HIGHLIGHTS:

- Over 81,000 meters were drilled in 2024, focused on identifying higher grade satellite targets, with the goal of supplementing production from the commencement of operations

- Results provide significant confidence in achieving the previously published short-term objective of discovering over 1Moz of M&I resources for satellites at a 50% higher grade compared to the Koné deposit

- Mineralisation was confirmed at all 18 targets drilled in 2024 out of the 52 exploration targets identified

- Starter maiden resources delineated for 7 new higher grade satellites, with grades ranging between 0.9 and 1.6 g/t Au, or between approximately 60% to 180% higher than the Koné deposit

- Efforts on the satellite deposits have added 160koz at 1.16 g/t Au and 270koz at 1.0 g/t Au of Indicated and Inferred Resources, respectively, with deposits remaining open as the focus was to delineate only a small portion of the orebodies to assess the grade profiles in order to prioritize 2025 drill efforts

- 6 other targets were progressed to pre-resource definition stage, which are currently being pursued given the high grade intercepts received (11.0m at 4.4 g/t Au and 15.0m at 2.17 g/t Au at Soman 1 & 2; 7.0m at 9.20 g/t Au at ANVIII)

- Koné deposit Indicated resource increased by 150koz to 4.49Moz at 0.57 g/t Au and Inferred Resource increased by 110koz to 0.51Moz at 0.43 g/t Au

- Koné project overall Indicated Resource grew by 340koz to 5.21Moz at 0.62 g/t Au and Inferred Resource grew by 380koz to 780koz at 0.54 g/t Au following the first drill campaign under the leadership of the new management team

- 90,000-meter drill programme was launched in early 2025 with the goal of continuing to delineate and test higher-grade satellites

ABIDJAN, CÔTE D'IVOIRE, April 08, 2025 (GLOBE NEWSWIRE) -- Montage Gold Corp. ("Montage" or the "Company") (TSXV: MAU, OTCQX: MAUTF) is pleased to announce that the results of its 2024 Koné project exploration programme, in Côte d'Ivoire, provide significant confidence in achieving its previously published short-term exploration target of discovering more than 1Moz of Measured and Indicated Resources, at a grade 50% higher than the Koné deposit, with the goal of further improving the production profile from the commencement of production in Q2-2027.

A total of 81,815 meters were drilled in 2024, amounting to US$13 million, under the leadership of the new management team, with the goal of delineating resources at selected advanced targets, in addition to continuing to drill test and progress other targets. Given the extensive 2,138km2 land package encompassing over 52 identified targets, the approach undertaken is to systematically drill test best selected targets to confirm their potential and define starter resources to validate their high-grade content before undertaking larger step-out drilling campaigns. Consequently, 18 targets were drill tested last year, which successfully delineated starter resources for 7 higher grade satellite deposits, while another 6 targets have advanced to the pre-resource definition stage and are currently being followed up.

As a result, the Koné project now hosts 8 satellite deposits, inclusive of the Gbongogo Main deposit. Efforts on the new satellite deposits have added 160koz at 1.16 g/t Au and 270koz at 1.0 g/t Au of Indicated and Inferred Resources, respectively, at grades ranging between 0.9 and 1.6 g/t Au, or between approximately 60% and 180% higher than the Koné deposit, as summarised in Tables 1 and 2 below. All deposits delineated remain open as the focus was to delineate only a small portion of the orebodies to assess the grade profiles in order to prioritize 2025 drill efforts.

In addition, exploration efforts at the Koné deposit resulted in adding near-surface mineralization and confirming mineralization at depth. As shown in Table 1 below, the Koné deposit Indicated Resource increased by 150koz to 4.49Moz at 0.57 g/t Au while the Inferred Resource increased by 110koz to 0.51Moz at 0.43 g/t Au. Coupled with the resource additions for the satellite deposit, the Koné project's Indicated Resources grew by 340koz to 5.21Moz at 0.62 g/t Au and Inferred Resources grew by 380koz to 780koz at 0.54 g/t Au.

| Table 1: Koné project resource update variance | |||||||||

| PREVIOUS RESOURCE ESTIMATE1 | UPDATED RESOURCE ESTIMATE2 | ||||||||

| Resources shown on a 100% basis | Tonnage | Grade | Content | Tonnage | Grade | Content | Variance | ||

| (Mt) | (Au g/t) | (Au koz) | (Mt) | (Au g/t) | (Au koz) | (Au koz) | |||

| Koné deposit | |||||||||

| Indicated Resources | 229 | 0.59 | 4,340 | 245 | 0.57 | 4,490 | +150 | ||

| Inferred Resources | 25 | 0.5 | 400 | 37 | 0.43 | 510 | +110 | ||

| Satellite deposits (including Gbongogo) | |||||||||

| Indicated Resources | 11 | 1.48 | 520 | 16 | 1.38 | 720 | +200 | ||

| Inferred Resources | - | - | - | 8.4 | 1.00 | 270 | +270 | ||

| Total | |||||||||

| Indicated Resources | 240 | 0.63 | 4,870 | 261 | 0.62 | 5,210 | +340 | ||

| Inferred Resources | 25 | 0.5 | 400 | 45 | 0.54 | 780 | +380 | ||

1) Updated Feasibility Study available on Montage's website and on SEDAR+. See "Technical Disclosure" below. 2) Updated Mineral Resource Estimates (the "2025 MRE") are reported in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") with an effective date of January 31, 2025 for satellite deposits and the Gbongogo deposit, and February 20, 2025 for the Koné deposit. Mineral Resource Estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definitions Standards for Mineral Resources and have been completed in accordance NI 43-101. This 2025 MRE was prepared by Mr. Jonathon Abbott of Matrix Resource Consultants of Perth, Australia who is a Qualified Person as defined by NI 43-101. Rounding errors are apparent. The 2025 MRE are reported on a 100% basis and are constrained within optimal pit shells generated at a gold price of US$2,000/ounce. The estimates at are reported at gold cut-off grades of 0.20 g/t (Kone), 0.50g/t (Gbongogo, Koban North, Sena, Gbongogo South, Diouma North and Lokolo Main) and 0.60g/t (Yere North and ANV) Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. No Measured Resources have been estimated. See "Technical Disclosure" below for details.

A subsequent 90,000-meter drill programme, for US$14 million, was launched in early 2025 with the goal of continuing to delineate and test higher-grade satellites. As part of the programme, significant infill and step out drilling has been planned on the 7 maiden higher-grade satellite deposits delineated in 2024. In addition, infill drilling is planned on the newly identified advanced targets that have shown significant potential through reconnaissance drilling during 2024.

Martino De Ciccio, CEO of Montage, commented: "We are very pleased with the progress being made to unlock value at our Koné project in Côte d'Ivoire by aggressively exploring while construction continues to rapidly advance.

Today's published updated resource estimate demonstrates the project's large scale and confirms our belief in the potential for numerous high-grade satellite deposits, with eight already identified. Moreover, it provides significant confidence in achieving our previously published short-term objective of discovering at least 1 million ounces of Measured and Indicated Resources for satellite deposits at a 50% higher grade compared to the Koné deposit, to be achieved prior to production commencing in Q2-2027. This would represent significant returns on our exploration investment and aligns with our strategic objective of boosting production from the onset while maintaining an annual production of at least 300koz for more than 10 years.

I would like to thank our exploration team for their strong efforts and congratulate them on the rapid success achieved, especially considering most of the drilling took place in the latter part of the year, following the end of the rainy season and the ramp-up of the exploration team, which now totals more than 150 people.

The success achieved thus far positions us well to continue unlocking exploration value and further build on the momentum generated to advance our strategy of creating a premier African gold producer and delivering value for all our stakeholders."

Silvia Bottero, EVP Exploration of Montage, stated: "We are very pleased with the rapid exploration progress achieved, as it significantly boosts our confidence in reaching our ambitious target of discovering at least one million ounces of higher-grade satellite resources before production commences in Q2-2027.

With our extensive land package encompassing over 50 identified targets, our approach is to systematically drill test best selected targets to define starter resources and validate their higher-grade content before undertaking larger step-out drilling campaigns. Consequently, last year we drilled over 18 targets, successfully delineating resources for seven deposits, while another six targets have advanced to the pre-resource definition stage and are currently being followed up.

Building upon this approach to enhance our understanding of the project's potential, we launched a larger 90,000-meter drilling program earlier this year. Half of this program is dedicated to infill and extension drilling of recent discoveries, while the other half will focus on drill testing and generating new targets. As a result, this year we anticipate growing the newly delineated deposits while also delineating initial maiden resources for additional targets, enabling us to prioritize infill and step-out drilling for 2026 as we approach production.

Given our recent successes and our rapidly evolving understanding of the geological potential, we are highly enthusiastic about continuing our exploration efforts to unlock further value."

ABOUT THE EXPLORATION PROGRAMME

Exploration Outlook and Objectives

The 2024 exploration programme results validate management's conviction that significant potential exists to add further higher-grade satellites, with the aim of enhancing the profile of the Koné project by slotting these discoveries early in the mine plan. In line with its commitment to accountability and transparency, on October 7, 2024, Montage published an aggressive target of discovering of at least 1 million ounces of Measured and Indicated Resources at a grade of over 1 g/t Au, which would be 50% higher compared to the current Koné deposit grade1, to be achieved before the commencement of production.

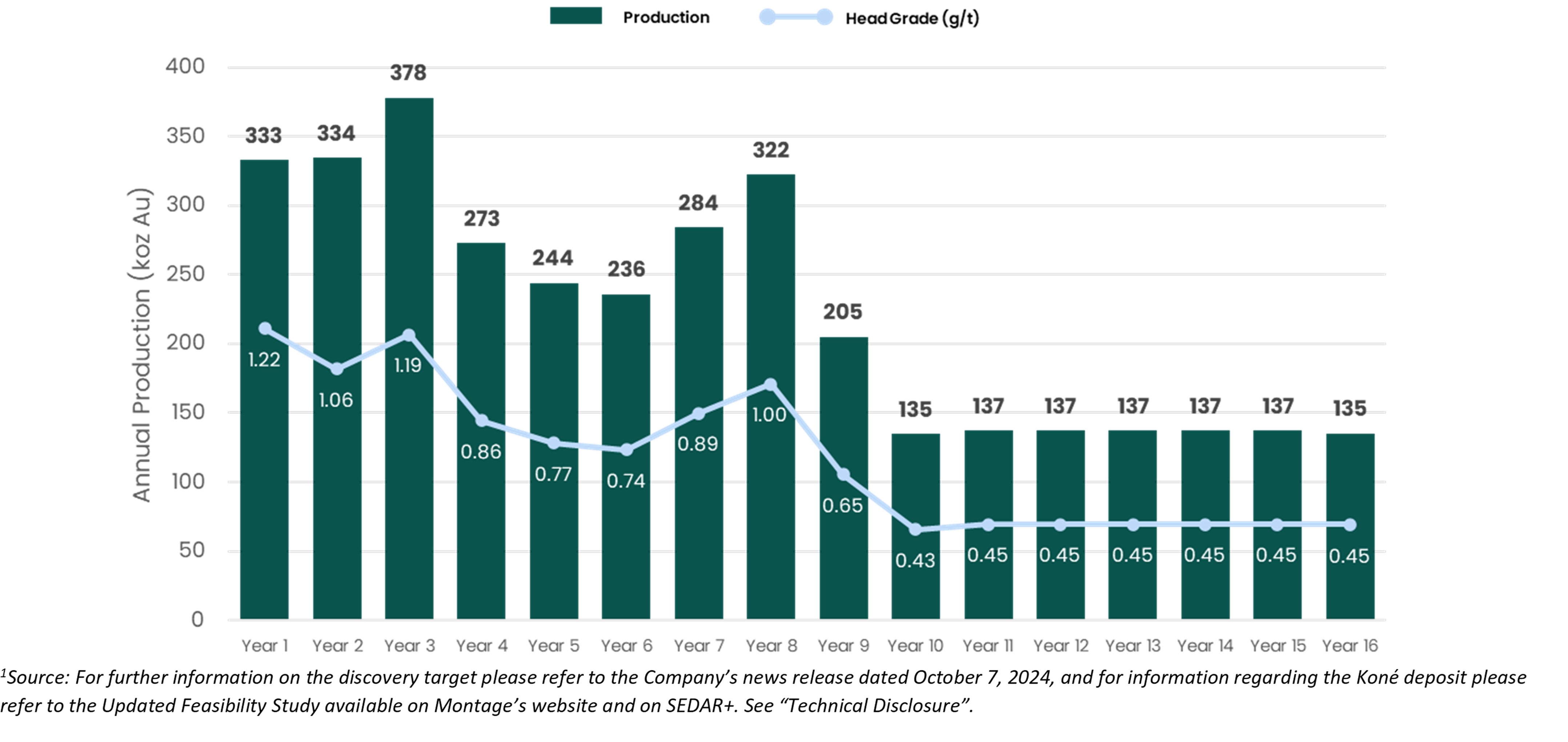

Achieving the set exploration target would represent a significant return on the exploration investment and aligns with the Company's strategic objective of boosting production from the commencement of production, while maintaining an annual production of at least 300koz for more than 10 years. As shown in Figure 1 below, the objective is to replicate the exploration success that resulted in the addition of the Gbongogo Main higher grade satellite deposit which is to be blended with the Koné deposit ore feed over the first three years of operations, resulting in an average gold production of 349,000 ounces per year during this period given that the Gbongogo Main deposit reserve grade is approximately 95% higher than that of the Koné deposit ore feed over the life of mine1.

Figure 1: Current production profile1

1Source: For further information on the discovery target please refer to the Company's news release dated October 7, 2024, and for information regarding the Koné deposit please refer to the Updated Feasibility Study available on Montage's website and on SEDAR+. See "Technical Disclosure".

