DJ Full year trading update and notice of results

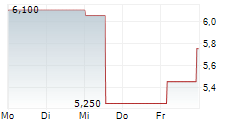

Molten Ventures Plc (GROW; GRW)

Full year trading update and notice of results

24-Apr-2025 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Molten Ventures plc

("Molten Ventures", "Molten", or the "Group")

Full year trading update and notice of results

Strong level of activity throughout the year, including significant realisations

Molten Ventures (LSE: GROW, Euronext Dublin: GRW), a leading venture capital firm investing in and developing

high-growth digital technology businesses, today announces an update on its Net Asset Value ("NAV") per share

(unaudited), Gross Portfolio Value ("GPV") (unaudited) and highlights for the financial year, ahead of announcing full

year results for the 12 months ended 31 March 2025 on 11 June 2025.

Highlights:

-- NAV per share (unaudited) is expected to be circa 671p (31 March 2024: 662p).

-- GPV (unaudited) is expected to be circa GBP1,367 million (31 March 2024: GBP1,379 million).

-- Excluding foreign exchange, GPV fair value uplift of GBP72 million (5.22%) for the financial year (H1: GBP20

million and H2: GBP52 million), driven by strong performers in the portfolio, notably Ledger, Aircall and Revolut.

-- Total cash realisations for the financial year of GBP135 million, including significant realisations from

M-Files, Endomag, Perkbox, Graphcore and a partial realisation of Revolut.

-- Secondary transaction in Revolut generated proceeds of circa GBP7 million at a headline valuation of USD45

billion as part of the company-led secondary share sale, 25% above the last reported NAV at 30 September 2024.

-- Invested GBP73 million from own balance sheet (year to 31 March 2024: GBP65 million) across new, follow-on

and secondary investments, with a further GBP34 million from the managed EIS and VCT strategies.

-- Completed GBP15 million of share buybacks during the financial year and commenced an additional GBP15 million

share buyback programme on 13 March 2025 (of which GBP3.8 million has been repurchased to date).

-- Molten cash balance as at 31 March 2025 of GBP89 million, with a further GBP23 million available for

investment from the managed EIS/VCT funds. Undrawn Revolving Credit Facility of up to GBP60 million provides further

funding flexibility.

-- Molten cash balance as at 23 April 2025 of GBP110 million, following receipt of Freetrade proceeds post

year-end.

Portfolio performance and fair value movements:

-- Overall underlying fair value growth (excluding foreign exchange impact) of circa 5% or GBP72 million

during the year, which has been offset by adverse foreign exchange movements of GBP22 million. Total fair value

uplift of circa 4% or GBP50 million, demonstrates resilience and a strong overall performance on a diversified

portfolio. Fair value movement reflects the net of GBP180 million increases offset by reductions of GBP108 million.

-- Portfolio company cash runway remains robust with 88% of core companies funded for at least 12 months and

71% have over 18 months of runway or are operating profitably.

-- Portfolio companies continue to maintain revenue growth momentum, demonstrating the strong underlying

value of the portfolio, the underlying resilience of these businesses and the structural demand for their products

across their respective end-markets.

- The core portfolio achieved an average value-weighted revenue growth of 51% in FY24. This growth

highlights the maturity and scale of these businesses, which now represent 61% of the overall portfolio value.

-- In the period following year-end, geopolitical developments, notably the introduction and subsequent

pause of tariffs by the US government, have contributed to an increasingly uncertain global trading environment.

Our preliminary assessment indicates that our portfolio, being technology and software focused, is less exposed to

the direct impact of tariffs.

