January - March 2025 (compared with January - March 2024)

- Rental income amounted to EUR 39.1 million (30.5).

- Net operating income totalled EUR 36.6 million (28.1).

- Profit from property management amounted to EUR 38.0 million (12.2). Profit from property management includes a non-recurring income item of EUR 20.5 million regarding negative goodwill in connection with the acquisition of Forum Estates. Profit from property management, excluding non-recurring items and exchange rate effects amounted to EUR 18.4 million.

- Earnings after tax amounted to EUR 31.0 million (-4.0), corresponding to EUR 0.42 (-0.08) per share.

- Unrealised changes in value affected by EUR -7.3 million (-22.3) on properties and by EUR -1.3 million (3.9) on interest rate derivatives.

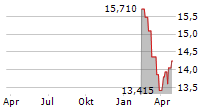

- EPRA NRV amounted to EUR 964.7 million (680.4), corresponding to EUR 12.6 (11.9) per share.

"In a very changing world, I am satisfied that Cibus has chosen the right industry and the right property segment to enable continued stable returns to our shareholders. We look forward to an exciting continuation of 2025."

- Christian Fredrixon, CEO

| Key figure¹ In EUR millions, unless otherwise stated | Q1 2025 | Q1 2024 | Full-year 2024 |

| Rental income | 39.1 | 30.5 | 122.4 |

| Net operating income | 36.6 | 28.1 | 116.5 |

| Profit from property management | 38.0 | 12.2 | 46.9 |

| Unrealised changes in property values | -7.3 | -22.3 | -44.7 |

| Earnings after tax | 31.0 | -4.0 | -4.8 |

| Market value of investment properties | 2,433 | 1,764 | 1,870 |

| EPRA NRV/share, EUR | 12.6 | 11.9 | 11.7 |

| Number of properties with solar panels | 73 | 46 | 49 |

| Net operating income, current earnings capacity | 156.3 | 114.1 | 122.3 |

| Net debt LTV ratio, % | 58.7 | 58.7 | 58.1 |

| Debt ratio (Net debt/EBITDA), multiple | 12.8 | 9.9 | 10.4 |

| Run rate debt ratio (Net debt/EBITDA), multiple | 10.0 | 9.8 | 9.7 |

| Interest coverage ratio, multiple | 2.3 | 2.2 | 2.2 |

1Refer to the full report for alternative performance measures and definitions.

For further information, please contact

Christian Fredrixon, CEO

christian.fredrixon@cibusnordic.com

+46 (0)8 12 439 100

Pia-Lena Olofsson, CFO

pia-lena.olofsson@cibusnordic.com

+46 (0)8 12 439 100

Link to the report archive:

https://www.cibusnordic.com/investors/financial-reports/

About Cibus Nordic Real Estate

Cibus is a real estate company listed on Nasdaq Stockholm Mid Cap. The company's business idea is to acquire, develop and manage high-quality properties in Europe with grocery retail chains as anchor tenants. The company currently owns approximately 640 properties in Europe. The largest tenants are Kesko, Tokmanni, Coop Sweden, S Group, Rema 1000, Salling, Lidl and Dagrofa.

This information is information that Cibus Nordic Real Estate AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation 596/2014. The information was submitted for publication, through the agency of the contact person set out above, at 08:00 CEST on 23 April 2025.