NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES

Vancouver, British Columbia--(Newsfile Corp. - April 11, 2025) - Torchlight Innovations Inc. (TSXV: TLX.P) ("Torchlight" or the "Company"), is pleased to announce that it has entered into an amalgamation agreement dated April 11, 2025 (the "Amalgamation Agreement") with Innovation Mining Inc. ("Innovation") and 1535261 B.C. Ltd. ("Subco"), a wholly owned subsidiary of the Company pursuant to which Torchlight will, by way of a "three-cornered amalgamation", acquire all of the issued and outstanding securities of Innovation (together with the related transactions and corporate procedures set forth in the Amalgamation Agreement, the "Transaction").

The Transaction is subject to TSX Venture Exchange (the "TSXV") approval and is intended to constitute Torchlight's "Qualifying Transaction" in accordance with TSXV Policy 2.4 - Capital Pool Companies ("Policy 2.4").

In connection with the Transaction, Torchlight intends to consolidate its common shares on a 1.93:1 basis (the "Consolidation") and change its name to "Innovation Mining Inc." or such other name as may be determined by Innovation (the "Name Change").

About Innovation

Innovation is a clean-tech company with an innovative technology that aims to transform the gold mining industry. Innovation has developed RZOLV, a proprietary, non-toxic hydrometallurgical formula for gold extraction. The formula offers a sustainable, safe, and water-based alternative to cyanide.

While cyanide has been the industry standard for over a century, its toxic nature has led to bans in several countries and costly permitting challenges for mining companies. RZOLV offers similar cost and performance metrics as cyanide, but with a non-toxic, reusable and sustainable profile. Innovation is currently focused on validating its technology through a 100-tonne industrial test, after which full commercialization efforts will begin.

Innovation has safeguarded RZOLV with a robust portfolio of patents (2 patents filed), trade secrets, facility security, chemical obfuscation, and stringent employment confidentiality agreements ensuring long-term competitive advantages. The intellectual property framework includes protection for its chemical formulation, regeneration processes, and specific applications in heap leaching, vat leaching, and concentrate processing.

Upon completion of the Transaction, the Resulting Issuer (as defined below) will take over the business of Innovation as a Tier 2 technology Issuer.

About Torchlight

The Company completed its IPO on August 8, 2022 for gross proceeds of $300,000 and, in connection therewith, listed on the TSXV as a CPC under the trading symbol "TLX.P". The Company is a reporting issuer in British Columbia, Alberta and Ontario.

The Transaction

Pursuant to the terms of the Amalgamation Agreement, and subject to certain conditions, including receipt of applicable regulatory and shareholder approvals, on the closing date of the Transaction (the "Closing Date"), Innovation will amalgamate with Subco pursuant to the provisions of the Business Corporations Act (British Columbia) (the "Amalgamation"). The amalgamated entity ("Amalco") will be a wholly-owned subsidiary of Torchlight.

The Amalgamation must be approved by not less than 662/3% of the votes cast at a meeting of shareholders of Innovation (the "Innovation Meeting"), which will be held to consider, among other things, the Amalgamation. The Amalgamation is not anticipated to be subject to Torchlight shareholder approval.

Innovation intends to complete a share split on an approximately 1:1.24 basis prior to completion of the SR Financing (defined below) and the Transaction (the "Share Split"). Pursuant to the Transaction, the Company will then issue one (1) post-Consolidation common share to Innovation shareholders for every one (1) common share of Innovation held. Outstanding options, warrants and broker warrants of Innovation will also be replaced with options, warrants and broker warrants of the Resulting Issuer exercisable on equivalent terms.

In connection with the Transaction and following the Share Split, Innovation intends to undertake a non-brokered private placement of subscription receipts (each a "Subscription Receipt") at a price of $0.50 per Subscription Receipt for aggregate gross proceeds of up to $2,000,000 (the "SR Financing"). Each Subscription Receipt is expected to be exchanged for one common share and one common share purchase warrant of Innovation (exercisable at a price of $0.75) prior to completion of the Transaction. The underlying Innovation common shares and warrants will subsequently be exchanged for common shares and warrants of the Resulting Issuer on a one for one basis, in accordance with the exchange ratio, at the time of completion of the Transaction.

