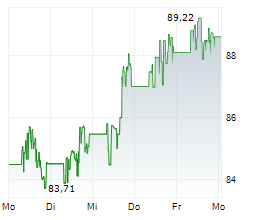

Kimberly-Clark's stock fell sharply after the company released disappointing first-quarter results for 2025 and significantly lowered its annual forecast. Shares declined by approximately 4% in pre-market trading and continued to struggle during regular trading hours, at times dropping more than 3%. The consumer goods giant reported a 6% decrease in total revenue to $4.84 billion, missing analyst estimates of $4.88 billion. The company's crucial North American business weakened with a 3.9% decline, while international personal care sales plummeted by 8.9%. Adding to investor concerns, Kimberly-Clark drastically reduced its earnings forecast for 2025, citing trade policy impacts that could increase supply chain costs by approximately $300 million this year.

Profit Pressure Mounts

Sollten Anleger sofort verkaufen? Oder lohnt sich doch der Einstieg bei Kimberly-Clark?

The company's net profit fell by 12.4% to $567 million in the first quarter, with earnings per share dropping to $1.70 compared to $1.91 in the same period last year. On an adjusted basis, earnings per share did slightly exceed analyst expectations at $1.93, but this positive note was overshadowed by the diminished annual outlook. Management now anticipates at best a stagnant adjusted operating result based on constant exchange rates, a significant downgrade from previous projections of high single-digit growth. The company's exit from the private label diaper business to focus on core areas like feminine hygiene products, coupled with unfavorable currency effects, further contributed to the disappointing performance.

Ad

Kimberly-Clark Stock: New Analysis - 22 AprilFresh Kimberly-Clark information released. What's the impact for investors? Our latest independent report examines recent figures and market trends.

Read our updated Kimberly-Clark analysis...