Overview of the exploration potential and programme

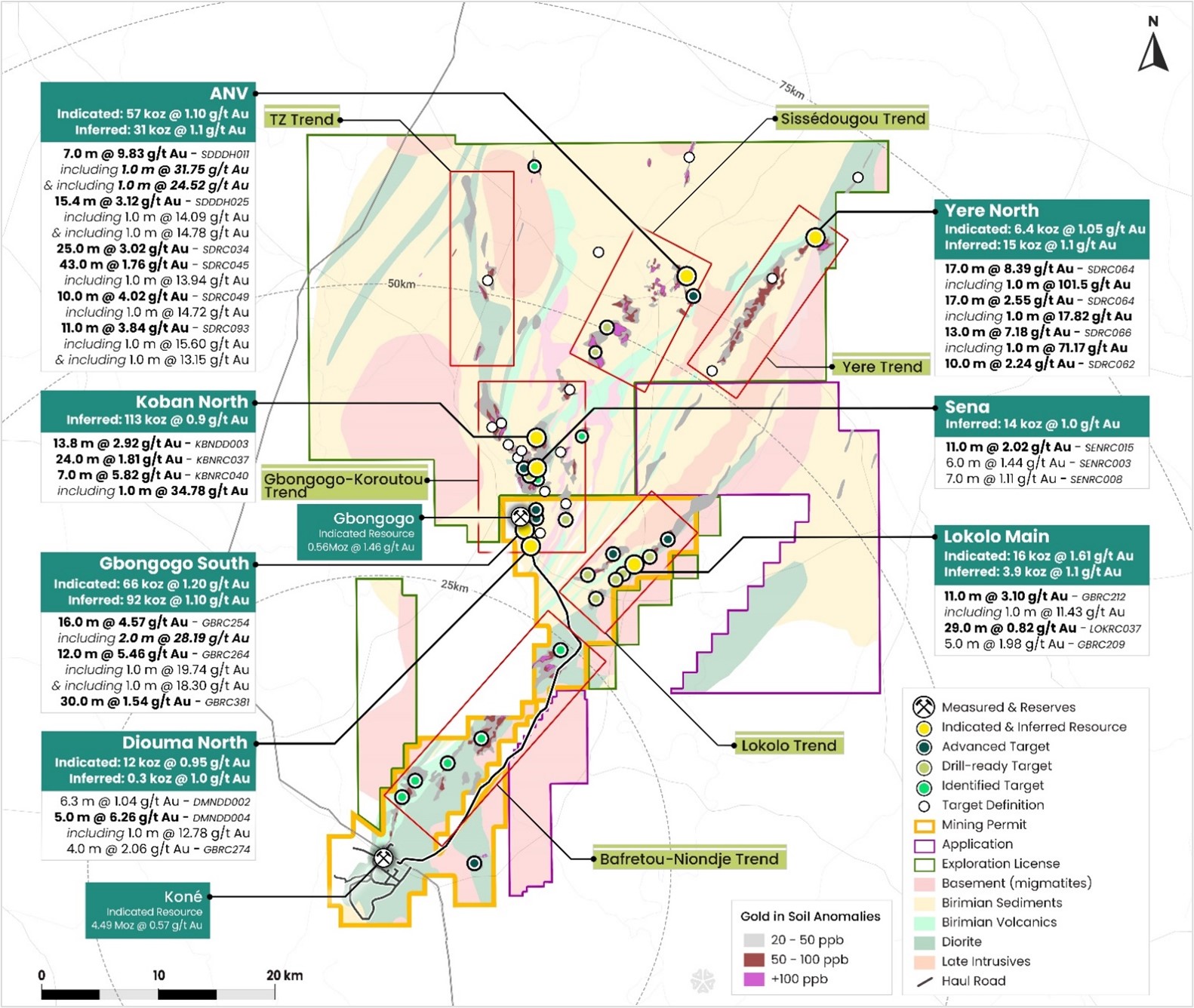

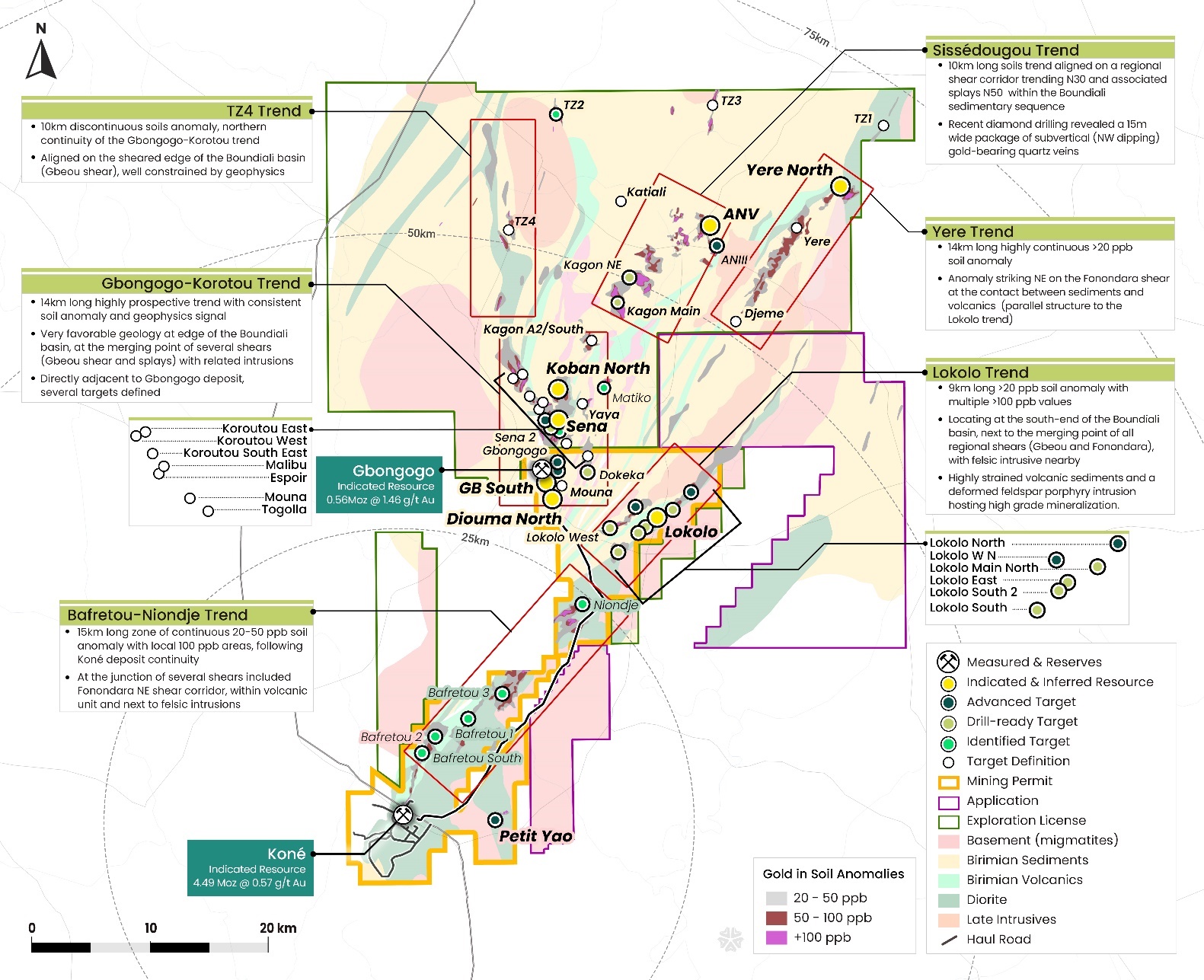

The Koné project is endowed with significant exploration potential across a 1,679.3km2 existing land package where the Company has, to date, identified a total of 52 exploration targets across 7 mineralised trends, as shown in Figure 2 below. The Company has a further 458.5km2 of additional adjacent exploration properties currently under permit application, which would increase its total land package to 2,138km2.

In total, 26 exploration targets are located within the permitted mining area within 3 major trends (Gbongogo-Korotou Trend, Lokolo Trend and Bafretou-Niondje Trend) which are located near the planned haul road, and host potential for higher grade discoveries. On the exploration permits, a further 26 targets have been identified across 4 major trends (Gbongogo-Korotou Trend, Sissédougou Trend, Yere Trend and TZ4 Trend), which also hosts the potential for higher grade mineralisation. Exploration efforts are focused on both the permitted mining area, due to its potential immediate benefits, as well as on the exploration permit to the north given the lead time required from discovery to permitting. Management anticipates that a trucking distance of 75km would result in an increase of approximately 0.2 g/t Au on the cut-off grade, thereby supporting its strategy of targeting over 1 g/t Au discoveries that would therefore have the potential to displace 0.7 g/t Au material sourced from the Koné deposit. Following the delineation of a maiden resource on the Sissédougou exploration permit (PR842), Montage has launched the environmental studies in support of an Environmental, Social Impact Assessment on the Sissédougou exploration permit.

Figure 2: Koné project map illustrating the 7 mineralised trends

As detailed in Table 2 below, a total of 81,815 meters were drilled in 2024, amounting to US$13 million, completed across 1,995 holes, which comprised 80 Diamond Drilling ("DD") holes for 12,682 meters, 566 Reverse Circulation ("RC") holes for 50,059 meters, 8 RC-DD for 1,233 meters, 342 Aircore holes for 11,872 meters, and 999 Auger holes for 5,969 meters. The first drill campaign of 2024, totalling 30,170 meters with results previously announced on October 7, 2024, was supplemented with a further 51,645 meters drilled from mid-September until the end of the year.

Priority was attributed to targets along the Gbongogo-Korotou Trend, given their proximity to the already identified Gbongogo Main deposit and its infrastructure, along with targets along the Lokolo trend and within the Sissédougou Trend (PR842).

| Table 2: 2024 drill program breakdown by trend and targets | ||

| Trend Name | Target Name | Drilling |

| Koné | Koné deposit; Petit Yao | 2,921 m |

| Gbongogo-Korotou | Gbongogo Main deposit; Gbongogo South; Diouma North; Koban North; Sena; Koban Main; Soman 1 &2; Gbongogo West; Dokeka; Marahoué Gap; Kagon NE; Matiko | 45,906 m |

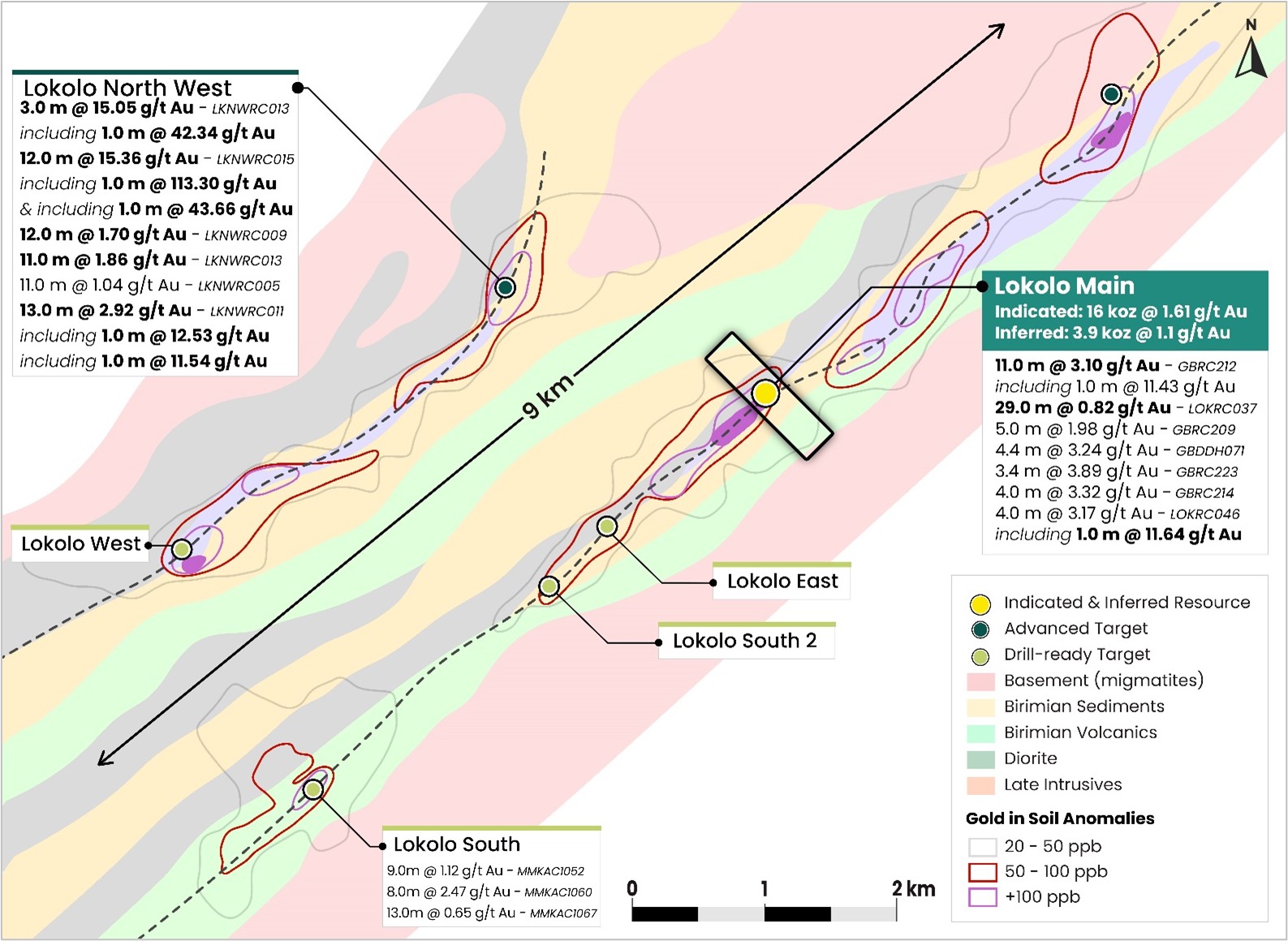

| Lokolo | Lokolo Main; Lokolo Main-North; Lokolo Northwest; Lokolo South; Lokolo East; Lokolo West; Lokolo W-N; Lokolo South 2; Lokolo North | 12,188 m |

