- Gross margin improved by 1.9 point, reaching 53% over the year

- Positive EBITDA of €0.5 million, despite a decline in 2024 revenue to €57.1 million, compared with €82.5 million in 2023

- Net financial debt remained low at €5.8 million as of December 31, 2024, vs. €8.5 million as of December 31, 2023, supported by a solid cash position of €16 million1 (vs. €14 million as of December 31, 2023)

Stable backlog of €23.3 million in Q1 2025

- Firm order intake of €6.5 million and Q1 2025 revenue of €6.3 million, down compared to Q4 2024

- A renewed marketing and commercial strategy, combined with an enhanced solution offering introduced in the first quarter, both expected to drive order intake recovery in H2 2025

Construction of the new industrial site in Etrelles progressing

- Delivery expected between late 2025 and early 2026, in line with the initial timeline

Regulatory News:

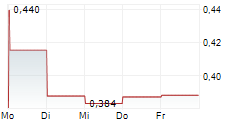

Groupe OKWIND (FR0013439627 ALOKW), which is specialized in the design, manufacture and sale of smart energy generation and management systems dedicated to self-consumption, today announces its consolidated results for 2024 and revenue for the first quarter of 2025, as approved by the Board of Directors on April 24, 2025.

Louis MAURICE, Founder and Chairman of Groupe OKWIND, states: "The 2024 financial year was marked by a highly unfavorable macroeconomic environment (price volatility, agricultural crisis, adverse weather conditions, political uncertainty and high interest rates), which impacted our commercial and financial performance. Nonetheless, we reported a positive EBITDA for the year, reflecting our strong cost control. Besides, several key milestones were achieved: the launch of our multi-technology offering, the reorganization and strengthening of our teams. We are now seeing early signs of improvement, particularly through highly positive feedback on our tracker-coupled storage offering, which should begin to yield results in the second half of the year. We intend to fully leverage our unique positioning and expanded offering, which now covers the entire energy value chain, in pursuit of our ambition: to make self-consumption accessible to as many people as possible."

Simplified income statement

in €million | 31/12/2024 | 31/12/2023 | Change in % |

Revenue | 57.1 | 82.5 | -31% |

of which BtoB | 50.1 | 75.2 | -33% |

of which BtoC | 7.0 | 7.2 | -4% |

Other operating income | 2.9 | 1.4 | +51% |

Purchases consumed | (27.2) | (40.0) | -47% |

Personnel expenses | (15.2) | (14.1) | +8% |

Other operating expenses | (16.8) | (16.4) | +2% |

Taxes | (0.4) | (0.4) | -4% |

EBITDA | 0.5 | 12.9 | |

Net changes in D&A and impairment | (2.3) | (2.5) | -8% |

Operating income | (1.9) | 10.4 | |

Financial income and expenses | (2.2) | (0.4) | |

Non-recurring income and expenses | (0.5) | (0.1) | |

Income tax | 0.9 | (2.4) | |

Net income (Group share) | (3.6) | 7.6 |

The 2024 financial year was marked by a highly unfavorable market environment. Groupe OKWIND's 2024 revenue amounted €57.1 million, down 31% compared to the previous year, primarily due to a sharp decline in BtoB activity.

The Farm business line, the Group's core market, was penalized by a wait-and-see attitude among prospects, stemming from the sector's crisis, particularly adverse weather conditions and a challenging economic and political backdrop.

In the Industry/Local Authorities business line, activity remained steady, with an increase in client references across a full spectrum of players: local authorities, trade unions and major delegated service providers. The number of tenders continued to grow in this promising market. However, the sales cycle proved longer than initially anticipated.

In the Individual Customers business line, Groupe OKWIND maintained its activity level close to that of the previous year.

Thanks to tight procurement cost control and long-term sourcing agreements, the Group's gross margin on procurement improved by nearly 2 points, reaching 53% versus 51.1% in 2023.

Personnel expenses increased by 8% to €15.2 million, reflecting the reinforcement of operating teams, primarily during the first half of the year.

Other operating expenses increased in 2024 due to greater recourse to subcontracting and associated equipment rentals, particularly during the final phases of tracker installations. By contrast, 2023 was characterized by a significant volume of project that had only reached the tracker component delivery stage (prior to assembly).

The decline in activity, combined with rising operating expenses, weighed on the Group's financial performance, which nonetheless reported a positive EBITDA of €0.5 million in 2024.

The financial result showed a loss of €2.2 million, mainly due to a €1.3 million impairment on the value of the Group's investment in OSMOSUN shares.

After incorporating a positive tax result of €0.9 million and a non-recurring loss of €0.5 million, primarily related to retrofits of first-generation trackers, Groupe OKWIND's 2024 consolidated net loss totaled €3.6 million.