Six Months

to

Six Months to 31

30 March 2025 Year to 31

September % change to % change to March 2025 % change to

2024 opening GPV (unaudited) opening GPV opening GPV

(unaudited)

(unaudited)

GBP'million GBP'million GBP'million

Opening Gross 1,379 1,343 1,379

Portfolio Value

Investments 51 22 73

Realisations (76) (59) (135)

Movement in Foreign (31) -2.25% 9 0.67% (22) -1.60%

Exchange (a)

Movement in Fair Value 20 1.45% 52 3.87% 72 5.22%

(b)

Total Fair Value (11) -0.80% 61 4.54% 50 3.62%

Movements (a+b)

Closing Gross 1,343 1,367 1,367

Portfolio Value

Ongoing strategic focuses:

-- Continued focus on capital allocation, balancing the pipeline of new investment opportunities with theability to drive returns to shareholders through share buyback programmes, while maintaining sufficient reserves.

-- Focusing on delivering an ongoing pipeline of realisations above reported NAV, starting FY26 with goodmomentum with a combined circa GBP30 million of proceeds from Lyst and Freetrade exits.

-- Growing the value of the portfolio through support of existing companies and new investments,particularly into Molten's core business of Series A and B investments.

-- Driving increased efficiencies, including through building scale and co-investment structures, as well asdisciplined management of costs, with announced delisting from Euronext Dublin supporting this.

Ben Wilkinson, Chief Executive Officer, commented:

"It is pleasing that the portfolio and NAV have continued to grow, demonstrating the robust performance within the portfolio. We've maintained a strong level of activity this year, with significant realisations that have provided capital to pursue attractive new and follow-on opportunities supporting European tech companies at critical growth stages. Recent macro events serve as a reminder of how quickly market dynamics can change. While these events have added short-term volatility, particularly in the public markets, our portfolio remains focused on capturing long-term opportunities driven by disrupting global industries. Molten's strong cash position and experienced team ensure we remain resilient and able to course correct when needed. Molten is driven by exceptional people and our unique investment platform. We remain focused on what we can control and continue to invest with discipline, finding opportunities in changing environments, backing businesses that are building for the long term and creating value for our shareholders."

Notice of Results:

Molten Ventures' full-year results for the year ended 31 March 2025 will be announced on 11 June 2025.

-ENDS-

Enquiries

Molten Ventures plc

+44 (0)20 7931 8800

Ben Wilkinson (Chief Executive Officer)

ir@molten.vc

Andrew Zimmermann (Chief Financial Officer)

Deutsche Numis

Joint Financial Adviser and Corporate Broker

Simon Willis +44 (0)20 7260 1000

Jamie Loughborough

Iqra Amin

Goodbody Stockbrokers

Joint Financial Adviser and Corporate Broker

Don Harrington +44 (0) 20 3841 6202

Tom Nicholson

William Hall

Sodali

+44 (0)7970 246 725/

Public relations

+44 (0)771 324 6126

Elly Williamson

molten@sodali.com

Jane Glover About Molten Ventures

Molten Ventures is a leading venture capital firm in Europe, developing and investing in high growth technology companies.

It invests across four sectors: Enterprise & SaaS; AI, Deeptech & Hardware; Consumer; and Digital Health & Wellness with highly experienced partners constantly looking for new opportunities in each.

Listed on the London Stock Exchange, Molten Ventures provides a unique opportunity for public market investors to access these fast-growing tech businesses, without having to commit to long term investments with limited liquidity. Since the IPO in June 2016, Molten has deployed over GBP1bn capital into fast growing tech companies and has realised over GBP600m to 30 September 2024.

For more information, go to https://investors.moltenventures.com/investor-relations/plc

----------------------------------------------------------------------------------------------------------------------- Dissemination of a Regulatory Announcement, transmitted by EQS Group. The issuer is solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BY7QYJ50 Category Code: TST TIDM: GROW; GRW LEI Code: 213800IPCR3SAYJWSW10 OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State Sequence No.: 384233 EQS News ID: 2122800 End of Announcement EQS News Service =------------------------------------------------------------------------------------

Image link: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=2122800&application_name=news&site_id=dow_jones%7e%7e%7ef1066a31-ca00-4e1a-b0a4-374bd7d0face

(END) Dow Jones Newswires

April 24, 2025 02:00 ET (06:00 GMT)