| Bafretou-Niondje | Niondje; Bafretou 1; Bafretou 2; Bafretou 3 | 3,297 m |

| Sissédougou | ANV; ANIII | 11,641 m |

| Yere | Yere North, Yere Trend | 5,862 m |

| TZ | TZ2; TZ4 | - |

| Total Drilled Meters | 81,815 m | |

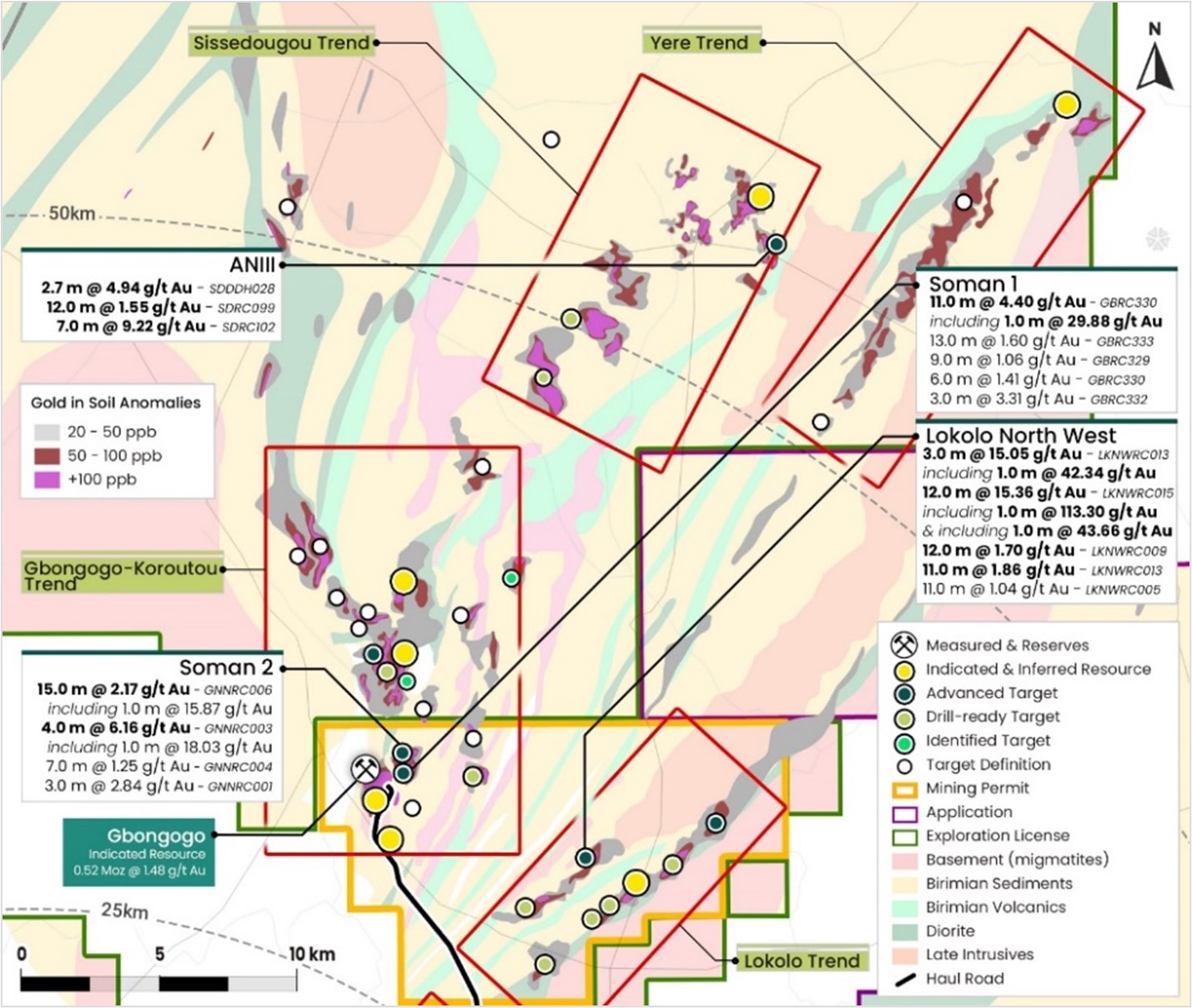

The 2024 exploration programme resulted in the delineation of 7 new deposits, which are further detailed in the next section, and the discovery of 5 new targets (Soman 1, Soman 2, Gbongogo West, Lokolo Northwest, and ANIII) that were promoted to pre-resource definition stage and will be followed up in 2025, with best selected drill results shown in Figure 3 below.

Figure 3: Map with notable intercepts for new discoveries made

Notable results are further detailed in Appendix 2.

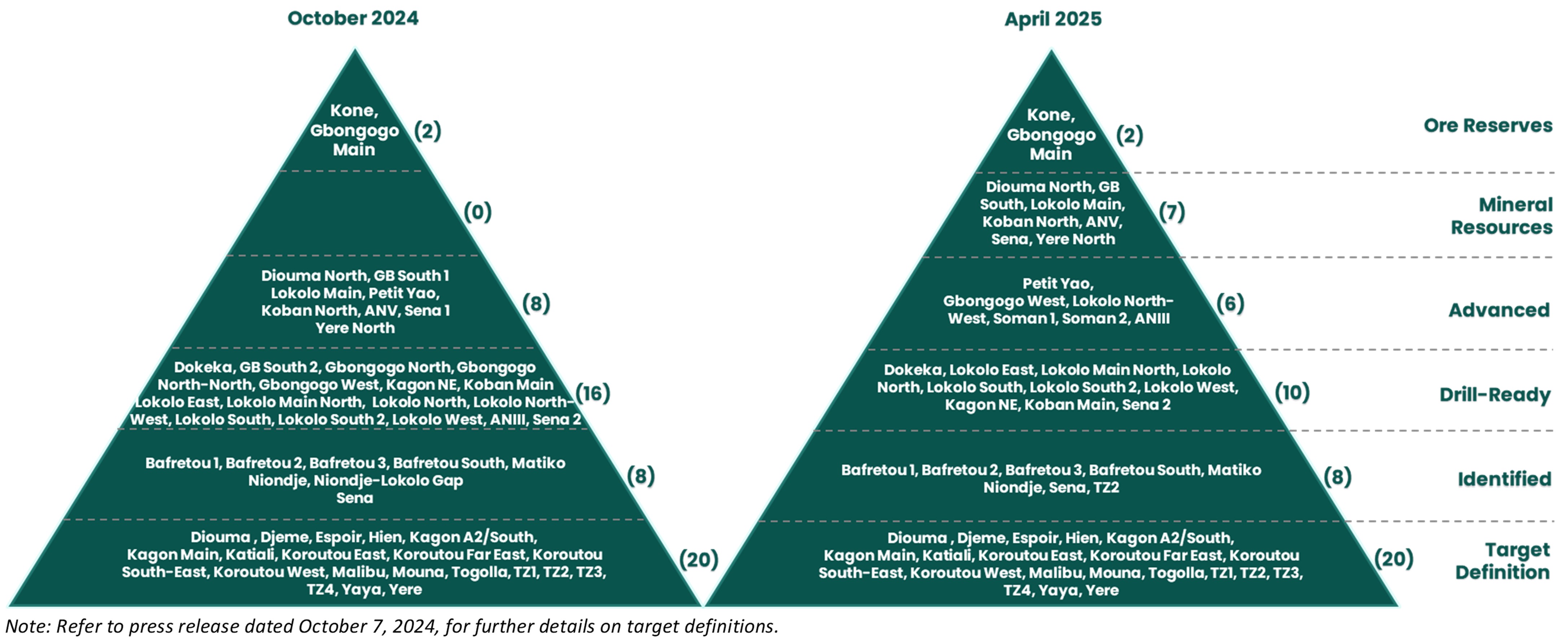

Figure 4 below illustrates the significant progress made, since the last exploration update published in October 2024, to advance targets from early-stage target to resource and pre-resource definition stage. The approach undertaken is to systematically drill test best selected targets to define starter resources and validate their high-grade content before undertaking larger step-out drilling campaigns.

Figure 4: Koné project exploration targets evolution

Note: Refer to press release dated October 7, 2024, for further details on target definitions.

A subsequent 90,000-meter drill programme, amounting to US$14 million, was launched in early 2025 with the goal of continuing to delineate and test higher-grade satellites, detailed as follows:

- 25,000 meters for resource extension, conversion and geotechnical drilling on known deposits

- 20,000 meters of infill drilling on new advanced targets to delineate additional maiden resources

- 45,000 meters of exploration drilling to test and generate new targets

Updated resource estimate

As shown in Table 3 below, an initial maiden resource for 7 new deposits was delineated with all deposits remaining significantly open, given that they are data constrained as the focus was to outline only a portion of the orebodies to assess the grade profiles in order to prioritize 2025 drill efforts. In addition, exploration efforts at the Koné deposit resulted in adding near-surface mineralization and confirming mineralization at depth. Results for both the satellite deposits identified and the Koné deposit are further detailed in the following section below.

| Table 3: Koné project resource update variance by deposit | |||||||||

| PREVIOUS RESOURCE ESTIMATE1 | UPDATED RESOURCE ESTIMATE2 | ||||||||

| Resources shown on a | Tonnage | Grade | Content | Tonnage | Grade | Content | Variance | ||

| 100% basis | (Mt) | (Au g/t) | (Au koz) | (Mt) | (Au g/t) | (Au koz) | (Au koz) | ||

| Koné deposit | |||||||||

| Indicated Resources | 229 | 0.59 | 4,340 | 245 | 0.57 | 4,490 | +150 | ||

| Inferred Resources | 25 | 0.5 | 400 | 37 | 0.43 | 510 | +110 | ||

| Satellite deposits: | |||||||||

| Gbongogo Main deposit | |||||||||

| Indicated Resources | 11 | 1.48 | 520 | 12 | 1.46 | 560 | +40 | ||

| Inferred Resources | - | - | - | 0.07 | 0.89 | 2.0 | +2 | ||

| Gbongogo South deposit | |||||||||

| Indicated Resources | - | - | - | 1.7 | 1.20 | 66 | +66 | ||

| Inferred Resources | - | - | - | 2.6 | 1.1 | 92 | +92 | ||

| Koban North deposit | |||||||||

| Indicated Resources | - | - | - | - | - | - | - | ||

| Inferred Resources | - | - | - | 3.9 | 0.9 | 113 | +113 | ||

| ANV (Sissédougou) deposit | |||||||||

| Indicated Resources | - | - | - | 1.6 | 1.10 | 57 | +57 | ||

| Inferred Resources | - | - | - | 0.88 | 1.1 | 31 | +31 | ||

| Yere North deposit | |||||||||

| Indicated Resources | - | - | - | 0.19 | 1.05 | 6.4 | +6 | ||

| Inferred Resources | - | - | - | 0.43 | 1.1 | 15 | +15 | ||

| Lokolo Main deposit | |||||||||

| Indicated Resources | - | - | - | 0.30 | 1.61 | 16 | +16 | ||

| Inferred Resources | - | - | - | 0.1 1 | 1.1 | 3.9 | +4 | ||

| Sena deposit | |||||||||

| Indicated Resources | - | - | - | - | - | - | - | ||

| Inferred Resources | - | - | - | 0.42 | 1.0 | 14 | +14 | ||

| Diouma North deposit | |||||||||

| Indicated Resources | - | - | - | 0.38 | 0.95 | 12 | +12 | ||

| Inferred Resources | - | - | - | 0.01 | 1.0 | 0.3 | +1 | ||

| Sub-total Satellites deposits | |||||||||

| Indicated Resources | - | - | - | 4.2 | 1.16 | 160 | +160 | ||

| Inferred Resources | - | - | - | 8.4 | 1.0 | 270 | +270 | ||

| Total | |||||||||

| Indicated Resources | 240 | 0.63 | 4,870 | 261 | 0.62 | 5,210 | +340 | ||

| Inferred Resources | 25 | 0.5 | 400 | 45 | 0.54 | 780 | +380 | ||

1)Updated Feasibility Study available on Montage's website and on SEDAR+. See "Technical Disclosure". 2) Updated Mineral Resource Estimates (the "2025 MRE") are reported in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") with an effective date of January 31, 2025 for satellite deposits and the Gbongogo deposit, and February 20, 2025 for the Koné deposit. Mineral Resource Estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definitions Standards for Mineral Resources in accordance with the NI-43-101. The 2025 MRE was prepared by Mr. Jonathon Abbott of Matrix Resource Consultants of Perth, Australia who is a Qualified Person as defined by NI 43-101. Rounding errors are apparent. The 2025 MRE are reported on a 100% basis and are constrained within optimal pit shells generated at a gold price of US$2,000/ounce. The estimates at are reported at gold cut-off grades of 0.20 g/t (Kone), 0.50g/t (Gbongogo, Koban North, Sena, Gbongogo South, Diouma North and Lokolo Main) and 0.60g/t (Yere North and ANV) Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. No Measured Resources have been estimated. See "Technical Disclosure" below for additional details.

Preliminary metallurgical test results on the 7 new satellite deposits confirmed that the nature of gold on additional satellites deposits is non-refractory with indicative recoveries in excess of 90%. No presence of arsenopyrite, graphite or other carbonaceous material was observed that could impact recoveries. Further recovery testwork is ongoing.