Prior to completion of the SR Financing and before the Share Split, Innovation intends to complete a non-brokered private placement of units (the "Units") at a price per Unit of $0.35 ($0.28 post-Share Split) for additional gross proceeds of up to $752,500 (the "PP Financing"). Each Unit will be comprised of one common share and one common share purchase warrant (each whole warrant exercisable for one common share at a price of $0.50 per share ($0.40 post-Share Split)). Any funds raised in the PP Financing will be available for Innovation's use towards its business prior to the completion of the Transaction and will not form part of the SR Financing.

No finder's fee is payable in connection with the Transaction. Finder's fees may be paid in connection with the SR Financing and PP Financing. There are no common control persons of both the Company and the Innovation. The Transaction will not constitute a "Non-Arm's Length Qualifying Transaction" (as such term is defined in Policy 2.4) or a related party transaction pursuant to the policies of the TSXV and applicable securities laws.

The completion of the Transaction is subject to the satisfaction of certain conditions, including but not limited to:

- the reconstitution of the board at closing to appoint Duane Nelson, Darryl Yea and Mike Cowin to the board;

- the appointment of Duane Nelson as Chief Executive Officer, Grant Bond as Chief Financial Officer ("CFO") and Marien Segovia as Corporate Secretary;

- the completion of the Share Split prior to undertaking the SR Financing;

- the completion of the SR Financing and the PP Financing;

- the completion of the Consolidation;

- approval of the Amalgamation by the shareholders of Innovation;

- the absence of any material adverse change in the business of either Torchlight or Innovation;

- no material action, cause of action, claim, demand, suit, investigation or other proceedings in progress, pending or threatened against or affecting any of Torchlight, Subco, Innovation or any such company's respective officers and directors;

- no proceeding or law being enacted or commenced that frustrates the consummation of the Transaction;

- dissent rights having not been exercised by shareholders of Innovation holding more than 5% of the outstanding common shares;

- each of Innovation and Torchlight being satisfied as to the results of their respective due diligence investigations; and

- receipt of all requisite regulatory, corporate, stock exchange, governmental and third party authorizations and consents, including the approval of the TSXV.

Accordingly, there can be no assurance that the Transaction will be completed on the terms proposed above or at all.

Resulting Issuer

On closing of the Transaction, it is expected that Torchlight (then, the "Resulting Issuer") will issue at a minimum the following securities to Innovation securityholders, on a post-Consolidation basis, in exchange for the issued and outstanding securities of Innovation at the Closing Date:

55,011,000 common shares to Innovation shareholders (in exchange for the same number of Innovation common shares issued and outstanding following the Share Split together with the common shares issued in connection with the PP Financing and upon exercise of the Subscription Receipts issued in connection with the SR Financing);

621,919 options to current Innovation option holders, exercisable for 621,919 common shares of the Resulting Issuer at a price of $0.08 per share (in exchange for the same number of Innovation options issued and outstanding following the Share Split);

3,793,703 options to current Innovation option holders, exercisable for 3,793,703 common shares of the Resulting Issuer at a price of $0.20 per share (in exchange for the same number of Innovation options issued and outstanding following the Share Split);

159,087 warrants to current Innovation warrant holders, exercisable for 159,087 common shares of the Resulting Issuer at a price of $0.20 per share (in exchange for the same number of Innovation warrants issued and outstanding following the Share Split);

80,899 warrants to current Innovation warrant holders, exercisable for 80,899 common shares of the Resulting Issuer at a price of $0.40 per share (in exchange for the same number of Innovation broker warrants issued and outstanding following the Share Split);

3,528,766 warrants to current Innovation warrant holders, exercisable for 3,528,766 common shares of the Resulting Issuer at a price of $0.60 per share (in exchange for the same number of Innovation warrants issued and outstanding following the Share Split);

2,674,250 warrants to Innovation warrant holders in connection with the PP Financing, exercisable for 2,674,250 common shares of the Resulting Issuer at a price of $0.40 per share; and

4,000,000 warrants to Innovation warrant holders in connection with the SR Financing, exercisable for 4,000,000 common shares of the Resulting Issuer at a price of $0.75 per share.

