246644_777bc052241de8b8_004full.jpg

Figure 4: Levack Mine Longitudinal Section Showing the Location of Mineralized Zones, and Vertical Section Showing the Location of the Keel Footwall Zone.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8002/246644_777bc052241de8b8_005full.jpg

Table 1: Summary of Drillhole Results from McCreedy West and Levack Drilling

| Drillhole | Zone | From (m) | To (m) | Length (m) | Cu % | Ni % | Co % | Pt g/t | Pd g/t | Au g/t | TPM g/t | NiEq | CuEq | |

| FNX33323 | 700 FW | 7.47 | 8.84 | 1.37 | 6.54 | 0.44 | 0.01 | 5.52 | 7.23 | 1.04 | 13.79 | 5.99 | 10.67 | |

| and | 37.95 | 41.15 | 3.20 | 1.37 | 1.26 | 0.01 | 7.00 | 3.79 | 1.29 | 12.08 | 3.71 | 6.60 | ||

| and | 50.75 | 51.66 | 0.91 | 20.65 | 0.18 | 0.00 | 13.87 | 13.52 | 4.72 | 32.11 | 16.49 | 29.35 | ||

| and | 87.17 | 105.16 | 17.98 | 4.42 | 0.58 | 0.01 | 1.38 | 2.21 | 0.47 | 4.06 | 3.52 | 6.26 | ||

| Including | 90.53 | 97.84 | 7.32 | 8.24 | 0.76 | 0.01 | 2.50 | 4.17 | 0.87 | 7.54 | 6.27 | 11.17 | ||

| FNX33338 | 700 FW | 36.73 | 39.93 | 3.20 | 8.73 | 0.28 | 0.00 | 6.20 | 12.20 | 14.44 | 32.84 | 11.82 | 21.05 | |

| and | 167.18 | 184.71 | 17.53 | 3.69 | 3.08 | 0.04 | 1.16 | 1.40 | 0.22 | 2.79 | 5.07 | 9.03 | ||

| Including | 177.85 | 184.71 | 6.86 | 5.10 | 3.95 | 0.04 | 1.50 | 1.89 | 0.06 | 3.45 | 6.64 | 11.82 | ||

| FNX33361 | 700 FW | 155.14 | 158.04 | 2.90 | 4.30 | 5.03 | 0.07 | 1.65 | 1.86 | 0.10 | 3.61 | 7.18 | 12.78 | |

| MLV-25-01 | Keel | 239.97 | 240.26 | 0.29 | 11.79 | 0.02 | 0.01 | 0.03 | 0.01 | 0.02 | 0.06 | 6.36 | 11.33 | |

| and | 288.40 | 291.80 | 3.40 | 12.24 | 0.52 | 0.01 | 0.73 | 1.45 | 0.66 | 2.84 | 7.51 | 13.38 | ||

| Including | 290.17 | 291.80 | 1.63 | 24.93 | 0.43 | 0.01 | 0.88 | 2.85 | 1.31 | 5.04 | 14.67 | 26.11 | ||

| All lengths are downhole length. True widths are uncertain at this time. Ni Eq % = (Ni% x 85% Recovery 2204 x Ni Price $/lb) + (Cu% x 96% Recovery x 2204 x Cu Price $/lb) + (Co% x 56% Recovery x 2204 x Co Price $/lb) + (Pt gpt x 69% Recovery / 31.1035 x Pt $/oz) +(Pd gpt x 68% Recovery / 31.1035 x Pd $/oz) + (Au gpt x 68% Recovery / 31.1035 x Au $/oz))/2204 x Ni $/lb. Cu Eq % = (Ni% x 85% Recovery 2204 x Ni Price $/lb) + (Cu% x 96% Recovery x 2204 x Cu Price $/lb) + (Co% x 56% Recovery x 2204 x Co Price $/lb) + (Pt gpt x 69% Recovery / 31.1035 x Pt $/oz) +(Pd gpt x 68% Recovery / 31.1035 x Pd $/oz) + (Au gpt x 68% Recovery / 31.1035 x Au $/oz))/2204 x Cui $/lb. Metal prices in US$: $7.30/lb Ni, $4.10/lb Cu, $15.00/lb Co, $1,000/oz Pt, $1,050/oz Pd and $2,200/oz Au. | ||||||||||||||