Table 4 below presents the 2025 MRE by rock type. Saprolite and transitional Indicated Resources increased by 80Koz over the previous estimate while saprolite and transitional Inferred Resources increased by 114koz.

| Table 4: Koné project 2025 MRE by weathering zone | |||||||||

| Resources shown on a 100% basis | Weathering Zone | Indicated | Inferred | ||||||

| Tonnage (Mt) | Grade (Au g/t) | Content (Au koz) | Tonnage (Mt) | Grade (Au g/t) | Content (Au koz) | ||||

| Koné deposit | Saprolite | 14 | 0.53 | 240 | 0.8 | 0.36 | 9.3 | ||

| Transition | 10 | 0.55 | 180 | 0.3 | 0.34 | 3.3 | |||

| Fresh | 221 | 0.58 | 4,120 | 36 | 0.43 | 500 | |||

| Subtotal | 245 | 0.57 | 4,490 | 37 | 0.43 | 510 | |||

| Satellites deposits (including Gbongogo) | Saprolite | 2.3 | 1.22 | 90 | 2.5 | 0.97 | 76 | ||

| Transition | 0.9 | 1.23 | 35 | 1.0 | 0.92 | 31 | |||

| Fresh | 13 | 1.42 | 580 | 4.8 | 1.03 | 160 | |||

| Subtotal | 16 | 1.38 | 720 | 8.4 | 1.00 | 270 | |||

| Total | Saprolite | 16 | 0.63 | 330 | 3.2 | 0.83 | 86 | ||

| Transition | 11 | 0.61 | 210 | 1.3 | 0.79 | 34 | |||

| Fresh | 223 | 0.59 | 4,700 | 41 | 0.50 | 660 | |||

| Total | 249 | 0.58 | 5,210 | 45 | 0.54 | 780 | |||

Updated Mineral Resource Estimates (the "2025 MRE") are reported in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") with an effective date of January 31, 2025 for satellite deposits and the Gbongogo deposit, and February 20, 2025 for the Koné deposit. Mineral Resource Estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definitions Standards for Mineral Resources in accordance with the NI-43-101. The 2025 MRE was prepared by Mr. Jonathon Abbott of Matrix Resource Consultants of Perth, Australia who is a Qualified Person as defined by NI 43-101. Rounding errors are apparent. The 2025 MRE are reported on a 100% basis and are constrained within optimal pit shells generated at a gold price of US$2,000/ounce. The estimates at are reported at gold cut-off grades of 0.20 g/t (Kone), 0.50g/t (Gbongogo, Koban North, Sena, Gbongogo South, Diouma North and Lokolo Main) and 0.60g/t (Yere North and ANV) Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. No Measured Resources have been estimated. See "Technical Disclosure" below for additional details.

Given that the Koné deposit is mainly fresh rock, the current design (which is mainly based on the Koné deposit) limits oxide material to 10% of total feed, and requires 18.8Mt of pre-stripping, stockpiling, and gradual reintroduction of oxide material into the feed over the first eight years of production. The delineation of satellite deposits has however increased the availability of oxide and transitional material, and as such the Company continues to engineer and contemplate the potential addition of an oxide circuit consisting of a sizer and conveyor to directly feed the mill with oxide and transitional material, bypassing the hard rock comminution and high-pressure grinding rolls. An oxide circuit, for a minimal incremental investment, would enable an earlier first gold pour while the hard rock comminution is being commissioned, reduce rehandling costs for oxide ore mined in pre-production, provide significant operational flexibility to continue production during maintenance of the sulphide crushing circuit and would improve blending optionality.

DETAILS BY TARGET

Gbongogo-Korotou Trend

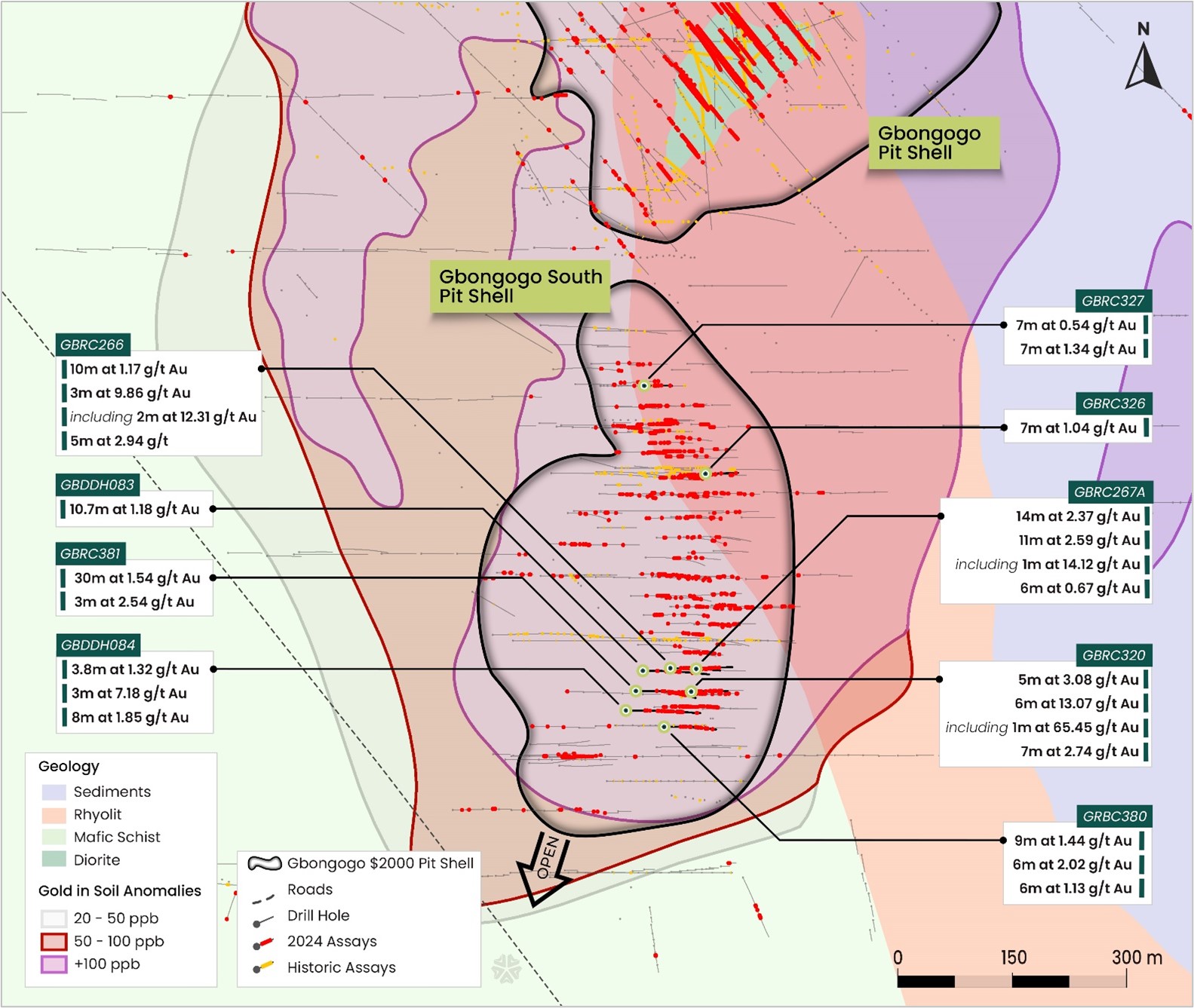

Gbongogo Main and Gbongogo South

A maiden resource was delineated for the Gbongogo South deposit, based on the drilling conducted in 2024, which represents an attractive discovery given its size and location in close proximity to the Gbongogo Main pit. Gbongogo South has direct access to the planned Koné-Gbongogo Main haul road and is located within the mining permit boundary. Exploration over the course of 2025 is expected to focus on infill drilling to convert Inferred Resources to Indicated Resources, as well as expanding the resource as mineralization remains open to the Southwest, as shown in Figure 5 below.

Mineralisation for Gbongogo South is litho-tectonically constrained, following a roughly north-south striking contact between the mafic sediment package to the west and the rhyolite unit to the east. The overall fabric dips moderately towards the northwest. Gbongogo South also shows localised diffusion of quartz-tourmaline veins which are associated with higher grade gold intercepts. Mineralisation remains open along strike and downdip.

Best selected intercepts include 30.0 meters at 1.54 g/t; 14.0 meters at 2.37 g/t Au; 11 meters at 2.59 g/t (including 1 meter at 14.12 g/t Au); and 10.0 meters at 1.17g/t Au.

Figure 5: Gbongogo South intercepts

At Gbongogo Main, drilling in 2024 confirmed the geological model and the controls of mineralization at depth. Preliminary drill results highlighted new shallower mineralised lenses on the west flank of the pit which are expected to be followed up in Q2-2025. The 2025 MRE accounts for the change in the gold price from US$1,800 to US$2,000/oz and the updated topographic survey as at December 2024, while a further resource update is expected to also incorporate additional drilling being conducted.