Financing and cash position as of December 31, 2024

in €million | 31/12/2024 | 31/12/2023 |

Operating cash-flow | (0.7) | 10.1 |

Change in WCR | 9.6 | (17.5) |

Cash-flow from operating activities | 8.9 | (7.3) |

Cash-flow from investments | (3.8) | (4.7) |

Cash-flow from financing activities | 4.0 | 4.2 |

Change in cash | 9.1 | (7.9) |

Opening cash position | 5.9 | 13.9 |

Closing cash position | 15.0 | 5.9 |

As of December 31, 2024, the Group's available cash position1, including short-term deposits, stood at €16 million, representing an improvement compared to the previous year.

Cash-flow from operating activities amounted to €8.9 million, driven primarily by a significant increase in receivables collected during the period, supported by structural improvements and enhanced receivables management.

Investing cash-flows in 2024 mainly reflected capitalized development expenditures (R&D) and initial construction work on the Etrelles project.

The Group continued its deleveraging efforts over the course of the year, with total debt decreasing from €23.5 million to €21.8 million.

2025 First Quarter Revenue

in €million | 31/03/2025 | 31/03/2024 | Change in % |

Revenue | 6.3 | 15.1 | -58% |

of which BtoB | 5.3 | 13.5 | -61% |

of which BtoC | 1.0 | 1.6 | -40% |

As of March 31, 2025, Groupe OKWIND recorded revenue of €6.3 million, compared to €15.1 million as of March 31, 2024. Firm order intake amounted to €6.5 million, down from €16.7 million a year earlier.

A gradual recovery in activity began in March, particularly in the Farm business line, supported by the ramp-up of the new commercial structure and the reactivation of offers with agricultural purchasing groups.

The backlog stood at €23.3 million as of March 31, 2025, a level similar to that recorded as of December 31, 2024.

Strategic milestone in the Group's industrial development

A major step forward was made at the beginning of the year with the start of construction of Groupe OKWIND's new industrial production site in Etrelles (35), Brittany. With an industrial capacity up to three times greater than of its current site, this new building will support the production ramp-up and diversification of the Group's operations. Scheduled for delivery between late 2025 and early 2026, the Etrelles site represents a strategic milestone in the Group's roadmap, aimed at supporting its medium- and long-term growth trajectory.

Development strategy and outlook

After a year of consolidation in 2024, Groupe OKWIND aims to get back to profitable and sustainable growth over the coming quarters, supported by a more favorable regulatory and market environment. The Group's roadmap is structured around the following strategic priorities:

- Groupe OKWIND will continue rolling out its multi-technology solutions to address energy autonomy and efficiency challenges of all customers. The Group also intends to expand its solution offerings and will position on larger-scale projects in collective self-consumption.

- On the innovation front, Groupe OKWIND will maintain its R&D investments to enhance the performance of existing solutions and develop new functionalities to further support energy self-sufficiency.

Availability of 2024 financial report

The annual statements were approved by the Board of Directors and reviewed on April 24, 2025. The 2024 annual financial report will be available no later than April 30, 2025 on the Investor Relations website (www.okwind-finance.com), in the "Documentation" section.

Next financial events:

- Annual General Meeting: June 12, 2025

- Publication of 2025 First-Half revenue, on July 23, 2025 (after market close)

About Groupe OKWIND

Founded in 2009 by Louis Maurice, Chairman and CEO, the French Group OKWIND is the expert in individual and collective self-consumption of energy. Its global approach and cutting-edge technology aim at enhancing the energy independence and sufficiency of farms, companies, local authorities and private individuals. Every day, the OKWIND Group strives to deploy local, controlled, stable, low-carbon, fixed-cost energy to accelerate and optimize the ecological transition. The Group designs, develops and deploys complete green energy management solutions (local solar production, self-consumption, excess energy recovery, improved consumption practices). By becoming producer-consumers (prosumers), OKWIND customers can generate their own energy, control their production and regulate their electrical processes. Historically based in the Great West of France, 30km from Rennes (Torcé), the OKWIND Group is close to its customers, with several agencies and work centers throughout France. In 2024, the OKWIND Group generated consolidated revenue of €57.1 million and today has 235 employees, with more than 5,000 installations throughout France. For more information: www.okwind.fr

1 Cash and cash equivalents include available cash, bank overdrafts, short-term marketable securities and term deposits

View source version on businesswire.com: https://www.businesswire.com/news/home/20250424279863/en/

Contacts:

Groupe OKWIND

Investor Relations

investors@okwind.fr

NewCap

Thomas Grojean/Aurélie Manavarere

Investor Relations

okwind@newcap.eu

T.: +33 (0)1 44 71 94 94

NewCap

Nicolas Merigeau

Media Relations

okwind@newcap.eu

T.: +331 44 71 94 98