VANCOUVER, BC / ACCESS Newswire / April 9, 2025 / KALO GOLD CORP. (TSXV:KALO) ("Kalo", "Kalo Gold" or the "Company") is pleased to announce that the Director of Mines, Ministry of Mineral Resources, Republic of Fiji, has formally granted the renewal of Special Prospecting Licence (SPL) 1511 for a three-year term effective March 26, 2025. The Company acknowledges the continued support and collaboration of the Fijian Government and the Mineral Resources Department.

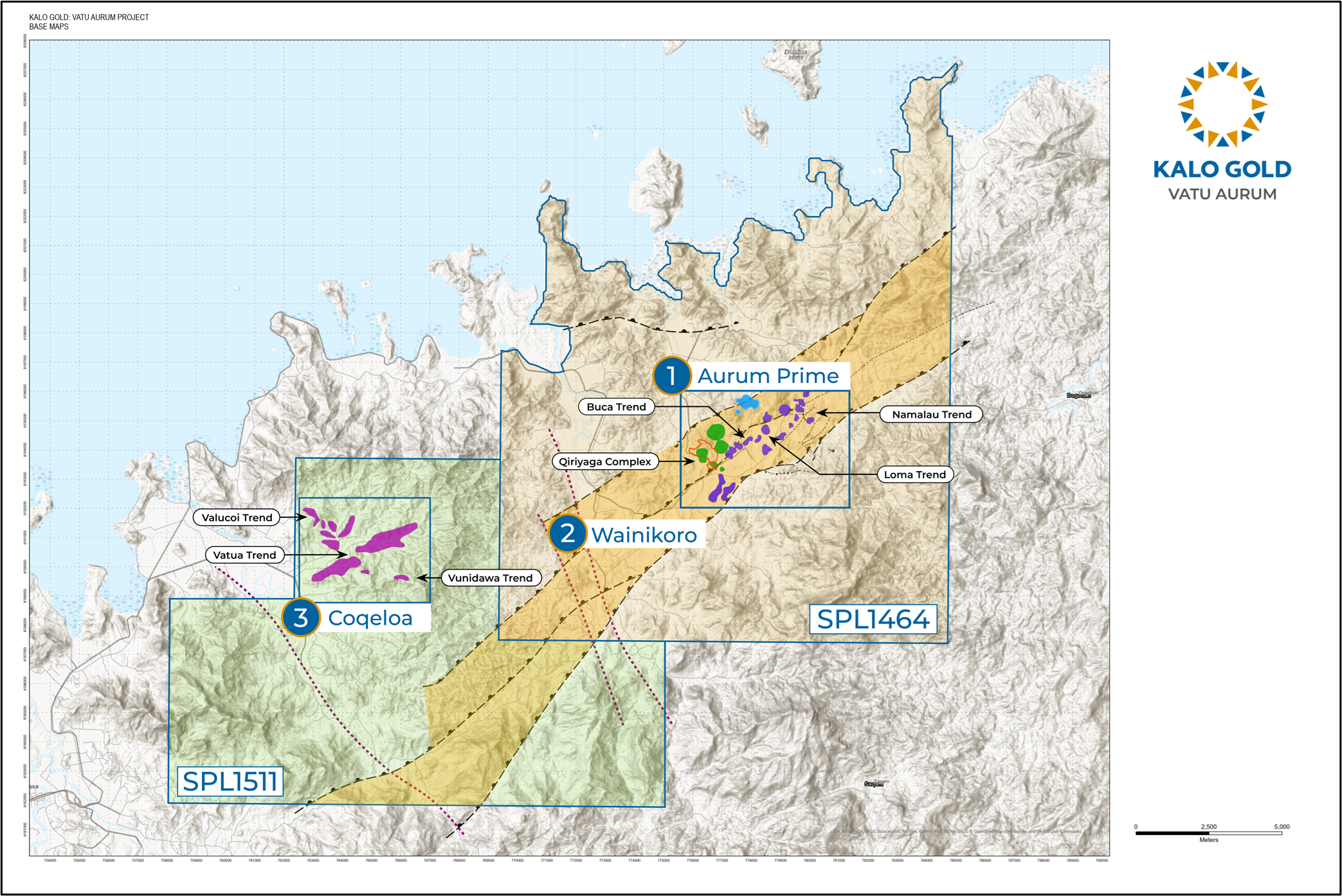

SPL 1511 covers Coqeloa, a historically underexplored gold target, located 15 km southwest of Aurum Prime, on the Company's 100%-owned Vatu Aurum Project, on Vanua Levu, Fiji (see figure 1 and 2). A recent reinterpretation of legacy datasets has elevated Coqeloa to a high priority, vertically preserved low sulphidation epithermal gold target. This advancement was driven by structural, geological and geochemical insights from Aurum Prime and comparative analysis of Pacific Rim gold systems - including Martha (Waihi) - allowing Kalo to apply an emerging exploration model without incurring additional on-the-ground field expenditures. Coqeloa exhibits multiple key CODES fertility indicators (Centre for Ore Deposit and Earth Sciences at the University of Tasmania), including preserved high-level epithermal textures, enriched pathfinder geochemistry, and alteration zonation consistent with minimal erosion. These features suggest the system remains vertically intact, with the upper epithermal cap preserved and deeper mineralized structures potentially still in place.

Key Highlights

SPL 1511 Renewed for 36 Months: Fiji's Mineral Resources Department has formally granted the renewal of SPL 1511, securing exploration rights through March 25, 2028.

High Grade Gold up to 33.0 g/t Au: Top results from surface rock sampling include 33.2 g/t (Solpac, 1987), 9.05 g/t (KEPL, 2018), 9.0 and 5.2 g/t (Jennings, 1990s), 2.275 g/t (Aquitaine, 1985), and 2.16 & 2.01 g/t (KEPL, 2018), confirming widespread high-grade gold potential across multiple zones.

>2.0 km Alteration Corridor with Feeder Structures: Over 2.0 kilometres of mapped alteration - including clay-rich zones, silica flooding, and quartz-pyrite veining - define a structurally controlled alteration corridor hosting multiple silicified ridges, interpreted as high-level epithermal feeder zones. These features represent a well-developed epithermal halo developed at low temperatures (100-150°C), supporting the interpretation of a vertically preserved and intact gold system.