Board and Management

Upon completion of the Transaction, it is expected that the board of directors and management of the Resulting Issuer will consist of: Duane Nelson (CEO and Director), Darryl Yea (Director), Mike Cowin (Director), Robert Archer (Director) and Grant Bond (CFO).

All current directors and officers of Torchlight, other than Robert Archer, will resign at the closing of the Transaction.

The following individuals are expected to be directors or senior officers of the Resulting Issuer:

Duane Nelson - Chief Executive Officer and Director

With over 40 years of entrepreneurial and leadership experience, Mr. Nelson has founded and led several successful ventures, including SilverMex Resources, which was sold for $235 million. He also founded Quotemedia Inc., a global leader in financial market data services. Mr. Nelson is a director of Group 11 Technologies, pioneering in-situ gold mining technologies, and serves on the board of NGO Sustainability Inc, focusing on sustainable development in partnership with United Nations initiatives. His career highlights include fostering innovation in mining, finance, and renewable energy.

Grant Bond - CFO

A Chartered Professional Accountant ("CPA, CA") with over 12 years of financial management experience in the mining industry, Mr. Bond currently serves as CFO for P2 Gold Inc. and Austin Gold Corp. His background includes financial reporting, risk management, and transitioning companies, including Pretium Resources Inc., from exploration to production phases. Mr. Bond began his career in the assurance group at PricewaterhouseCoopers LLP, and holds a Diploma in Accounting and Bachelor of Science from the University of British Columbia.

Darryl Yea - Director

With 35+ years of experience in operations, investment banking, and corporate finance, Mr. Yea has held leadership roles in diverse industries. He has served as CEO of financial and technology firms, chaired several companies, and advised regulatory bodies. Mr. Yea's expertise in mergers and acquisitions, strategic planning, and corporate governance has made him a prominent figure in finance and mining. He holds a Bachelor of Commerce from the University of British Columbia.

Mike Cowin - Director

Mr. Cowin brings 20 years of investment and portfolio management experience, particularly in emerging companies. As a director at Northcape Capital, he has managed funds totaling over AUD 8 billion. His career includes leadership roles at AMP and UBS, with a focus on industrial and diversified sectors.

Robert Archer - Director

Mr. Archer has more than 40 years' experience in the mining industry, working throughout the Americas. After spending more than 15 years with major mining companies (including Newmont, Placer Dome and Rio Algom), Mr. Archer held several senior management positions in the junior mining sector. He cofounded and built Great Panther Mining Limited from concept into a mid-tier precious metals producer with three operating mines and a listing on NYSE American. He currently serves as President & CEO and Director of Pinnacle Silver and Gold Corp. Mr. Archer is a Professional Geologist and holds a B.Sc. (Hons.) degree from Laurentian University in Sudbury, Ontario.

Filing Statement

In connection with the Transaction and pursuant to the requirements of the TSXV, Torchlight will file a filing statement on its issuer profile on SEDAR+ (www.sedarplus.ca), which will contain details regarding the Transaction, Torchlight, Innovation and the Resulting Issuer.

Sponsorship

Sponsorship of a Qualifying Transaction (as such term is defined in Policy 2.4) is required by the TSXV unless a waiver from the sponsorship requirement is obtained. Torchlight intends to apply for a waiver from sponsorship for the Transaction. There is no assurance that a waiver from this requirement will be obtained.

Additional Information

All information contained in this press release with respect to Innovation was supplied by Innovation, and Torchlight and its directors and officers have relied on Innovation for such information. Torchlight and Innovation plan to issue additional press releases in accordance with the policies of the TSXV providing further details in respect of the Transaction, including summary financial information of Innovation, and other material information as it becomes available.