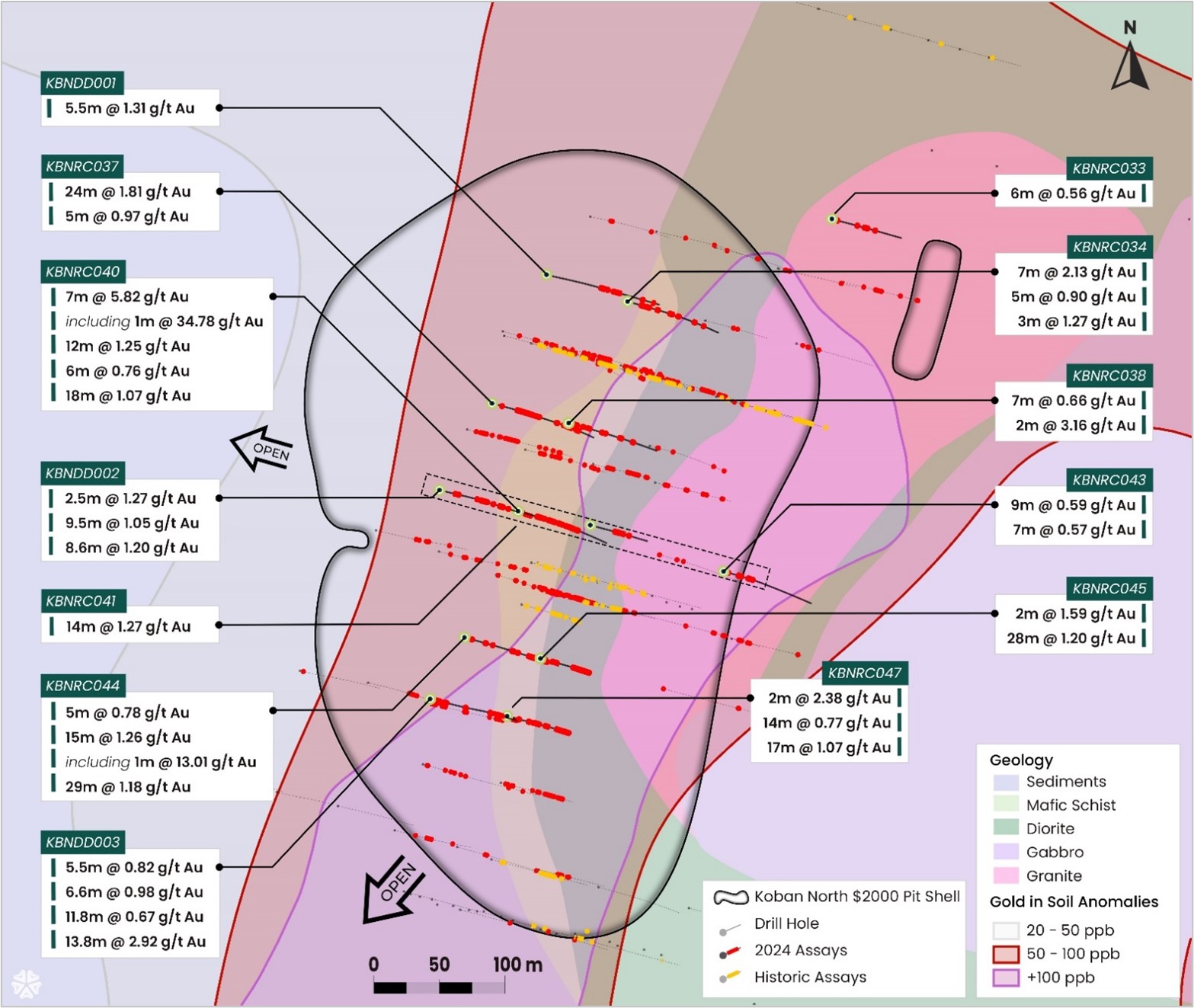

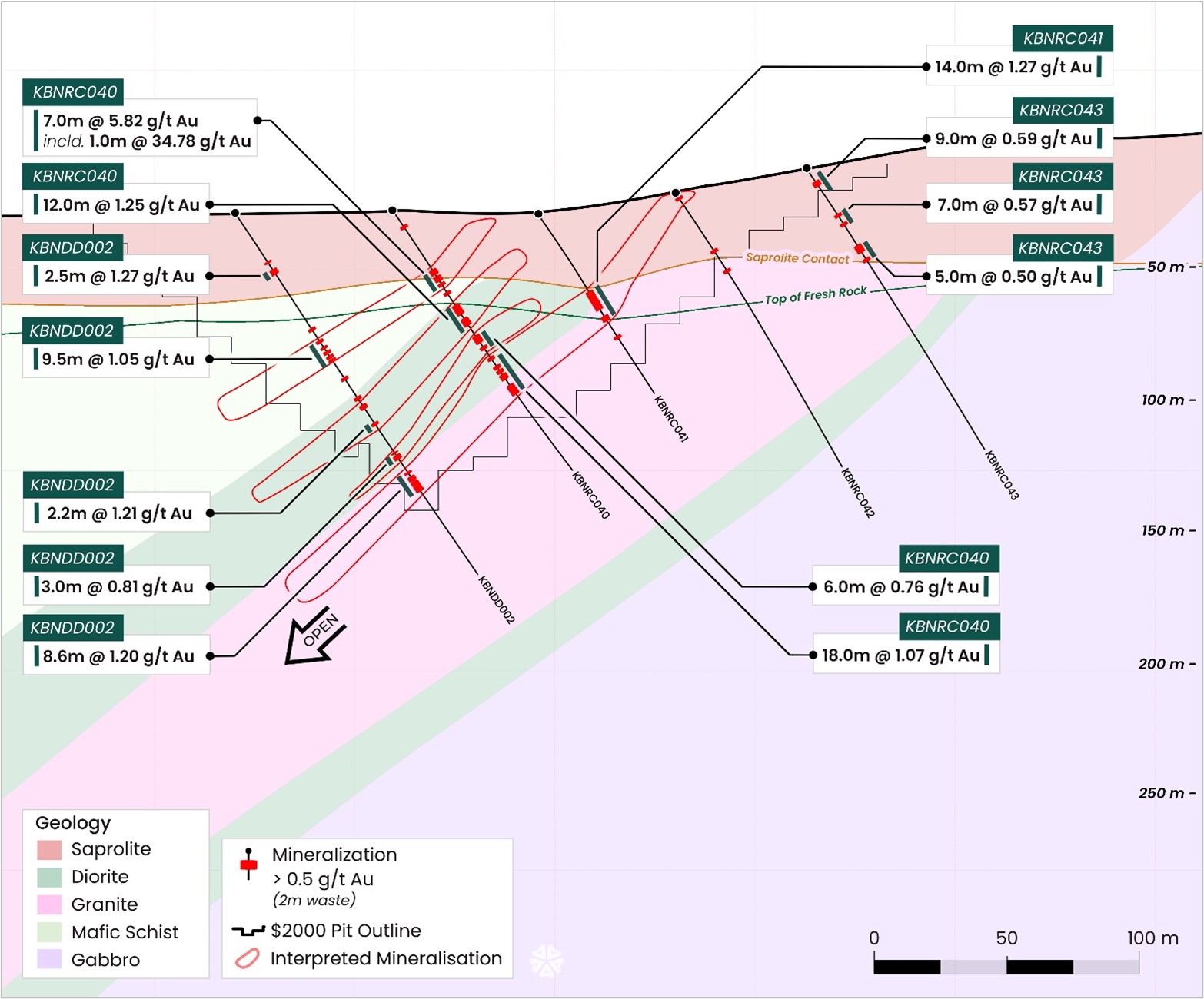

Koban North

A maiden Inferred Resource was delineated for the Koban North target which appears to be a promising discovery. It has been drilled on a wide spacing in 2024 and infill drilling is scheduled in 2025 with the goal of converting Inferred Resources to Indicated Resources, as well as to test extensions at depth and along strike towards the southwest which remain open, as shown in Figures 6 and 7 below.

Geology consists of sediments in the west and diorite and granite intrusions to the east. Gold mineralisation is associated with an intense zone of shearing between both intrusives. Gold is hosted within the shear and within parts of the diorite as quartz and quartz-tourmaline veins.

Best selected intercepts include 13.8 meters at 2.92 g/t Au; 24.0 meters at 1.81 g/t Au; and 7.0 meters at 5.82 g/t Au (including 1.0 meter at 34.78 g/t Au).

Figure 6: Koban North intercepts

Figure 7: Koban North cross section

Diouma North

A small maiden resource was delineated for the Diouma North target, which location is immediately South of Gbongogo Main deposit and adjacent to the Gbongogo haulage road. While 2025 exploration efforts are expected to be prioritized on other targets, a small drilling campaign is scheduled at Diouma North to test its at-depth potential and extensions.

Best selected intercepts include 6.3 meters at 1.04 g/t Au and 5.0 meters at 6.26 g/t Au (including 1.0 meters at 12.78 g/t Au).

Sena

A starter maiden resource was delineated at Sena, which is mainly an oxide target at shallow depth. Mineralisation was confirmed over 700 meters, striking 30-degrees with a higher-grade core. Further exploration was launched in Q1-2025 with the objective of improving the geological confidence of the deposit and subsequently converting Inferred to Indicated Resources with infill drilling. Estimates for the deposit is expected to increase, particularly given the high grade and consistent auger anomalies above 100ppb over 1,000 meters striking 30-degrees, as identified during the 2024 programme.

Best selected intercepts include 11.0 meters at 2.02 g/t Au and 6.0 meters at 1.44 g/t Au.

New discoveries on the Gbongogo-Korotou Trend

Successful reconnaissance drilling has identified three new targets (Soman 1, Soman 2, and Gbongogo West) which were promoted to pre-resource definition stage and will be followed up with drilling in 2025. Best selected intercepts from Soman 1 and 2 include 11.0 meters at 4.4 g/t Au (including 1.0 meters at 29.88 g/t Au) and 15.0 meters at 2.17 g/t Au (including 1.0m at 15.87 g/t).

Sissédougou Trend

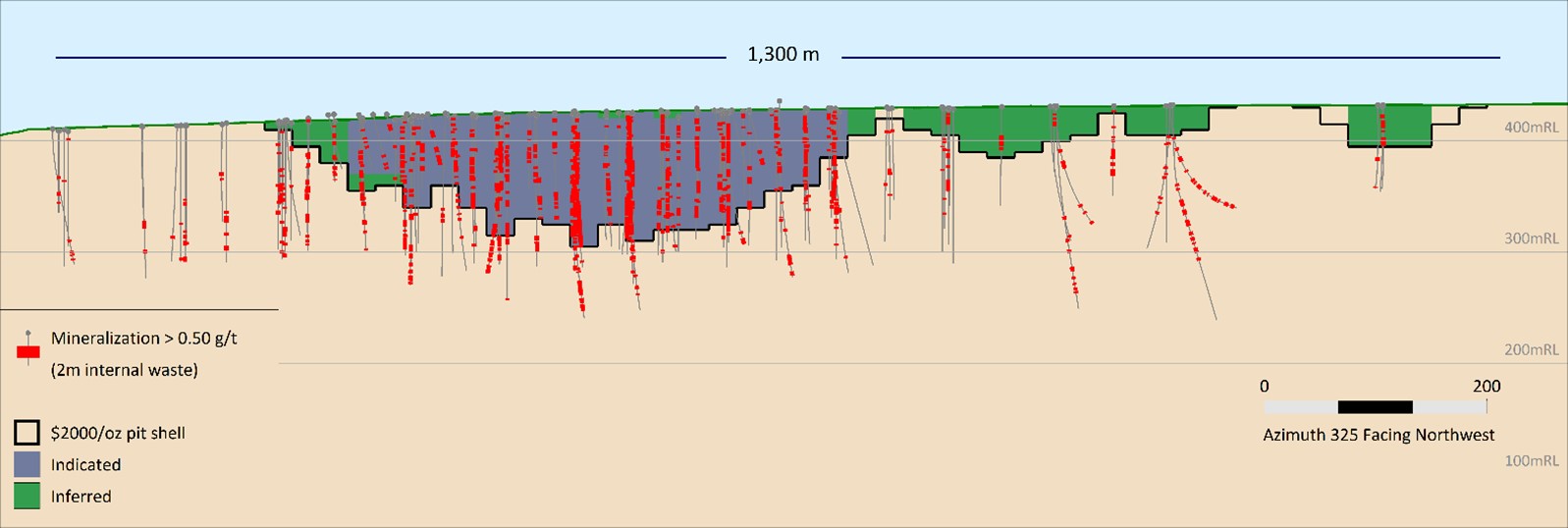

ANV

As shown in Figure 8 below, the ANV target returned significant intercepts following the infill drilling conducted in 2024 which resulted in the delineation of an already attractive maiden Indicated and Inferred resource. Given that the target extends across a strike of over 1,300 meters, further drilling is currently underway to infill and step out on the ANV target with the goal of converting the Inferred Resources to Indicated Resources while further extending the deposit.

Prospect geology at ANV is a package of Boundiali basin metasediments, ranging from medium-grained sandstones to poorly sorted and matrix supported polymictic conglomerates. Foliations are steeply dipping (70°-80° northwest) and northeast-striking. Gold is associated with silica-sericite-chlorite and calcite alteration and an array of quartz calcite +/- tourmaline veins controlled by a northeast shear. Visible gold at ANV is generally associated with quartz tourmaline +/- sulphides (pyrite pyrrhotite).

Best selected intercepts include 7.0 meters at 9.83 g/t Au (including 1.0 meter at 31.75 g/t Au and 1.0 meter at 24.52 g/t Au); meters at 3.12 g/t Au (including 1.0 meter at 14.09 g/t Au and 1.0 meter at 14.78 g/t Au); 25.0 meters at 3.02 g/t Au; and 43.0 meters at 1.76 g/t Au (including 1.0 meter at 13.94 g/t Au).

Figure 8: ANV long section, Facing North West

ANVIII

Successful reconnaissance drilling has identified the new ANIII target on the Sissédougou trend which is located 2km south of ANV where initial drilling returned encouraging results, confirming continuity over 350 meters which will inform a follow-up drilling campaign in 2025. Best selected intercepts include 12.0 meters at 1.55 g/t Au and 7.0 meters at 9.20 g/t Au.

Lokolo Trend

Lokolo Main

The Lokolo Trend is located adjacent to the main haul road and within the fully permitted Koné-Gbongogo mining area. While the starter maiden resource for the Lokolo Main target is relatively small, it only represents a small portion of the largely untested 9km continuous surface geochemical anomalies over the full Lokolo trend, as shown in Figure 9 below. Given the high grade Indicated Resource delineated, of above 1.6 g/t Au, further drilling is currently underway with preliminary results of stepping out drilling confirming potential to delineate other targets along the trend.

Best selected intercepts from Lokolo Main include 11.0 meters at 3.10 g/t Au (including 1.0 meters at 11.43 g/t Au); and 29.0 meters at 0.82 g/t Au.

Figure 9: Lokolo trend map

Lokolo North West

Successful reconnaissance drilling has identified the new Lokolo North West target which was upgraded to an advanced pre-resource definition stage target following encouraging drill results received, with best select intercepts including 12.0 meters at 15.36 g/t Au (including 1.0 meters at 113.30 g/t Au & including 1.0 meter at 43.66 g/t Au).

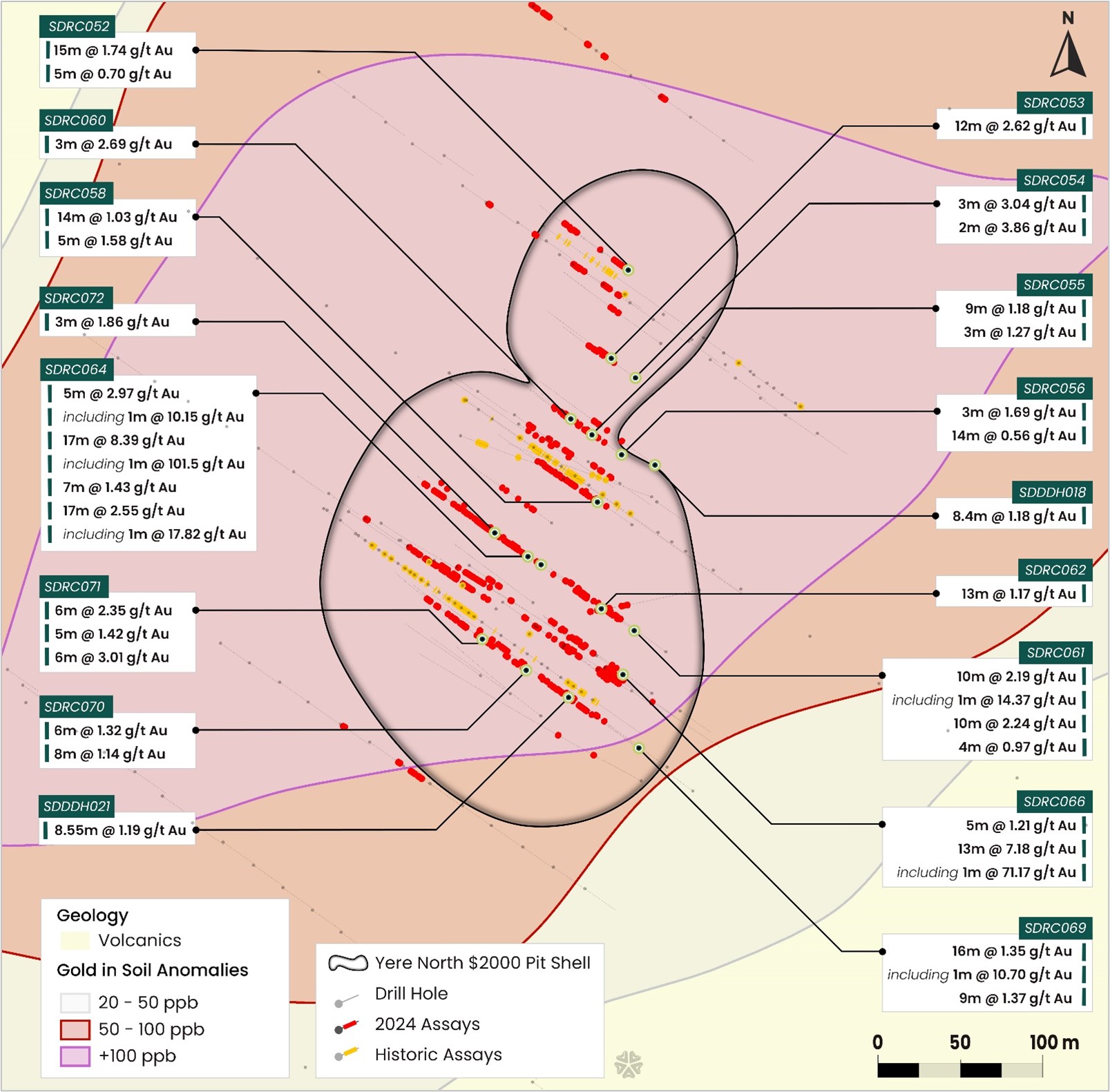

Yere Trend

A starter maiden resource was delineated at Yere North, which was initially considered as an oxide target but the 2024 drilling campaign also confirmed mineralisation in fresh rock. The deposit remains open at depth and along strike. A drilling campaign is currently underway to test the Northeast extension with the goal of expanding the resource base while converting Inferred Resources to the Indicated Resources.