Vertically Intact Epithermal System with Strong Pathfinder Signature: Surface anomalies include: As (up to 1,080 ppm), Sb (up to 207 ppm), Te (up to 10.5 ppm), Mo (up to 14 ppm), Cu (up to 1,030 ppm), Pb (up to 1,500 ppm), Zn (up to 3,110 ppm) and Ag (up to 11.5 ppm) consistent with upper-level low sulphidation epithermal systems.

Aurum Prime Exploration Model Reclassifies Coqeloa without Additional Field Costs: Comparative insights from Aurum Prime and regional Pacific Rim epithermal systems enabled Coqeloa's reclassification using legacy datasets, without requiring new exploration expenditures.

"The renewal of SPL 1511 and Coqeloa's reclassification mark a pivotal step for Kalo," said Terry L. Tucker, P.Geo., President & CEO. "By applying an exploration model informed by structural and geochemical insights from Aurum Prime and other Pacific Rim epithermal systems, we've identified Coqeloa as a high-potential analog to deposits such as Martha (Waihi), where narrow surface veins led to multi-million-ounce discoveries. While Aurum Prime remains early-stage, its geological characteristics have helped unlock new value from legacy data at Coqeloa. The combination of high-grade gold, pathfinder elements, and intact alteration zoning presents a compelling, data-driven target for continued exploration and initial drill testing beneath preserved high-level structures."

Technical Reinterpretation: A Preserved Epithermal System Cap

Coqeloa, originally explored as a base metal VMS system, is now recognized as a vertically intact low sulphidation epithermal system within Miocene-Pliocene volcanic rocks.

Key geological evidence includes:

Feeder Structures: Silicified ridges (300-500 m × 1 m) with epithermal textures (crustiform banding, chalcedony, and comb quartz, accompanied by boxwork after pyrite and preserved pyrite cubes) along NE/ESE faults hosted within broader phyllic and argillic alteration corridors extending over 2.0 kilometres in strike length and several hundred metres in width. This is consistent with formation at shallow crustal levels above the boiling zone.

Alteration Zoning: Over 2.0 kilometres of mapped phyllic to advanced argillic alteration - including zones of intense silicification, quartz-muscovite-pyrite veining, kaolinite-goethite overprinting, and the presence of low-temperature zeolite mordenite, a key indicator of paleoboiling conditions (~100-150°C)- defines a structurally controlled corridor interpreted to host multiple high-level feeder zones above the epithermal boiling horizon.

