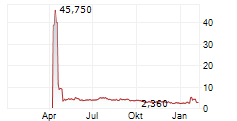

SINGAPORE, April 11, 2025 (GLOBE NEWSWIRE) -- iOThree Limited ("iOThree" or the "Company") (NASDAQ: IOTR), a leading provider of maritime digital technologies including satellite connectivity and digitalization solutions in Singapore with a focus on facilitating the maritime industry towards digital transformation, today announced the closing of its initial public offering (the "Offering") of an aggregate of 2,100,000 ordinary shares of par value $0.00625 per share (the "Ordinary Shares"), at a public offering price of US$4.00 per share, of which 1,650,000 Ordinary Shares were sold by the Company and 450,000 Ordinary Shares were sold by the selling shareholders of the Company. The Company did not receive any proceeds from any sale of Ordinary Shares by the selling shareholders. The Company's Ordinary Shares began trading on April 10, 2025, U.S. Eastern time, on the Nasdaq Capital Market under the ticker symbol "IOTR".

The aggregate gross proceeds from the Offering were $8,400,000, including $6,600,000 received by the Company and $1,800,000 received by the selling shareholders of the Company. In addition, the Company has granted the underwriters a 45-day option (the "Over-Allotment Option") to purchase up to 247,500 Ordinary Shares to cover over-allotments at the initial public offering price, less underwriting discounts. The Company intends to use the net proceeds from the Offering for: (i) solution development to expand and enhance its current solution offerings for JARVISS; (ii) obtaining class approval from major maritime organization for its range of digital applications; (iii) marketing and branding, including expanding commercial sales team with dedicated marketing staff, and investing in marketing and promotional activities to further expand its customer base and strengthen its brand; and (iv) working capital and general corporate purposes.

The Offering was conducted on a firm commitment basis. Eddid Securities USA Inc. acted as the lead underwriter, with Network 1 Financial Securities, Inc. acting as a co-underwriter for the Offering. Bevilacqua PLLC acted as U.S. securities counsel to the Company, and Ortoli Rosenstadt LLP acted as U.S. securities counsel to the lead underwriter in connection with the Offering.

A registration statement on Form F-1 relating to the Offering (File No. 333-276674) was originally filed with the U.S. Securities and Exchange Commission (the "SEC") on January 24, 2024, and was declared effective by the SEC on December 31, 2024, as further amended by post-effective amendments to such registration statement which was declared effective on March 31, 2025. The Offering was made only by means of a prospectus, copies of which may be obtained from: Eddid Securities USA Inc., by standard mail to 40 Wall Street, Suite 1606, New York, NY 10005, by email at ecm@eddidusa.com, or by telephone at (+1) 212-363-6888; or Network 1 Financial Securities, Inc., by standard mail to 2 Bridge Avenue, Suite 241, Red Bank, NJ 07701, by email at adampasholk@netw1.com, or by telephone at (+1) 732-758-9001. Copies of the registration statement can be accessed via the SEC's website at www.sec.gov.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About iOThree Limited

iOThree is a leading provider of maritime digital technologies including satellite connectivity and digitalization solutions in Singapore focused on facilitating the maritime industry towards digital transformation. The Company was established to adopt an innovative approach towards the management of solutions accustomed to contemporary needs and drive the digital evolution in the maritime industry.

For more information, please visit the Company's website: https://io3.sg/.

Forward-Looking Statements

All forward-looking statements, expressed or implied, in this release are based only on information currently available to the Company and speak only as of the date on which they are made. Investors can find many (but not all) of these statements by the use of words such as "approximates," "believes," "hopes," "expects," "anticipates," "estimates," "projects," "intends," "plans," "will," "would," "should," "could," "may" or other similar expressions in this release. Except as otherwise required by applicable law, the Company disclaims any duty to publicly update any forward-looking statement to reflect events or circumstances after the date of this press release. These statements are subject to uncertainties and risks, including, but not limited to, the uncertainties related to market conditions, and other factors discussed in the "Risk Factors" section of the registration statement for the Offering filed with the SEC. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company's registration statement and other filings with the SEC. Additional factors are discussed in the Company's filings with the SEC, which are available for review at www.sec.gov.

For more information, please contact:

iOThree Limited

Investor Relations

Email: ir@io3.sg

HBK Strategy Limited

Katy Chan

Email: ir@hbkstrategy.com