Geology of the Yere North prospect consists of a northeast-striking sequence of andesite and feldspar porphyry lavas, intruded by a mineralized diorite plug. Regional northeast-striking structures have been identified by geophysics and are interpreted to be important controls on gold mineralization. Mineralization is associated to silica, K-feldspar, sulphides and veining system localized on the margins and within the diorite intrusive units.

Best selected intercepts include 17.0 meters at 8.39 g/t Au (including 1.0 meter at 101.5 g/t Au), as shown in Figure 10 below.

A total of 3,120 meters for 52 holes of RC scout drilling was conducted in 2024 on the higher soil geochem anomaly over the 10km NE striking regional anomaly, which allowed to improve the understanding of the structure. Additional field works coupled with geophysics reinterpretation will be done in 2025 to support upcoming drill programmes.

Figure 10: Yere North map

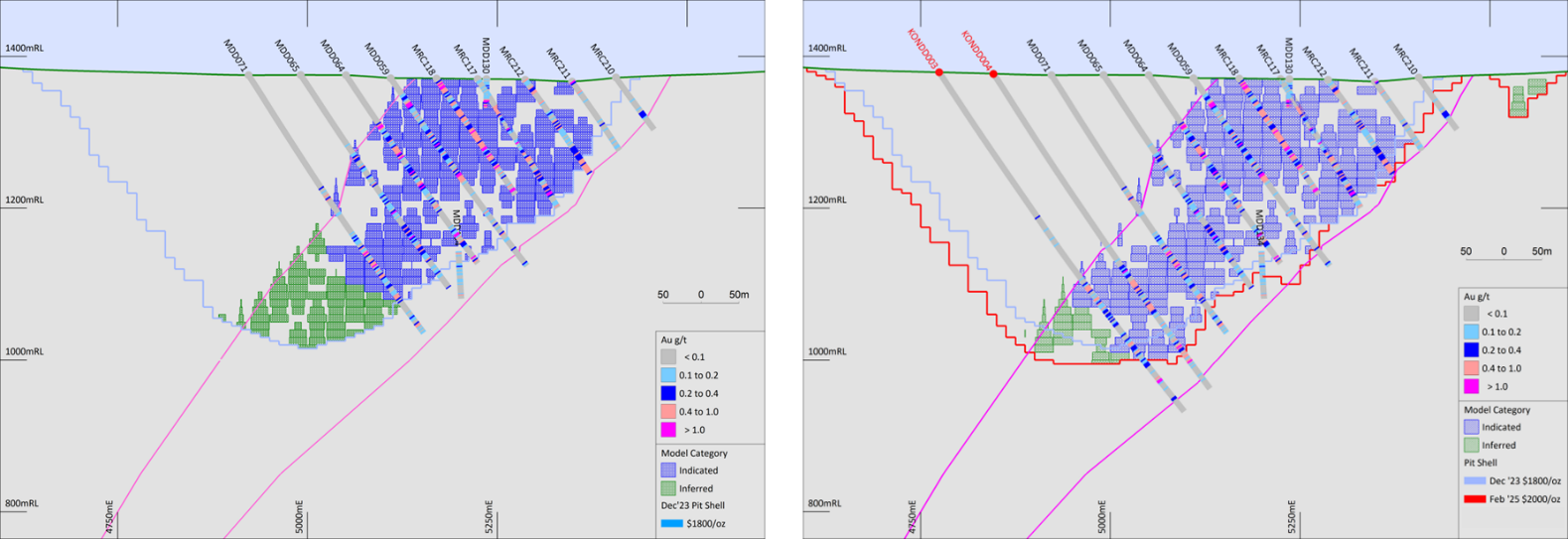

Koné deposit

A total of 2,921 meters of RC and DD was conducted in 2024 which resulted in adding near-surface mineralization and confirming mineralization at depth, as shown in Figures 11 and 12.

A total of 4 DD holes for 1,811 meters were drilled at vertical depth down to 400 meters, towards the southern extent of the pit. This successfully resulted in confirming continuity of the mineralization at depth towards the south, thereby increasing the overall resource base and enabling the conversion of Inferred Resources to the Indicated Resource category. Separately, a total of 11 RC holes for 1,110 meters were drilled at surface to the Southeast, consisting of 2 holes per section every 50 meters along 300 meters, which successfully proved the existence of a parallel mineralized envelope, further delineating resources. In addition, the optimal pit shell was optimized at a gold price US$2,000/oz, rather than US$1,800/oz previously used.

Figure 11: Koné deposit plan view

Figure 12: Koné pit shells cross section with extension drilling

NEXT STEPS

- Initial results for the ongoing 90,000 meter drill programme expected to be published in late Q2-2025

- An Environmental, Social Impact Assessment has been launched for the Sissédougou exploration permit (PR842)

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ABOUT MONTAGE GOLD CORP.

Montage Gold Corp. (TSXV: MAU) is a Canadian-listed company focused on becoming a premier multi-asset African gold producer, with its flagship Koné project, located in Côte d'Ivoire, at the forefront. Based on the Feasibility Study published in 2024, the Koné project ranks as one of the highest quality gold projects in Africa with a long 16-year mine life and sizeable annual production of +300koz of gold over the first 8 years. Over the course of 2024, the Montage management team will be leveraging their extensive track record in developing projects in Africa to progress the Koné project towards a construction launch.

TECHNICAL DISCLOSURE

Mineral Resource Estimates

The 2025 MRE were carried out by Mr. Jonathon Abbott of Matrix Resource Consultants of Perth, Western Australia, who is considered to be independent of Montage Gold. Mr. Abbott is a member in good standing of the Australian Institute of Geoscientists and has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under NI 43-101.

KONÉ DEPOSIT - 2025 MRE

The 2025 MRE for the Koné deposit has been classified and reported in accordance with NI 43-101 and classifications adopted by CIM Council in May 2014 and has an effective date of the February 20, 2025.

The 2025 MRE for the Koné deposit are based sampling information supplied by Montage in February 2025 and are reported within optimal pits generated at gold price of US$2,000/ oz constrained by topographic wire-frames derived from DGPS surveys. The combined drilling dataset comprises 321 RC holes and 149 diamond holes undertaken by Montage and previous corporate entities totalling 103,713 metres of drilling. Relative to the dataset available for the 2021 Koné modelling, the current dataset includes information for an additional 11 RC holes and 10 diamond holes totalling 4,950 metres of drilling. Resources were estimated for Koné by Multiple Indicator Kriging ("MIK") of two metre down-hole composited gold assay grades of samples from RC and diamond drilling. Estimated resources include variance adjustments to give estimates of recoverable resources above gold cut-off grades for selective mining unit dimensions of 5 meters by 10 meters by 5 meters (cross strike, strike, vertical).

Estimates tested by drilling spaced at around 50 by 50 metres are classified as Indicated, with Inferred estimates based on generally 100-meter spaced drilling extrapolated to around 50 metres from drilling. More broadly sampled and peripheral mineralization is too poorly defined for estimation of Mineral Resources and is not included in estimated resources.

The resource modelling incorporated a mineralized envelope capturing continuous drill hole intervals with two metre composited gold assay grades of greater than 0.1 g/t, and a western and eastern background domains which contain only comparatively rare, mineralized drill intercepts. The mineralized envelope, which strikes north-northeast (350º) and dips to the west at an average of around 50º is interpreted over 2.6 kilometres of strike with horizontal widths ranging from generally around 50 to 450 meters and averaging around 215 meters. True widths are up to 350 meters. The mineralized envelope is subdivided into three mineralized domains comprising lower grade southern and northern domains, and a main higher grade central zone. The modelling domains are consistent with geological understanding of the deposit.

Wire-framed surfaces representing the base of saprolite and top of fresh rock interpreted by Montage geologists from drill hole logging were used for density assignment and portioning the estimates by weathering zone. Within the general area of estimated resources, the interpreted base of saprolite averages around 26 meters below surface, and the underlying saprock averages around 11 meters thick with fresh rock occurring at an average depth of around 38 meters.

The MIK modelling utilized 14 indicator thresholds defined using consistent percentiles of composite gold grades with grade continuity characterized by indicator variograms modelled at each percentile. All bin grades were determined from the bin mean grade, with the exception of the upper bins, which were reviewed on a case-by-case basis, and an appropriate grade selected to reduce the impact of small numbers of outlier composites. For the south, central and northern mineralized domains, upper bin grades were derived from the bin means with small numbers of outlier composite gold grades cut to 2.9, 16 and 4.5 g/t respectively.

Bulk densities of 1.65, 2.55 and 2.80 t/bcm were assigned to saprolite, saprock and fresh material respectively on the basis of 4,656 immersion density measurements of wax coated, oven dried core samples undertaken by Company personnel.

Micromine software was used for data compilation, domain wire framing and coding of composite values and GS3M was used for resource estimation. The resulting estimates were imported into Micromine for pit optimization and resource reporting.

Model review included comparison of estimated grades with informing composites. These checks comprised inspection of sectional plots of the model and drill data and review of swath plots for some deposits and showed no significant issues.

Optimal pit constraints

To satisfy the definition of Mineral Resources having reasonable prospects for eventual economic extraction, the estimates are constrained within an optimal pit generated from the following key parameters:

- Gold price of US$2,000/oz.

- Processing recovery of 93%, 91% and 89% for saprolite, saprock and fresh material, respectively.

- Overall slope angles of 39°, 58° and 60° for saprolite, saprock and fresh material, respectively.

- Average mining costs for saprolite, saprock and fresh material of $2.36/t, $2.33/t and $2.99/t, respectively.

- Processing costs (including G&A) of $7.96/t, $8.20/t and $9.41/t for saprolite, saprock and fresh material, respectively.

- The pit shell constraining the 2025 MRE extends over 2.6 kilometres of strike to a maximum depth of around 600 meters.

NEW SATELLITE DEPOSITS - 2025 MRE

The 2025 MRE for the satellite deposits has been classified and reported in accordance with NI 43-101 and classifications adopted by CIM Council in May 2014 and has an effective date of the 31 of December 2024.

The resource estimates are based sampling information supplied by Montage in December 2024 and are reported within optimal pits generated at gold price of US$2,000/oz constrained by topographic wire-frames derived from December 2024 LIDAR surveys.

The combined drilling datasets available for these deposits comprises 212 AC, 459 RC and 84 diamond holes totalling 69,945 meters of drilling and including holes by Barrick Gold Corporation (2 holes), Endeavour Mining Corporation (118 holes), Randgold Resource Limited ("RRL")(21 holes) and Montage (614 holes).

Recoverable resources were estimated for the advanced KPG deposits by Multiple Indicator Kriging ("MIK") of two meter down-hole composited gold assay grades of samples from RC, diamond and generally comparatively minor amounts of Aircore drilling. Estimated resources include variance adjustments to give estimates of recoverable resources above gold cut-off grades for selective mining unit dimensions of 4 meters by 8 meters by 2.5 meters (cross strike, strike, vertical).

Estimates for mineralization tested by drilling spaced at around 50 meters by 50 meters are classified as Indicated, with Inferred estimates generally based on drilling spaced at a maximum of around 100 by 100 meters.

Resource modelling of each deposit incorporates mineralized envelopes interpreted by Matrix capturing continuous intervals of drill hole composite gold grades of greater than 0.1 g/t Au. The domains are consistent with geological understanding of each deposit. Wire-framed surfaces representing the base of saprolite and top of fresh rock interpreted by Montage geologists from drill hole logging were used for density assignment and portioning the estimates by weathering zone. The MIK modelling of each mineralized domain utilized 14 indicator thresholds defined using consistent percentiles of composite gold grades with grade continuity characterized by indicator variograms modelled at each percentile. All bin grades were determined from the bin mean grade, with the exception of the upper bins which were selected on a case-by-case basis from generally either the bin median or mean excluding outliner grades.

Bulk densities were assigned to the estimates by weathering zone on the basis of immersion measurements of wax coated, oven dried core samples undertaken by Company personnel.

Micromine software was used for data compilation, domain wire framing and coding of composite values and GS3M was used for resource estimation. The resulting estimates were imported into Micromine for pit optimization and resource reporting.

Model reviews included comparison of estimated grades with informing composites. These checks comprised inspection of sectional plots of the model and drill data and review of swath plots for some deposits and showed no significant issues

Optimal pit constraints

To satisfy the definition of Mineral Resources having reasonable prospects for eventual economic extraction, the estimates are constrained within optimal pits generated from the following key parameters:

- Gold price of US$2,000/oz.

- Combined royalties of 5%.

- Processing recovery of 90%.

- Overall slope angles of 35°, 40° and 45° for saprolite, saprock and fresh material, respectively.

- Mining costs of US$3.42 per tonne.

- Processing costs (including G&A) of US$9.92 per tonne.

- Haulage costs per tonne of Yere North: $16.30, ANV: $13.20, Koban North: $9.20, Sena: $8.60, Gbongogo South: $7.90, Diouma North: $7.70 and Lokolo Main: $7.70.