Historic High-Grades: Multiple surface rock samples confirm Coqeloa's gold potential, including: 33.2 g/t Au (Solpac, 1987), 9.05 g/t Au (KEPL 2018), 9.0 and 5.2 g/t Au (Jennings Mining, 1990s), 2.275 g/t Au (Aquitaine, 1995), and 2.16 g/t Au and 2.01 g/t Au (KEPL, 2018). These high-grade values, spatially associated with structurally controlled silicified ridges and alteration zones, support the interpretation of a vertically preserved low sulphidation system with potential for deeper mineralised feeders.

Pathfinder Element Enrichment: The presence and zoning of these elements provide reliable vectoring tools in targeting deeper mineralised structures, with surface geochemistry yielding values up to:

Arsenic (As): up to 1,080 ppm

Antimony (Sb): up to 207 ppm

Tellurium (Te): up to 10.5 ppm

Molybdenum (Mo): up to 14 ppm

Copper (Cu): up to 1,030 ppm

Lead (Pb): up to 1,500 ppm

Zinc (Zn): up to 3,110 ppm

Silver (Ag): up to 11.5 ppm

CODES Fertility Framework: According to models developed by the Centre for Ore Deposit and Earth Sciences (CODES), fertile low sulphidation epithermal systems are defined by five key features: (1) preserved upper-level vein textures such as crustiform banding, chalcedony, and boxwork; (2) zoned hydrothermal alteration from phyllic to advanced argillic assemblages; (3) enrichment in pathfinder elements including arsenic, antimony, tellurium and silver; (4) structurally focused fluid pathways such as faults and ring fractures; and (5) minimal erosion, allowing the upper epithermal cap and vertical system integrity to remain preserved. Coqeloa meets all five criteria, supporting its classification as a vertically preserved, high-potential epithermal gold system and a top-ranked exploration target within the Vatu Aurum Project.

These insights, guided by Kalo's evolving epithermal model - informed by work at Aurum Prime and comparisons to Pacific Rim analogues - support the reclassification of Coqeloa as a high-priority, vertically preserved gold target. This advancement was achieved entirely through reinterpretation of legacy data, without additional field expenditures.

Exploration Potential

Coqeloa's >2.0 km alteration corridor, high-grade surface samples (up to 33.0 g/t Au), and pathfinder zoning suggest:

Strike Extension: The system remains open along strike and at depth, with structural and geochemical similarities to Pacific Rim analogues such as Martha (Waihi), where narrow surface veins were found to expand at depth.

Boiling Zone Target: Silicified ridges and mordenite suggest preservation of the upper epithermal boiling horizon (~100-150 m depth). Planned drilling would test below this zone for potential vein-hosted mineralization between 200-400 meters.

Multi-Phase Mineralization: Structurally controlled feeders (e.g., NE/ESE faults) may host stacked veins.

Analogous Features with Aurum Prime and Known Epithermal Systems

The Coqeloa system exhibits striking structural and geochemical similarities to Aurum Prime, including the Namalau, Loma and Buca Trends. The presence of narrow, fault-aligned silicified ridges with high-level epithermal textures and pathfinder element enrichment mirrors the early-stage surface expression of established low sulphidation systems such as Martha (Waihi, NZ). In this analogue, narrow surface veins were ultimately linked to broader, high-grade mineralized zones at depth, validating the exploration strategy now applied to Coqeloa.

Taken together, the multi-source high-grade gold values, textbook alteration patterns and mineralogy, enriched pathfinder element suite, preserved vertical zonation, and reinterpretation through comparative epithermal models - including learnings from Aurum Prime - confirm Coqeloa as a high-confidence, vertically intact low sulphidation epithermal gold target.

Next Steps - Systematic Target Advancement

Kalo Gold will initiate follow-up exploration at Coqeloa in H2 2025, including:

Geological, structural and alteration mapping;

Soil grid expansion and XRF and TerraSpec analysis to refine geochemical and mineralogical vectoring tools;

Refinement of drill targets based on interpreted structural intersections and multi-element anomalies.

Drill targeting beneath the silicified ridges and phyllic-altered zones to test for mineralized feeder structures.