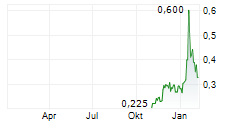

Trading in the common shares of Torchlight is currently halted and will remain halted until such time as all required documentation in connection with the Transaction has been filed with and accepted by the TSXV and permission to resume trading has been obtained from the TSXV.

None of the securities issued in connection with the Transaction will be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), and none of them may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act. This press release shall not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of the securities in any state where such an offer, solicitation, or sale would be unlawful.

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Completion of the Transaction is subject to a number of conditions, including but not limited to, TSXV acceptance and if applicable pursuant to TSXV Requirements, majority of the minority shareholder approval. Where applicable, the Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Transaction, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed Transaction and has neither approved nor disapproved the contents of this press release.

For further information, please contact:

Fayyaz Alimohamed

Torchlight Innovations Inc.

Email: fayyaz@zabinacapital.com

Phone: 604-999-4456

Duane Nelson

Innovation Mining Inc.

Email: duane@innovationmining.com

Phone: 604-512-8118

Forward-Looking Information

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this press release only, and Torchlight, Innovation and the Resulting Issuer do not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. These forward-looking statements include, among other things, statements relating to: (a) the business plans of the Resulting Issuer, (b) the completion of the SR Financing and the PP Financing, (c) the Transaction (including TSXV approval and the closing of the Transaction), the Amalgamation and the issuance of securities of Torchlight to the shareholders of Innovation, (d) the listing of the Resulting Issuer on the TSXV (as a Tier 2 technology issuer), (e) the Innovation Meeting, (f) the completion of the Consolidation and Share Split, (g) the Name Change; and (h) the expected composition of the board of directors and management of the Resulting Issuer.

Such forward-looking statements are based on a number of assumptions of the management of Innovation and the management of the Company, including, without limitation, that (i) the parties will obtain all necessary corporate, shareholder and regulatory approvals and consents required for the completion of the Transaction (including TSXV approval), (ii) the SR Financing and the PP Financing will be completed, (iii) the Transaction and the Amalgamation will be completed on the terms and conditions and within the timeframes expected by each of Torchlight and Innovation, (iv) the Resulting Issuer will be listed on the TSXV as a Tier 2 technology issuer, as anticipated, (v) the Innovation Meeting will be held as expected by Innovation, (vi) Torchlight will complete the Consolidation as expected and Innovation will complete the Share Split as expected, (vii) the Resulting Issuer will complete the Name Change, (viii) the board of directors and management of the Resulting Issuer will be composed of the individuals expected by Torchlight and Innovation; and (ix) there will be no adverse changes in applicable regulations or TSXV policies that impact the Transaction.

Additionally, forward-looking information involve a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Torchlight, Innovation or the Resulting Issuer to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (A) there can be no assurances that Torchlight and Innovation will obtain all requisite approvals for the Transaction, including the approval of the Innovation shareholders, or the approval of the TSXV (which may be conditional upon amendments to the terms of the Transaction), or that the Amalgamation will be completed on the terms and conditions contained in the Amalgamation Agreement, or at all, (B) there can be no assurances as to the completion of or the actual gross proceeds raised in connection with the SR Financing and the PP Financing, (C) the parties and the completion of the Transaction may be adversely impacted by changes in legislation, changes in TSXV policies, political instability or general market conditions, (D) the Innovation Meeting and may not be held within the timeframe expected (E) the proposed directors may refuse to act as directors of the Resulting Issuer, (F) risks relating to the current global trade war, (G) following completion of the Transaction, the Resulting Issuer may require additional financing from time to time in order to continue its operations, or (H) financing may not be available when needed or on terms and conditions acceptable to the Resulting Issuer.

Such forward-looking information represents the best judgment of the management of Innovation and the management of the Company based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information. Neither Torchlight, nor Innovation, nor any of their representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this press release. Neither Torchlight, nor Innovation, nor any of their representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this press release by you or any of your representatives or for omissions from the information in this press release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/248319

SOURCE: Torchlight Innovations Inc.