Yere North Modelling

The Yere North estimation dataset includes information selected from 41 RC and diamond drill holes drilled by Barrick (2 holes) and Montage (39 holes) for 4,648 meters of drilling. This drilling tests the mineralization at spacings ranging from around 25 by 25 meters in central portions of the currently drilled deposit to notably broader in peripheral areas and at depth. The resource modelling included a mineralized envelope which strikes northeast and dips to the east at around 75º and is interpreted over around 310 meters, with horizontal widths averaging around 100 meters at surface, and generally reducing in width with depth. Within the general area of modelled mineralization, the interpreted base of saprolite averages around 39 meters below surface, and the underlying saprock averages around 7 meters thick with fresh rock occurring at an average depth of around 45 meters.

Bulk densities of 1.60, 2.25 and 2.75 t/bcm were assigned to saprolite, saprock and fresh material respectively on the basis of 110 immersion density measurements

The pit shell constraining the 2025 MRE extends over 370 meters of strike to a maximum depth of around 70 meters.

ANV Modelling

The ANV estimation dataset includes information selected from the combined drilling dataset for this deposit area comprising 185 RC and diamond holes drilled by Endeavor (115 holes) and Montage (70 holes) totalling 23,025 meters of drilling. This drilling tests central portions of currently interpreted mineralization with approximately 25 meters spaced traverses of generally northwesterly inclined holes, with hole spacing notably broader in peripheral areas and at depth. It includes several pairs of holes separated by around 6 meters, giving a locally clustered dataset. ANV Resource modelling included a north-east trending, sub vertical mineralized envelope, interpreted over around 1,400 meters of strike with horizontal widths ranging from around 20 to 330 meters and averaging around 175 meters. With the general area of modelled mineralization, the interpreted base of saprolite averages around 57 meters below surface, and saprock averages around 10 meters thick with fresh rock at an average depth of around 67 meters. Indicator thresholds and bin grades used for MIK modelling of the mineralized domain were derived from composite gold grades excluding selected clustered drill holes.

Bulk densities of 1.80, 2.20 and 2.75 t/bcm were assigned to saprolite, saprock and fresh material respectively on the basis of 206 immersion density measurements.

The resource pit shell extends over approximately 1,100 meters of strike to a maximum depth of around 120 meters.

Koban North

The Koban North estimation dataset includes information selected from the 55 RC and diamond holes drilled by Endeavor (3 holes) and Montage (52 holes) totalling 6,220 meters of drilling available for this deposit area. Central portions of the interpreted mineralization have been tested by generally approximately 50 meters spaced traverses of generally west-south westerly inclined drill holes, with locally closer spaced drilling and broader drill spacing in peripheral areas and at depth Resource modelling included a north-northeast striking, approximately 50º westerly dipping mineralized envelope interpreted over around 700 meters of strike with horizontal widths averaging around 175 meters. With the general area of modelled mineralization, the interpreted base of saprolite averages around 26 meters below surface, and saprock averages around 13 meters thick with fresh rock interpreted at an average depth of around 40 meters.

Bulk densities of 1.70, 2.30 and 2.75 t/bcm were assigned to saprolite, saprock and fresh material respectively on the basis 30 immersion density measurements of diamond core performed by company personnel.

The pit shell constraining the MRE extends over approximately 570 meters of strike and reaches around 140 meters depth.

Sena

The Sena estimates are based on information extracted from the drilling dataset available for this deposit which comprises 84 Aircore hole and 39 RC holes drilled by Montage for 6,465 meters of drilling. This drilling tests the currently interpreted mineralisation with traverses of generally east-southeast (azimuth 110) inclined holes, varying from approximately 100 meters spaced traverses of generally comparatively shallow Aircore holes in the south to 50 meters and locally 25 meters traverses of Aircore and RC holes in the north. Resource modelling utilised two north-northeast striking mineralized domains, which dip towards the west at around 50º with average horizontal widths of around average 50 meters. These domains comprise an eastern zone interpreted over approximately 770 meters of strike and a western domain interpreted over 480 meters of strike. With the general area of modelled mineralization, the interpreted base of saprolite averages around 19 meters depth with the underlying saprock averaging around 8 meters thick with fresh rock occurring at an average of around 27 meters depth.

No density measurements are available, for Sena. The estimates for this deposit, which are all classified as Inferred include bulk densities of 1.65, 2.55 and 2.70 t/bcm for saprolite, saprock and fresh material respectively on the basis of values assigned to the nearby Gbongogo deposit.

The pit shell constraining the MRE comprises several sub-pits over a combined strike of approximately 750 meters of strike which reach a maximum depth of around 55 meters.

Gbongogo South

The Gbongogo South estimates are based on information extracted from the drilling dataset available for this deposit which includes 168 AC, RC and diamond holes by RRL (11 holes) and Montage (157 holes) totalling 12,639 meters of drilling. The available drilling tests the eastern and northern portions of the interpreted mineralisation with generally easterly inclined holes spaced at around 25 meters. Western and southern portions of the deposit are generally more broadly drilled, with commonly 100 meters spaced holes, including comparatively shallow Aircore holes. Resource modelling utilised a moderately westerly dipping mineralized envelope interpreted over around 700 meters of strike subdivided into an eastern mineralized domain containing comparatively higher gold grade drill hole composites, and a western domain characterized by generally more sparse drilling and commonly lower composite grades. Horizontal widths of the eastern and western zones average around 70 and 200 meters respectively. With the general area of modelled mineralization, the interpreted base of saprolite averages around 25 meters below surface, and underling saprock averages around 7 meters thick with fresh rock occurring at an average depth of around 33 meters.

Bulk densities of 1.75, 2.45 and 2.75 t/bcm were assigned to saprolite, saprock and fresh material respectively on the basis 183 immersion density measurements of diamond core performed by company personnel for the combined Gbongogo South and Diouma North deposits, including 59 measurements from the Gbongogo South mineralized domains.

The optimal pit shell constraining the MRE extends over approximately 700 meters north-south to a maximum depth of around 180 meters.

Diouma North

The Diouma North estimates are based on information extracted from the drilling dataset available for this deposit which includes 113 AC, RC and diamond holes by RRL (1 hole) and Montage (112 holes) totalling 9,207 meters. Diouma North drilling includes holes of several orientations, with two dominant groups comprising a dominant set inclined towards the east-southeast (azimuth 100) and smaller set inclined towards the north-northeast (azimuth 020), sub-parallel to the interpreted strike of the mineralized domains. Each of these groups are spaced at around 25 by 25 meters. Mineralized domain composite gold grades from north-northeast inclined holes show notably different distribution and higher average grades than the east-southeast holes. To provide a representative dataset, for determination of indicator thresholds and bin grades the north-northeasterly inclined holes were excluded. However, all drill holes were included in the dataset used for estimation. Resource modelling included a north-northeast (010) striking, approximately 60º westerly dipping mineralized envelope interpreted over around 400 m of strike with horizontal widths averaging around 65 meters. With the general area of modelled mineralization, the interpreted base of saprolite averages around 6 meters below surface, and saprock averages around 12 m thick with fresh rock interpreted at an average depth of around 19 meters.

Bulk densities of 1.75, 2.45 and 2.75 t/bcm were assigned to saprolite, saprock and fresh material respectively on the basis 183 immersion density measurements of diamond core performed by company personnel for the combined Gbongogo South and Diouma North deposits, including 80 measurements from the Diouma North mineralized domain.

The optimal pit shell constraining the MRE extends over approximately 350 meters of strike to a maximum depth of around 80 meters.

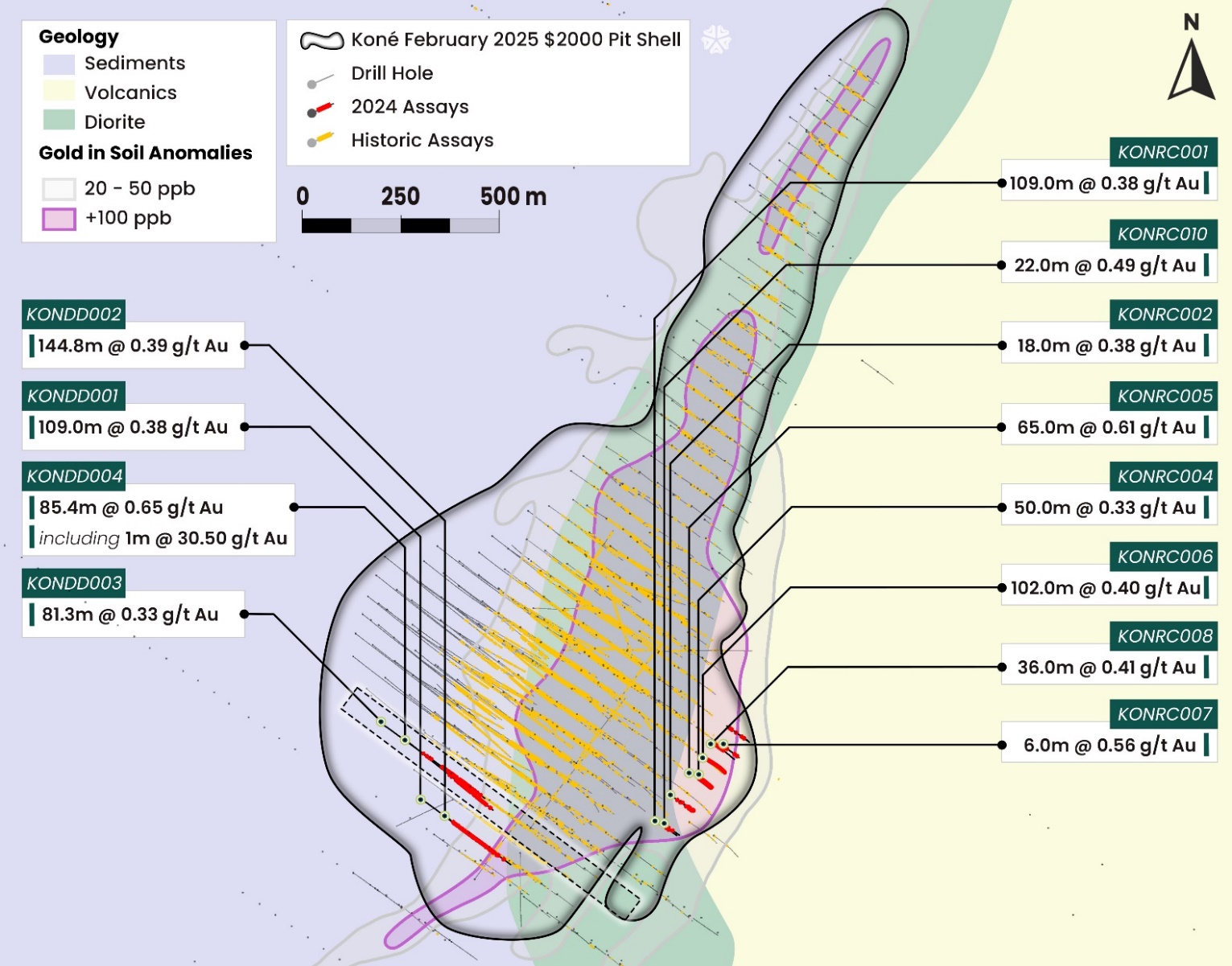

Lokolo Main

The Lokolo Main estimates are based on information extracted from the drilling dataset available for this deposit of 55 RC holes and 15 diamond holes by RRL (9 holes) and Montage (61 holes) for 7,741 meters of drilling. This drilling tests central portions of currently interpreted mineralization with approximately 25 meters spaced traverses of generally north-westerly inclined holes, with notably broader hole spacing in peripheral areas and at depth. Resource modelling utilised two north-northeast striking mineralized domains, which dip towards the west at around 70º. These domains comprise a western zone interpreted over approximately 630 meters of strike with an average horizontal width of around 20 meters and an eastern domain interpreted over around 220 meters of strike with an average horizontal width of around 30meters. With the general area of modelled mineralization, the interpreted base of saprolite averages around 35 meters depth, with underlying saprock averaging around 6 meters thick with fresh rock interpreted at an average depth of around 41 meters.

Bulk densities of 1.60, 1.85 and 2.85 t/bcm were assigned to saprolite, saprock and fresh material respectively on the basis 245 immersion density measurements of diamond core performed by company personnel.

The resource pit shell constraining the MRE extends over approximately 470 meters of strike to a maximum depth of around 90 meters.

Sampling & Assaying - QA/QC

All exploration work on Kone project is designed and carried out under the supervision of Executive Vice President, Exploration, Silvia Bottero, a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (SACNASP) and Qualified Person as defined in NI 43-101.

Samples used for the results described above that come from DD holes and are based on 1 meter composite sample. Core samples were cut in two by core blade at the camp facilities then shipped by road to Bureau Veritas facility in Abidjan, Côte d'Ivoire.

For RC and Aircore drilling, samples were collected over 1 meter downhole intervals from the base of the cyclone and split with a three-tier riffle split. Three kilograms samples were collected then shipped by road to Bureau Veritas facility in Abidjan, Côte d'Ivoire. All samples were crushed to 2mm (80% passing) with 1 kilogram split out for pulverization to 75µm (85% passing) then analysed by fire assay using a 50-gram charge.

Field duplicate samples are taken, and blanks and standards are inserted by Montage geologists into the sample sequence at a rate of one of each sample type per 25 samples. This ensures that there is a minimum 4% QA/QC sample insertion rate applied to each fire assay batch. The sampling and assaying are monitored and audited through analysis of these QA/QC samples by a consultant independent of Montage. QA/QC has been designed to be in line with industry best standards and to follow NI 43-101 standards and the interpretation reviewed by the Qualified Person. Individual batches are monitored for standard and blank failure during import to the database, whilst longer term QA/QC trends are monitored on a periodic basis by Jonathan Hunt, consultant independent of Montage and Chartered Geologist of the Geological Society of London.

Results for exploration drillholes (all satellite deposits) used the following parameters: 0.3 g/t Au cut off for samples, 0.5 g/t Au minimum value composite and 2.0 meter maximum interval dilution length. Composite intervals represent (apparent) downhole thickness. "Including" represents >10 g/t Au

Results for exploration drillholes (Koné deposit) used the following parameters: 0.2 g/t Au cut off for samples, 0.3 g/t Au minimum value composite and 10.0 meter maximum interval dilution length. Composite intervals represent (apparent) downhole thickness. "Including" represents >10 g/t Au.