Renewal of Special Prospecting Licence (SPL) 1511

The Director of Mines, Ministry of Mineral Resources, Republic of Fiji, has formally granted the renewal of Special Prospecting Licence (SPL) 1511. The licence, held by the Company's wholly owned Fijian subsidiary, Kalo Exploration Ltd., has been renewed for a three-year term effective March 26, 2025, and will remain valid until March 25, 2028. The renewal was granted pursuant to the provisions of the Fiji Mining Act, following the submission of the required renewal application. The renewed licence authorizes the Company to continue exploration activities within the SPL 1511 area, including geological mapping, geochemical sampling, trenching, and drilling, as approved under the submitted work program.

Qualified Person

All the technical information in this news release was prepared, reviewed, and approved in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects by Andrew Randell, P. Geo, principal of SGDS Hive, a qualified person as defined by National Instrument 43-101 of the Canadian Securities Administrators. Mr. Randell is independent of the Company and has verified the data disclosed having conducted two site visits, directly supervised the exploration program, completed review of field data collection protocols, including sampling procedures, analytical methods, and quality assurance/quality control protocols, where applicable.

ABOUT KALO GOLD CORP.

Kalo Gold Corp., a gold exploration company, focused on epithermal gold deposits on the Company's Vatu Aurum Project, located on Vanua Levu (North Island). Kalo holds 100% of two Special Prospecting Licenses covering 367 km², encompassing a regional back-arc basin with volcanic calderas. Historical and ongoing exploration has identified numerous priority epithermal gold targets.

On behalf of the Board of Directors of Kalo Gold Corp.

Terry L. Tucker, P.Geo.

President and Chief Executive Officer

Kevin Ma, CPA, CA

Executive Vice President, Capital Markets and Director

For more information, please write to info@kalogoldcorp.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Forward-Looking Statements Disclaimer

This news release contains "forward-looking statements" within the meaning of applicable securities laws. These statements reflect management's current expectations, strategic objectives, and exploration priorities at the time of this release. Forward-looking statements are not statements of historical fact and include, but are not limited to:

The Company's planned multi-phase exploration and drilling program, including the targeting of structurally controlled gold zones at Coqeloa, Aurum Prime, Namalau, Loma, Buca Trends, and the Qiriyaga Complex.

Interpretations of geological features, mineralization continuity, and deposit potential, based on geophysical surveys, surface sampling, and historical drill data, which are subject to change as additional drilling and verification work is conducted.

The potential for district-scale gold mineralization, subject to further exploration, drilling, and independent verification.

All exploration results, including geochemical data and historical intercepts, are preliminary in nature and do not constitute a mineral resource estimate. Further exploration, including drilling, is required to confirm the continuity, grade, and extent of mineralization at the Vatu Aurum Project.

The Company's ability to secure sufficient financing, obtain necessary regulatory approvals, and establish strategic partnerships to advance exploration and development activities.

Exploration Risks & Uncertainties

Forward-looking statements are subject to geological, financial, and regulatory risks that may cause actual results to differ materially from those anticipated. These risks include, but are not limited to:

Exploration risk: There is no guarantee that current exploration activities will result in an economically viable mineral resource.

Drilling uncertainty: Trench and soil sampling results are not necessarily indicative of subsurface mineralization, and drilling is required to confirm continuity, grade, and extent.

Permit and regulatory risks: Exploration activities are subject to government approvals, environmental regulations, and permitting requirements.

Funding constraints: The Company's ability to execute exploration programs depends on market conditions and financing availability.

Commodity price volatility: Gold price fluctuations may impact the economic feasibility of any future discoveries.

Forward-looking statements contained in this news release are based on current expectations, estimates, forecasts, and projections about Kalo Gold Corp.'s business, as well as beliefs and assumptions made by the Company's management.

Readers are cautioned that forward-looking statements are based on assumptions that may not prove to be correct. Actual results may differ materially due to a number of known and unknown risks and uncertainties that are beyond the control of the Company.

Kalo Gold Corp. does not undertake any obligation to update or revise any forward-looking statements, except as required by applicable securities laws. Readers should not place undue reliance on forward-looking information contained in this release.

For a more detailed discussion of risks and uncertainties, please refer to Kalo Gold Corp.'s public filings on SEDAR+ at www.sedarplus.ca.

SOURCE: Kalo Gold Corp.

View the original press release on ACCESS Newswire