Table 2: Drillhole Collar Coordinates

| BHID | Easting | Northing | Elevation | Azimuth | Dip | Depth (m) |

| MLV-25-01 | 471511 | 5166871 | 377 | 227 | -56 | 400 |

| FNX33323 | 469649 | 5164908 | 2 | 181.4 | 17 | 108 |

| FNX33338 | 469835 | 5164878 | -48 | 211.4 | 2 | 186 |

| FNX33361 | 469835 | 5164878 | -48 | 204.4 | 2 | 162 |

| *Drillhole Coordinates are in Coordinate System NAD 83 Zone 17 | ||||||

Update on the McCreedy West Mine

Magna Mining assumed ownership of the McCreedy West Mine following the closing of the acquisition of a subsidiary of KGHM on February 28, 2025. Upon closing, production at the mine was governed by the prior operational plan which was approved and implemented by KGHM. Magna immediately undertook multiple operational improvement initiatives during the first week of ownership, and the Company is pleased with the current progress of these initiatives. These initiatives are aimed streamlining processes, improving grade control and increasing efficiency, and there is a renewed focus on underground development. Magna anticipates that increased development will result in additional ore mining areas that can be accessed within the mine, subsequently increasing production flexibility, stope sequencing and efficiency of the operation. Magna intends to provide more detailed production plans for the McCreedy West mine before the end of Q2.

Jason Jessup, CEO of Magna stated "The assay results today highlight the potential opportunity to increase production grades at our McCreedy West Mine and incorporate high grade copper footwall veins into a restart plan for Levack Mine. The exploration drilling at Levack Mine is being accelerated with a third diamond drill rig in April. We have begun the necessary investments and changes at the McCreedy West Mine to bring it to what we believe is an optimal, sustainable production level. One of the keys to successfully growing production will to be increasing the amount of capital development within the mine, which will facilitate access to additional ore mining workplaces. This will require some time and a modest capital investment, but we see the opportunity to continue to grow production and set up the mine for a strong 2026 and beyond."

Investor Rights Agreement with Dundee Corporation

Magna and Dundee Resources Limited ("Dundee") entered into an investor rights agreement effective as of July 23, 2024 (the "Investor Rights Agreement") pursuant to which Dundee is entitled to certain customary investor rights, provided that Dundee maintains certain equity ownership thresholds in Magna and satisfies certain other conditions. Among other things, the Investor Rights Agreement provides Dundee with (i) the right to designate one director for appointment to the board of directors of Magna, (ii) the right to participate in certain financings completed by Magna, and (iii) information rights.

A copy of the Investor Rights Agreement is available on SEDAR+ (www.sedarplus.ca) under Magna's issuer profile.

Qualified Person

The technical information in this press release has been reviewed and approved by David King, M.Sc., P.Geo. Mr. King is the Senior Vice President, Exploration and Geoscience for Magna Mining Inc. and is a qualified person under Canadian National Instrument 43-101.

QAQC

Sample QA/QC procedures for Magna have been designed to meet or exceed industry standards. Drill core is collected from the diamond drill and placed in sealed core trays for transport to Magna's core facilities. The core is then logged, and samples marked in intervals of up to 1.5m. Samples are then put into plastic bags with 10 bagged samples being placed into rice bags for transport to Swastika Laboratories in Kirkland Lake Ontario via Gardewine Transport for preparation and analysis. Samples are submitted in batches of 50 with 5 QA/QC samples including, 2 certified reference material standards, 2 samples of blank material and 1 lab duplicate.

About Magna Mining Inc.

Magna Mining is a producing mining company with a portfolio of copper, nickel and PGM operating, exploration and development projects in the Sudbury Region of Ontario, Canada. The Company's primary assets are the producing McCreedy West copper mine and the past producing Levack, Podolsky, Shakespeare and Crean Hill mines. Additional information about the Company is available on SEDAR (www.sedar.com) and on the Company's website (www.magnamining.com).

For further information, please contact:

Jason Jessup

Chief Executive Officer

or

Paul Fowler, CFA

Senior Vice President

705-482-9667

Email: info@magnamining.com

Cautionary Statement

This press release contains certain forward-looking information or forward-looking statements as defined in applicable securities laws. Forward-looking statements are not historical facts and are subject to several risks and uncertainties beyond the Company's control, including statements regarding, the production and exploration potential of the McCreedy West Mine and Levack Mine, production and operational objectives, plans to complete exploration programs, potential mineralization, exploration results and statements regarding beliefs, plans, expectations, or intentions of the Company. Resource exploration and development is highly speculative, characterized by several significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law.

A production decision at the McCreedy West mine was made by the previous operator of the mine, and Magna has made a decision to continue production subsequent to the completion of the Acquisition. This decision by Magna to continue production following completion of the Acquisition and, to the knowledge of Magna, the prior production decision by the current operator, were not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that anticipated production results and costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on Magna's cash flow and future profitability. Readers are cautioned that there is increased uncertainty and higher risk of economic and technical failure associated with such production decisions.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this press release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/246644

SOURCE: Magna Mining Inc.