- I am proud to report an 11% increase in operating surplus and a 16% increase in income from property management in the first quarter. This development was due to stable earnings in the comparable portfolio, effects of completed projects, contributions from the acquisition of Mimo and lower financing costs. Simultaneously our financial position is steadily improving. This puts us in a much stronger position than a year ago and we are better equipped to navigate in an unpredictable world, says Johanna Hult Rentsch, CEO at Platzer.

Period January - March 2025

- Rental income increased by 10% to SEK 445 million (404)

- Operating surplus increased by 11% to SEK 348 million (313)

- Income from property management amounted to SEK 195 million (169), corresponding to SEK 1.63 per share (1.41)

- Net lettings amounted to SEK -3 million (3)

- Nordic Credit Rating (NCR) raised Platzer's outlook to "stable" and confirmed BBB- rating. NCR also raised instrument rating to BBB-.

After the end of the reporting period

- Completion of sale of residential building rights in Södra Änggården for SEK 393 million

- A fully rented logistics project is starting up with 30,000 square meters in Sörred Logistics Park.

For more information, please contact:

Johanna Hult Rentsch, CEO, Platzer, phone: +46 (0)709 99 24 05

Ulrika Danielsson, acting CFO, Platzer, phone: +46 (0)706-47 12 61

This is information that Platzer Fastigheter Holding AB (publ) is obliged to disclose in accordance with the EU Market Abuse Regulation and the Swedish Securities Market Act. The information was released for publication on 11 April 2025 at 08:00 CET through the agency of the contact persons shown above.

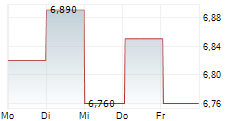

Platzer Fastigheter Holding AB (publ) owns and develops commercial property in Gothenburg worth around SEK 30 billion. Platzer is listed on Nasdaq Stockholm, Mid Cap