Data Verification

Procedures utilized for monitoring representativity of field sampling and reproducibility and accuracy of sample preparation and assaying for the Koné project AC, RC and DD drilling are consistent with the QP experience of good industry standard practices. Information available to demonstrate the sample representivity for the Koné Project drilling includes RC, Aircore and DD sample condition logs, recovered sample weights, core recovery measurements and assay results for field duplicates. Information available to demonstrate the reliability of sample preparation and analysis includes assay results for coarse blanks and certified reference standards. The QP frequently visited site in 2024 to check sampling and assays protocols, to check for internal consistency between and within database tables and to random check comparisons between database entries and original field records.

Additionally, Mr Abbott, who is considered to be independent of Montage Gold, most recently visited the Koné and Gbongogo deposits in September 2023, and visited the Koban North, Sena, Gbongogo South, Diouma North Lokolo Main, Yere North and ANV deposits in October 2024. Mr Abbott considers that the sample preparation, security, and analytical procedures adopted for drilling informing Mineral Resources provide an adequate basis for the 2025 MRE.

QUALIFIED PERSONS STATEMENT

The scientific and technical contents of this press release have been verified and approved by Silvia Bottero, BSc, MSc, a Qualified Person pursuant to NI 43-101. Mrs. Bottero, EVP Exploration of Montage, is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (SACNASP), a member of the Geological Society of South Africa and a Member of AusIMM.

CONTACT INFORMATION

| For Investor Relations Inquiries: Jake Cain Strategy & Investor Relations Manager jcain@montagegold.com +44-7788-687-567 | For Media Inquiries: John Vincic Oakstrom Advisors john@oakstrom.com +1-647-402-6375 | For Regulatory Inquiries: Kathy Love Corporate Secretary klove@montagegold.com +1-604-512-2959 |

FORWARD-LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, "Forward-looking Statements"). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as "will", "intends", "proposed" and "expects" or similar expressions are intended to identify Forward-looking Statements. Forward-looking Statements in this press release include statements related to the Company's mineral reserve and resource estimates; the timing and amount of future production from the Koné Project; anticipated mining and processing methods of the Koné Project; anticipated mine life of the Koné Project; targeted improvements in the production profile; expected timing of commencement and completion of our stated drill programs in 2025; results of the drill programs including targeted additions to the estimated mineral resources at the Koné Project, and the timing thereof; the establishment of satellite deposits and the development of these deposits; expected recoveries and grades of the Koné Gold Project; timing in respect of the commencement of construction, and the length of construction, of the mining operations at the Koné Gold Project; timing and amount of necessary financing related to the mining operations at the Koné Gold Project; and timing for permits and concessions, including that the Company will receive all approvals necessary to build the project and conduct exploration.

Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions. There is no assurance that any economic satellite deposits will be discovered, and if discovered ever developed or mined. There can be no assurance that any Forward-looking Statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties inherent in the preparation of mineral reserve and resource estimates and definitive feasibility studies such as the UFS and the 2025 MRE, and in delineating new mineral reserve and resource estimates, including but not limited to, assumptions underlying the production estimates not being realized, incorrect cost assumptions, unexpected variations in quantity of mineralized material, grade or recovery rates being lower than expected, unexpected adverse changes to geotechnical or hydrogeological considerations, or expectations in that regard not being met, unexpected failures of plant, equipment or processes, unexpected changes to availability of power or the power rates, failure to maintain permits and licenses, higher than expected interest or tax rates, adverse changes in project parameters, unanticipated delays and costs of consulting and accommodating rights of local communities, environmental risks inherent in the Côte d'Ivoire, title risks, including failure to renew concessions, unanticipated commodity price and exchange rate fluctuations, delays in or failure to receive access agreements or amended permits, and other risk factors set forth in the Company's 2023 Annual Information form available at www.sedarplus.ca, under the heading "Risks and Uncertainties". The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

APPENDIX 1: KONÉ MINERALIZED TRENDS AND TARGETS

Source for Indicated Resources stated in map above: Updated Feasibility Study press release dated January 16, 2024 available on Montage's website and on SEDAR+. See "Technical Disclosure".

APPENDIX 2: BEST SELECTED INTERCEPTS

| Prospect | Hole ID | Drill Type | Collar Location | Orientation | Depth (m) | From (m) | To (m) | Apparent Width1 (m) | Au Grade (g/t) | Comments | |||

| (UTM Zone 29N) | |||||||||||||

| m E | m N | mRL | Dip | Azim | |||||||||

| ANIII | SDDDH028 | DD | 783,616 | 1,012,860 | 409 | -55 | 305 | 182.8 | 73.2 | 75.9 | 2.7 | 4.94 | |

| SDRC099 | RC | 783,554 | 1,012,750 | 404 | -55 | 305 | 100.0 | 63.0 | 75.0 | 12.0 | 1.55 | ||

| ANV | SDDDH013A | DD | 782,457 | 1,014,347 | 424 | -55 | 125 | 164.8 | 86.0 | 104.8 | 18.8 | 1.53 | |

| SDDDH025 | DD | 782,459 | 1,014,411 | 426 | -55 | 126 | 200.6 | 122.0 | 137.4 | 15.4 | 3.12 | Incl. 1m @ 14.09 g/t; 1m @ 14.78 g/t | |

| SDRC034 | RC | 782,489 | 1,014,325 | 424 | -55 | 125 | 100.0 | 46.0 | 71.0 | 25.0 | 3.02 | ||

| SDRC041 | RD | 782,527 | 1,014,446 | 427 | -50 | 125 | 144.5 | 73.0 | 98.0 | 25.0 | 1.62 | ||

| SDRC045 | RC | 782,630 | 1,014,594 | 428 | -55 | 125 | 90.0 | 31.0 | 74.0 | 43.0 | 1.76 | Incl. 1m @ 13.94g/t | |

| Diouma North | GBRC277 | RC | 769,612 | 991,482 | 343 | -55 | 100 | 130.0 | 111.0 | 118.0 | 7.0 | 1.74 | |

| GBRC280 | RC | 769,633 | 991,626 | 340 | -55 | 100 | 90.0 | 49.0 | 57.0 | 8.0 | 1.77 | ||

| Gbongogo South | GBRC264 | RC | 769,262 | 992,708 | 337 | -55 | 90 | 100.0 | 65.0 | 73.0 | 8.0 | 3.98 | |

| GBRC267A | RC | 769,264 | 992,650 | 337 | -55 | 90 | 90.0 | 8.0 | 22.0 | 14.0 | 2.37 | ||

| GBRC268 | RC | 769,245 | 992,601 | 335 | -55 | 90 | 100.0 | 60.0 | 76.0 | 16.0 | 1.89 | ||

| GBRC321 | RC | 769,248 | 992,672 | 339 | -55 | 90 | 90.0 | 43.0 | 57.0 | 14.0 | 1.70 | ||

| GBRC323 | RC | 769,235 | 992,795 | 343 | -55 | 90 | 120.0 | 0.0 | 13.0 | 13.0 | 1.88 | ||

| GBRC381 | RC | 769,182 | 992,622 | 336 | -55 | 90 | 140.0 | 76.0 | 106.0 | 30.0 | 1.54 | ||

| Koban North | KBNDD003 | DD | 769,974 | 1,000,454 | 393 | -55 | 105 | 120.5 | 106.7 | 120.5 | 13.8 | 2.92 | |

| KBNRC034 | RC | 770,122 | 1,000,754 | 400 | -55 | 105 | 126.0 | 25.0 | 32.0 | 7.0 | 2.13 | ||

| KBNRC037 | RC | 770,020 | 1,000,677 | 397 | -55 | 105 | 150.0 | 34.0 | 58.0 | 24.0 | 1.81 | ||

| KBNRC040 | RC | 770,040 | 1,000,596 | 396 | -55 | 105 | 120.0 | 26.0 | 33.0 | 7.0 | 5.82 | Incl. 1m @ 34.78g/t | |

| KBNRC045 | RC | 770,057 | 1,000,485 | 396 | -55 | 105 | 75.0 | 45.0 | 73.0 | 28.0 | 1.20 | ||

| Lokolo Main | GBDDH071 | DD | 778,557 | 989,667 | 365 | -55 | 315 | 149.7 | 131.7 | 136.0 | 4.4 | 3.24 | Incl. 0.5m @ 25.10 g/t |

| GBRC212 | RC | 778,658 | 989,767 | 361 | -55 | 315 | 144.0 | 99.0 | 110.0 | 11.0 | 3.10 | Incl. 1m @ 11.43 g/t | |

| Lokolo NW | LKNWRC009 | RC | 776,953 | 990,723 | 379 | -55 | 315 | 60.0 | 44.0 | 56.0 | 12.0 | 1.70 | |

| LKNWRC011 | RC | 776,875 | 990,647 | 381 | -55 | 315 | 70.0 | 54.0 | 67.0 | 13.0 | 2.92 | Incl. 1m @ 12.53g/t; 1m @ 11.54g/t | |

| LKNWRC013 | RC | 776,873 | 990,588 | 383 | -55 | 315 | 120.0 | 88.0 | 99.0 | 11.0 | 1.86 | ||

| Sena | SENRC015 | RC | 769,777 | 997,724 | 367 | -55 | 110 | 82.0 | 20.0 | 31.0 | 11.0 | 2.02 | |

| Soman 1 | GBRC330 | RC | 770,238 | 994,032 | 341 | -55 | 140 | 100.0 | 76.0 | 87.0 | 11.0 | 4.40 | Incl. 1m @ 29.88g/t |

| GBRC333 | RC | 770,208 | 993,985 | 341 | -55 | 140 | 100.0 | 83.0 | 96.0 | 13.0 | 1.60 | ||

| Soman 2 | GNNRC001 | RC | 770,156 | 994,521 | 350 | -55 | 140 | 150.0 | 25.0 | 28.0 | 3.0 | 2.84 | |

| GNNRC003 | RC | 770,177 | 994,571 | 352 | -55 | 140 | 100.0 | 60.0 | 64.0 | 4.0 | 6.16 | Incl. 1m @ 18.03g/t | |

| GNNRC006 | RC | 770,159 | 994,442 | 350 | -57 | 140 | 100.0 | 0.0 | 15.0 | 15.0 | 2.17 | Incl.1m @ 15.87g/t | |

| Yere North | SDRC053 | RC | 794,759 | 1,017,216 | 397 | -50 | 305 | 72.0 | 2.0 | 14.0 | 12.0 | 2.62 | |

| SDRC061 | RC | 794,773 | 1,017,053 | 399 | -50 | 305 | 90.0 | 54.0 | 64.0 | 10.0 | 2.24 | ||

| SDRC064 | RC | 794,709 | 1,017,097 | 399 | -50 | 305 | 120.0 | 41.0 | 58.0 | 17.0 | 2.55 | Incl. 1m @ 17.82 g/t | |

| RC | 794,709 | 1,017,097 | 399 | -50 | 305 | 120.0 | 10.0 | 27.0 | 17.0 | 8.39 | Incl. 1m @ 101.5 g/t | ||

| SDRC066 | RC | 794,766 | 1,017,027 | 399 | -50 | 305 | 96.0 | 49.0 | 62.0 | 13.0 | 7.18 | Incl. 1m @ 71.17g/t | |

1 True thickness not available.

Figures and tables accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/115d49a8-ee31-4475-ad67-1b5f8cd8dfb1

https://www.globenewswire.com/NewsRoom/AttachmentNg/82fd7f36-a90d-435d-a1d2-9e1c0a00243e

https://www.globenewswire.com/NewsRoom/AttachmentNg/63fdf213-89b0-4244-9cca-9ff9b02528bf

https://www.globenewswire.com/NewsRoom/AttachmentNg/c1640028-2d48-4703-a9f0-777d879f964d

https://www.globenewswire.com/NewsRoom/AttachmentNg/a6e393d7-37f7-44fc-80bb-da26c494d7e0

https://www.globenewswire.com/NewsRoom/AttachmentNg/42a4554a-1521-473c-b7f9-e815f70d6cf3

https://www.globenewswire.com/NewsRoom/AttachmentNg/b1bfb50a-792e-47ec-b5a1-7add32bf6c55

https://www.globenewswire.com/NewsRoom/AttachmentNg/ddc87e34-57e5-443f-b3d3-271a192070ac

https://www.globenewswire.com/NewsRoom/AttachmentNg/521e1b77-56e5-4b3a-b4ba-e67ab9ba46e1

https://www.globenewswire.com/NewsRoom/AttachmentNg/f818e720-b06e-4fea-9514-ea699ca0264d

https://www.globenewswire.com/NewsRoom/AttachmentNg/bca215d2-7a18-4166-92fb-f942f35dd30d

https://www.globenewswire.com/NewsRoom/AttachmentNg/b958d3f0-0e0c-4308-84d6-303272f11b59

https://www.globenewswire.com/NewsRoom/AttachmentNg/c63084a5-42f2-4b79-a5bd-7e7b9fde64b4

https://www.globenewswire.com/NewsRoom/AttachmentNg/7b4dcc3a-6cd4-4556-b564-1f66a9bc2d8d

https://www.globenewswire.com/NewsRoom/AttachmentNg/fd5e5e52-e9e2-4532-a4b1-25eab4069ceb

https://www.globenewswire.com/NewsRoom/AttachmentNg/ae28b2e0-e888-4f95-a255-82b422e9feff

https://www.globenewswire.com/NewsRoom/AttachmentNg/00e4a1d3-cb4f-46c2-8f7d-f791545f2b16

https://www.globenewswire.com/NewsRoom/AttachmentNg/a6113210-0a97-4bd3-ba0e-d2eaf3ed5337