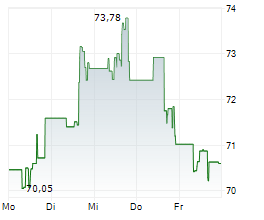

General Motors stock experienced a significant decline on Thursday, falling by approximately 5% amid mounting concerns over the impact of U.S. import tariffs on the automotive industry. A study by the Center for Automotive Research paints a grim picture, suggesting that the 25% tariffs on auto imports could cost U.S. automakers approximately $108 billion by 2025, with Detroit's Big Three facing around $42 billion in additional expenses. For GM specifically, these tariffs could translate to average costs of $4,911 per domestically manufactured vehicle and $8,641 for imported vehicles. The company has attempted to mitigate these pressures by increasing truck production at an Indiana facility and building up inventory reserves in the U.S. to temporarily avoid tariff impacts. Adding to investor concerns, UBS downgraded GM from "Buy" to "Neutral" and slashed its price target from $64 to $51, estimating potential annual tariff costs of up to $5 billion for the automaker.

Production Adjustments Amid Market Pressure

Sollten Anleger sofort verkaufen? Oder lohnt sich doch der Einstieg bei General Motors?

GM announced layoffs of approximately 200 employees at its "Factory Zero" electric vehicle plant in Detroit, citing necessary adjustments to production based on current "market dynamics." This facility manufactures the Chevrolet Silverado EV and GMC Sierra EV, suggesting weakening demand for electric vehicles. Meanwhile, Goldman Sachs reduced its forecast for U.S. auto sales by nearly one million units this year, predicting that new vehicle prices could increase by $2,000 to $4,000 over the next 6-12 months due to tariff impacts. Analysts express doubt that manufacturers can fully pass these costs to consumers amid already declining demand.

Ad

General Motors Stock: New Analysis - 10 AprilFresh General Motors information released. What's the impact for investors? Our latest independent report examines recent figures and market trends.

Read our updated General Motors analysis...